In A Time Of Resilience-Orientated Executives, Are Microgrids Finally Coming Of Age?

Harry Wilson

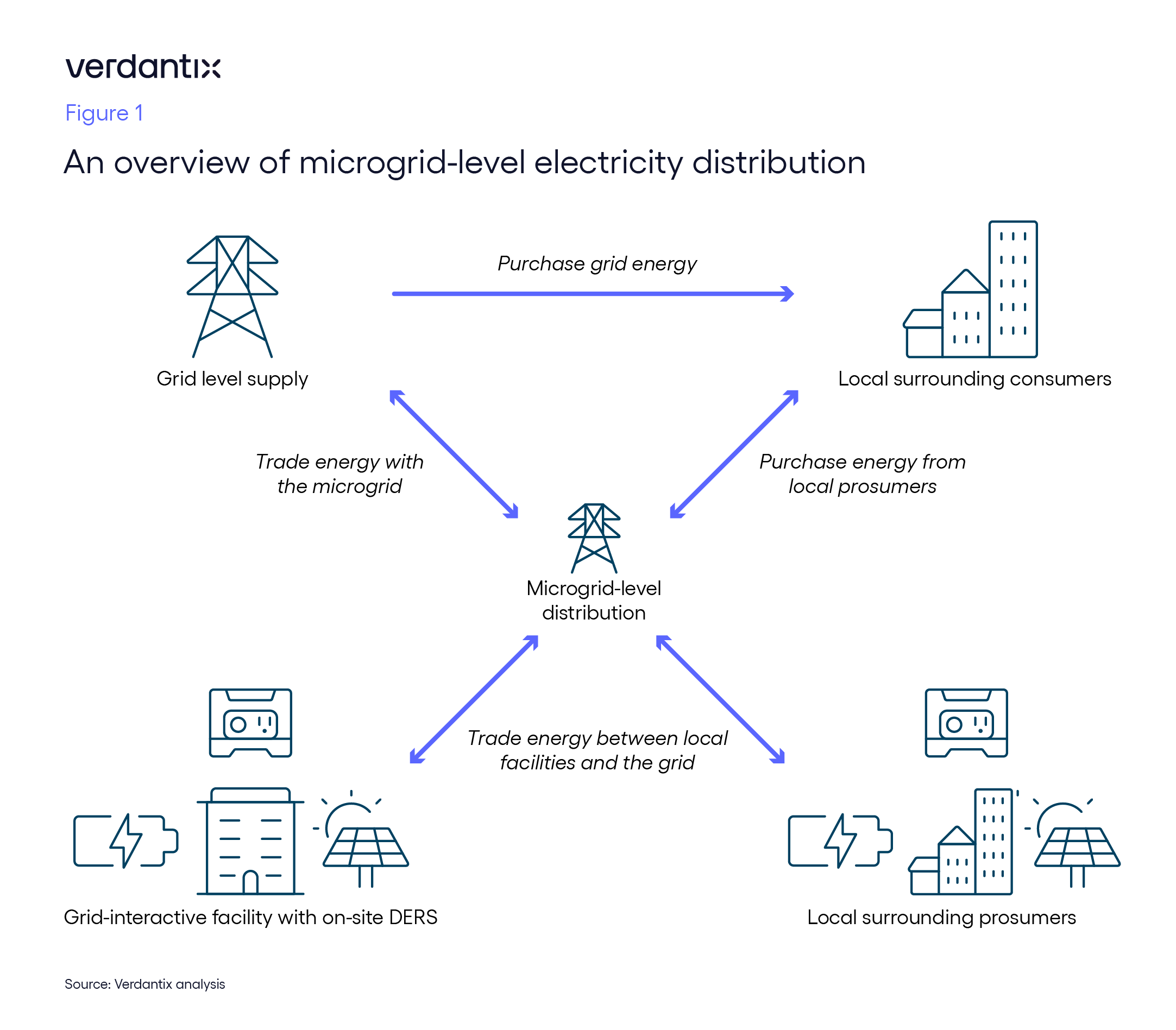

Microgrids are growing in popularity on a global scale as firms look to build resilience and improve their energy efficiency while meeting sustainability targets. A microgrid enables site-level management of distributed energy resources (DERs) and optimizes energy flows to allow for efficient energy consumption, while reducing cost through peak grid tariff avoidance (see below). Valued at $63.5 billion in 2021, the microgrid market is set to reach a value of $206.1 billion by 2031, driven by population and energy demand growth, alongside growing pressures to decarbonize energy supply. Verdantix has covered grid response and other power resilience technologies in a previous blog – but microgrids are back on the radar due to an uptake in M&A activity and changes in executive priorities.

Climate related disasters are on the rise in the US – with 25 disasters totalling damages over $1 billion each in 2023 as of Dec 8 – and subsequently so is the objective of resilience against grid outages for real estate executives. Data from the US Energy Information Administration reveals that the average American experienced two hours of power outage annually as of 2021 (the latest year of data) – when considering additional outages caused by extreme weather, this number rose to seven hours annually – and these outages came at a cost of $150 billion per year for US businesses. Power outages not only contribute to loss of revenue for organizations due to disruption of commercial activities, but they also pose serious risks to human health – for example, in the event of loss of air conditioning.

Data from the latest Verdantix global survey of real estate executives reveal that there has been a dramatic increase in the number of North American executives ranking building resilience within their portfolios as their highest priority – 27% up from 14% in 2022. As resilience moves to the forefront of executives’ minds, we anticipate that demand for microgrid technology will surge.

In recent months, there has been an uptake in M&A activity pertaining to microgrid software and solutions. One of the most notable developments came in December 2023: Uplight, a technology solution provider to the utility sector, announced it was acquiring AutoGrid, a distributed energy resources management solution (DERMS), from Schneider Electric. Interestingly, Uplight is part owned by Schneider Electric, and this shift in ownership structure shows how the vendor is trying to cater to both energy providers and consumers simultaneously with its microgrid offering.

Schneider Electric – alongside other technology vendors – continues to innovate within its own in-house microgrid technology unit. The firm launched its EcoStruxure Microgrid Flex earlier this year, which aims to provide a standardized ‘off-the-shelf’ solution for rapid deployment at customer sites, addressing common customer concerns of long design and implementation periods. Other vendors with such standardized solutions include Standard Microgrid, which focuses on microgrid solutions in the rural African market, and ABB, which has offered its ‘plug and play’ microgrid solution since 2016. It is likely we will see more of these standardized offerings come to market in the near future, to cater to the resilience needs of executives.

Boosting and improving resilience in the built environment is a key theme of the upcoming Verdantix Climate Summit in Washington, DC – for more information and to register please visit Climate Summit North America 2024.

For more information on microgrid technologies, as well as the energy storage technologies that are paramount in microgrid creation, please read Verdantix Tech Roadmap: Energy Management Technologies.

About The Author

Harry Wilson

Senior Analyst