New Maturity Model Provides Roadmap For Corporate Climate Risk Management

New Maturity Model Provides Roadmap For Corporate Climate Risk Management

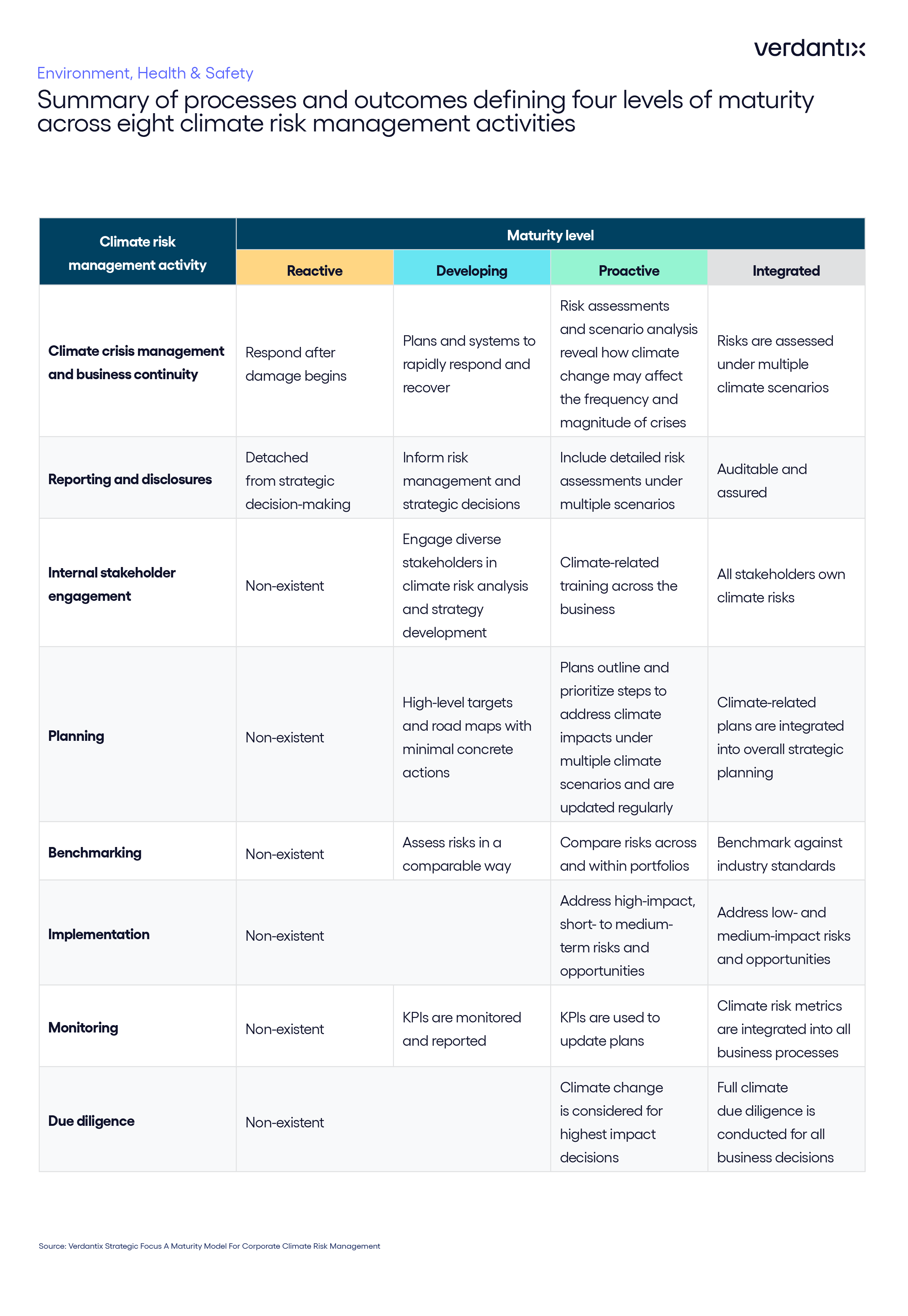

Increasingly, firms recognize that climate risks are material and must be incorporated into their risk management frameworks. How to do this, however, is not always straightforward. To help firms advance their climate strategies, Verdantix has developed a climate risk maturity model. This model defines four levels of climate risk maturity: reactive, developing, proactive and integrated.

At the reactive level, firms take a ‘checkbox’ approach to compliance, meeting investor demands and maintaining business continuity in the face of imminent critical events. The developing maturity level entails preliminary education, risk assessments and target-setting. This work lays the foundation for proactive risk management, at which point firms have detailed plans in place, with implementation under way. At the highest level of climate risk maturity, organizations integrate climate data and analysis across the business, accounting for climate risk in all decisions. By progressing through these maturity levels, firms become less exposed to climate-related risks, more resilient to climate change and, consequently, more appealing to investors.

To understand what maturity looks like, we have defined reactive, developing, proactive and integrated climate risk management across eight business activities:

- Climate crisis management and business continuity, which – depending on maturity – ranges from haphazard, with significant impacts on operations, to well-coordinated, with rapid recovery.

- Reporting and disclosures that describe the risks facing a firm, strategies to mitigate those risks, climate governance, and metrics and targets.

- Internal stakeholder engagement when developing and implementing plans to generate buy-in from across the enterprise for climate action.

- Planning – encompassing transition, adaptation, resilience, net zero and other plans – which is key for managing diverse climate risks across the value chain.

- Benchmarking risks across and within portfolios to identify assets and investments with the greatest risk.

- Implementation of plans, starting with the highest priority actions based on the risk assessment and risk mitigation options.

- Monitoring KPIs and reporting on progress, as well as incorporating this information into updated risk assessments and plans.

- Due diligence that considers climate impacts on business decisions, such as mergers and acquisitions, procurement and strategic decision-making.

Within each activity, we have also defined criteria that firms can use to benchmark themselves, and we have identified the functionality offered by software vendors and consultants that can help organizations move to the next maturity level. To learn more, check out our recent report presenting the details of the Verdantix climate risk maturity model.