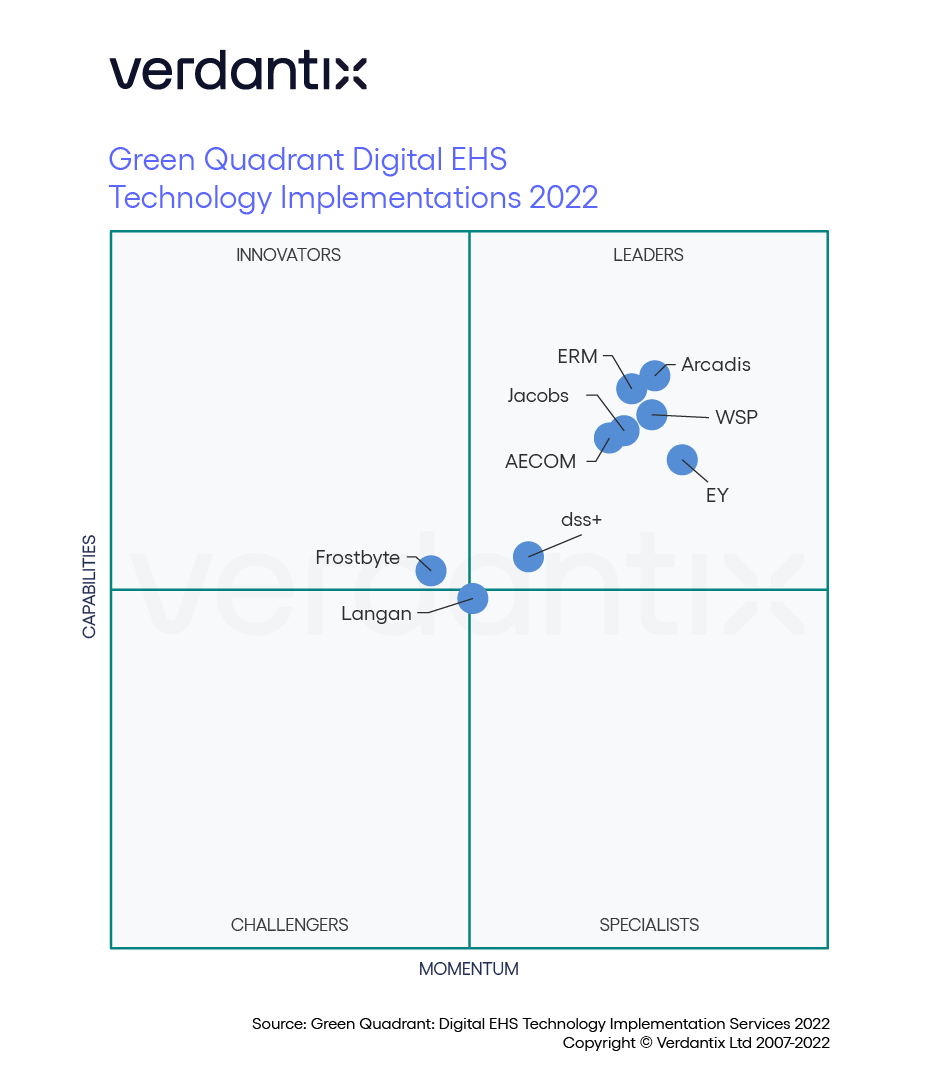

Verdantix Green Quadrant Benchmarks The Capabilities Of Prominent EHS Technology Implementation Service Vendors

The recently released 2022 Green Quadrant evaluated both the capabilities and market momentum of nine prominent digital EHS implementation service vendors. The insights driven from the benchmarking study were founded on a combination of a 120-point questionnaire and a two-hour live briefing from each vendor, in addition to existing information gained through our Global Corporate EHS Services Survey Of 302 EHS Executives. What are the key findings Verdantix gained from the benchmark of digital EHS implementation service vendors?

Firms can draw several benefits from using digital service partners to drive EHS digitization through implementation projects.

EHS implementation partners can offer firms a range of additional wrap-around services to support new technology rollouts. Service vendors are able to engage clients within any stage of a EHS digitization projects, from mapping EHS requirements and strategizing technology roadmaps to providing technical support and internal change management throughout the implementation process. This support is highly valued by clients, which often engage in longstanding partnerships with EHS service firms to execute on ambitious, multi-phased technology rollouts. Take for example, Arcadis, which consulted, selected and then implemented several Intelex modules for manufacturing firm, Magna International across multiple regions.

Vendors are in an intense battle to diversify their digital service offerings, despite relatively standardized implementation best practices.

Seven vendors- AECOM, Arcadis, dss+, ERM, EY, Jacobs, WSP were identified as leaders within the Verdantix Green Quadrant benchmark. The concentrated group of leaders is testament to the strong digital service focused of vendors within the study but can also be attributed to the well-established technical implementation best practices within the market. In order to differentiate their service products, EHS service vendors have invested heavily in developing advanced digital proficiencies to offer high impact benefits for clients. A prime example of this is Jacob’s internally developed ion platform, that allows clients to aggregate, analyse and act upon data from IoT devices monitoring asset and worker information.

Widespread ESG investment amongst EHS service vendors position them as ideal partners for firms executing digitally-centred ESG and sustainability projects.

Due to their existing subject matter expertise within environmental and sustainability, EHS service vendors have a strong platform to address pressing corporate ESG challenges. Resultingly, nine of the vendors within the Green Quadrant study stood up and taken note of this opportunity, identifying ESG and sustainability as a key area for business growth. Resultingly, EHS service vendors have made it a priority to develop their ESG and sustainability service lines. To bolster ESG service lines, vendors have invested attaining new talent, through hiring campaigns and numerous acquisitions. This is typified by ERM, which has built upon its strong environmental and sustainability consulting capacity with numerous acquisitions within the last 18 months, including the likes of OPEX Group, Point Advisory, Stratos Inc. and The Renewables Consulting Group.

Please follow the link to access the full Green Quadrant benchmark report, find out more about the broader research that Verdantix publishes, please visit our research portal.

About The Author

Tom Brown

Senior Consultant, Advisory Services