The Results Are In: Sustainability Commitments Continue, Despite Omnibus Shake-Up

The EU’s proposed Omnibus Simplification Package has been making waves across the sustainability landscape. Proposing major changes to the CSRD, CSDDD, Taxonomy Regulation and the Carbon Border Adjustment Mechanism (CBAM), it has sparked widespread debate and uncertainty.

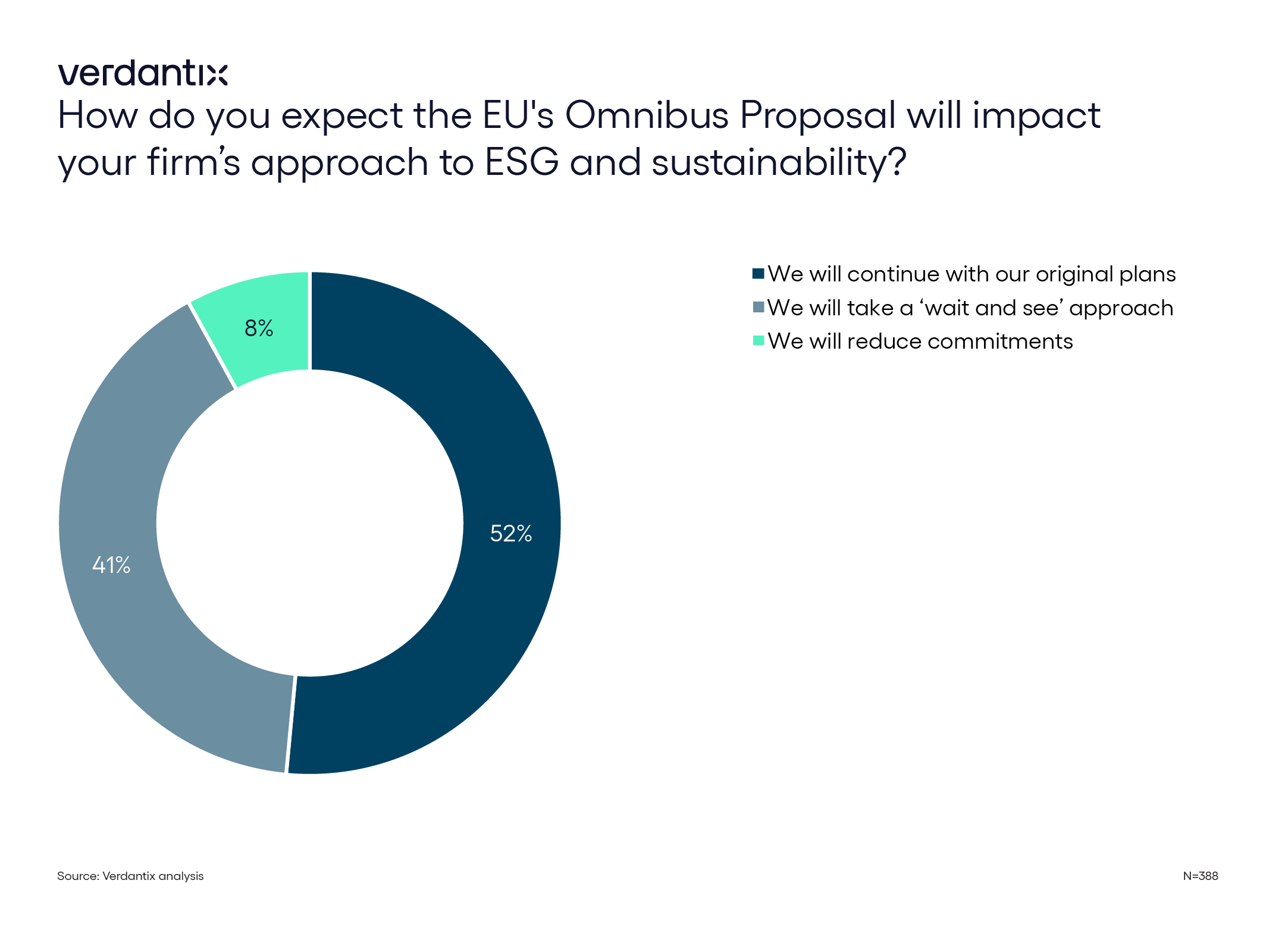

As the dust begins to settle, and the implications of the Omnibus proposal come into focus, Verdantix has been exploring how it might reshape corporate sustainability strategies and software investments. To get a real-time pulse on market sentiment, we polled over 700 attendees during our recent webinar on how the changes could impact their plans moving forward. We found that:

- Over half of organizations plan to stay the course with their original sustainability strategies. Of our 338 respondents, 52% will press ahead with their original sustainability plans. This reinforces our broader findings: sustainability leaders are increasingly viewing ESG and sustainability investments not just as a compliance exercise, but as a path to lower risk, reduce costs and create new revenue opportunities.

- Uncertainty still looms over the Omnibus proposal, with 41% of respondents taking a cautious ‘wait and see’ stance. However, it is crucial for organizations to remember that while the proposal must still go through several stages of review, the CSRD remains fully in force in countries that have already transposed it into national law. So it’s business as usual – until the stop-the-clock mechanism is adopted.

What does this mean for the sustainability reporting software market?

The CSRD has been a major driver of growth in the ESG and sustainability reporting software market. However, with the Omnibus proposal cutting the number of firms required to report under the CSRD by some 80% – from 50,000 down to just 7,000 – many organizations are suddenly off the hook for near-term compliance.

But the story doesn’t end there. The good news is that 76% of respondents we polled said the Omnibus proposal would have either no impact (56%) or even a positive impact (20%) on their organization’s software spend.

While the Omnibus proposal is unlikely to affect software spending amongst the largest organizations, we anticipate that Wave 2 CSRD reporters may delay their investments by up to two years amid the regulatory uncertainty. Meanwhile, many small and medium-sized enterprises (SMEs) are expected to pause software spend altogether, unless customer insistence forces them to act.

Why does this matter?

Beyond regulation, firms are encountering growing pressure from a range of stakeholders to deliver investor-grade sustainability data on a regular basis. That’s exactly why many are turning to software, to streamline reporting, improve data quality and stay abreast of stakeholder expectations.

Where does this leave vendors?

To stay relevant and drive demand in a shifting market, vendors must go beyond compliance and clearly articulate their broader value proposition. That means positioning their platforms to help firms benchmark progress, engage teams across the business, and plan for the future.

The message is clear: if your software only solves the reporting challenge, you're already behind.

For more information on what is included in the Omnibus Simplification Package, please see Verdantix Strategic Focus: Unpacking The EU Omnibus And Its Impact On Sustainability Software. For firms located in the US, read Strategic Focus: ESG & Sustainability In The US.

About The Author

Luke Gowland

Senior Analyst

Jessica Pransky

Principal Analyst