Verdantix Analysis Reveals Disparity Among Insurance Firms’ Climate Governance Disclosures

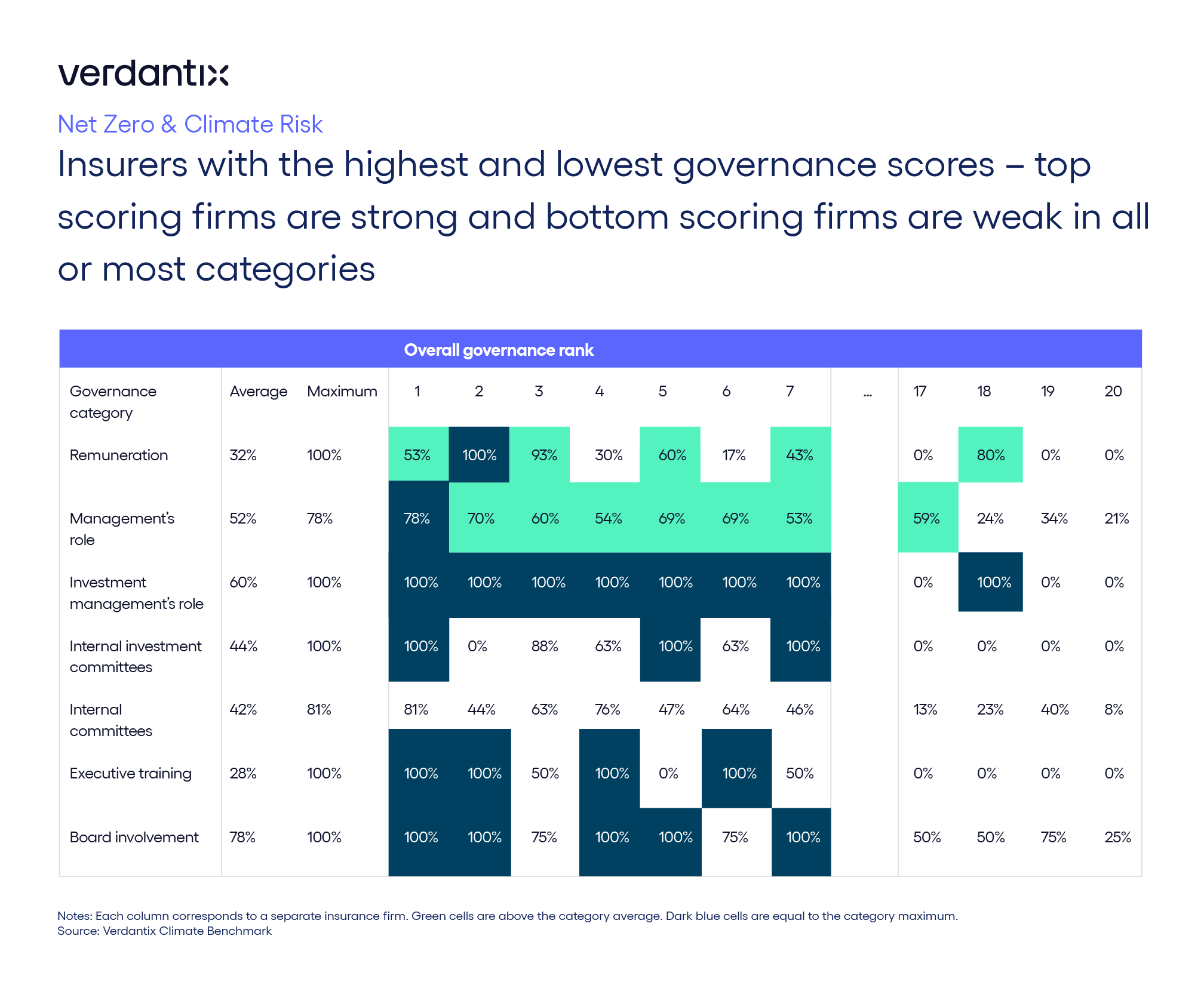

Good corporate climate governance improves cohesion around climate targets and lowers the risk of greenwashing – both of which are important to communicate to stakeholders via risk disclosures. To reveal the elements of good governance, the Verdantix Climate Benchmark assesses and compares disclosed indicators across seven categories: remuneration, management’s role, investment management’s role, internal committees, internal investment committees, executive training and board involvement. Within each of these categories, the benchmark scores firms on a scale from 0% to 100% based on the completeness and quality of their climate risk disclosures.

Based on the 20 large insurance providers in the benchmark, firms that lead in one category tend to lead in multiple. For example, two organizations are above average in all categories, and another four are above average in all but one. Five can claim to be tied for the highest score in at least three of the seven categories. Furthermore, there are several insurers that score poorly across almost all these indicators; leaders lead across the board, and laggards have much to do to catch up. Although many firms are still in the early stages of climate risk management, some have created effective governance structures and their disclosures reflect this maturity.

Good climate governance ranges from executive engagement to financial incentives

Good climate governance involves senior management and the board. In the Climate Benchmark, the highest ranked firms disclose how the CEO and executives from the finance, investment, procurement and risk functions contribute to climate strategies. These high-quality disclosures also describe who is accountable for climate strategy and the role of enterprise risk management. Additionally, these disclosures explain the involvement and relevant climate expertise of the board.

Firms that score well on governance metrics have board-level committees dedicated to aspects of climate strategy such as auditing, ethics and responsible investment, as well as external sustainability panels. Good disclosures clearly define the roles of these various committees and explain relevant training provided for executives and the board.

Leading organizations connect compensation to climate metrics and disclose the remuneration that is linked to climate performance. The highest ranked insurers in the Climate Benchmark report that more than 20% of executive salary- or share-based compensation is linked to climate or ESG metrics and also have financial incentives for employees linked to sustainability goals.

Implementing climate strategies requires good governance. As firms start on their climate risk journeys, they can learn from the benchmark leaders. To discover how Verdantix can support your climate governance disclosures, check out our Climate Benchmark and resources to transform your climate strategy.

About The Author

Emma Cutler

Principal Analyst