First-Ever Green Quadrant Benchmark On Construction Management Software Reveals Six Leading Providers In A Rapidly Maturing Market

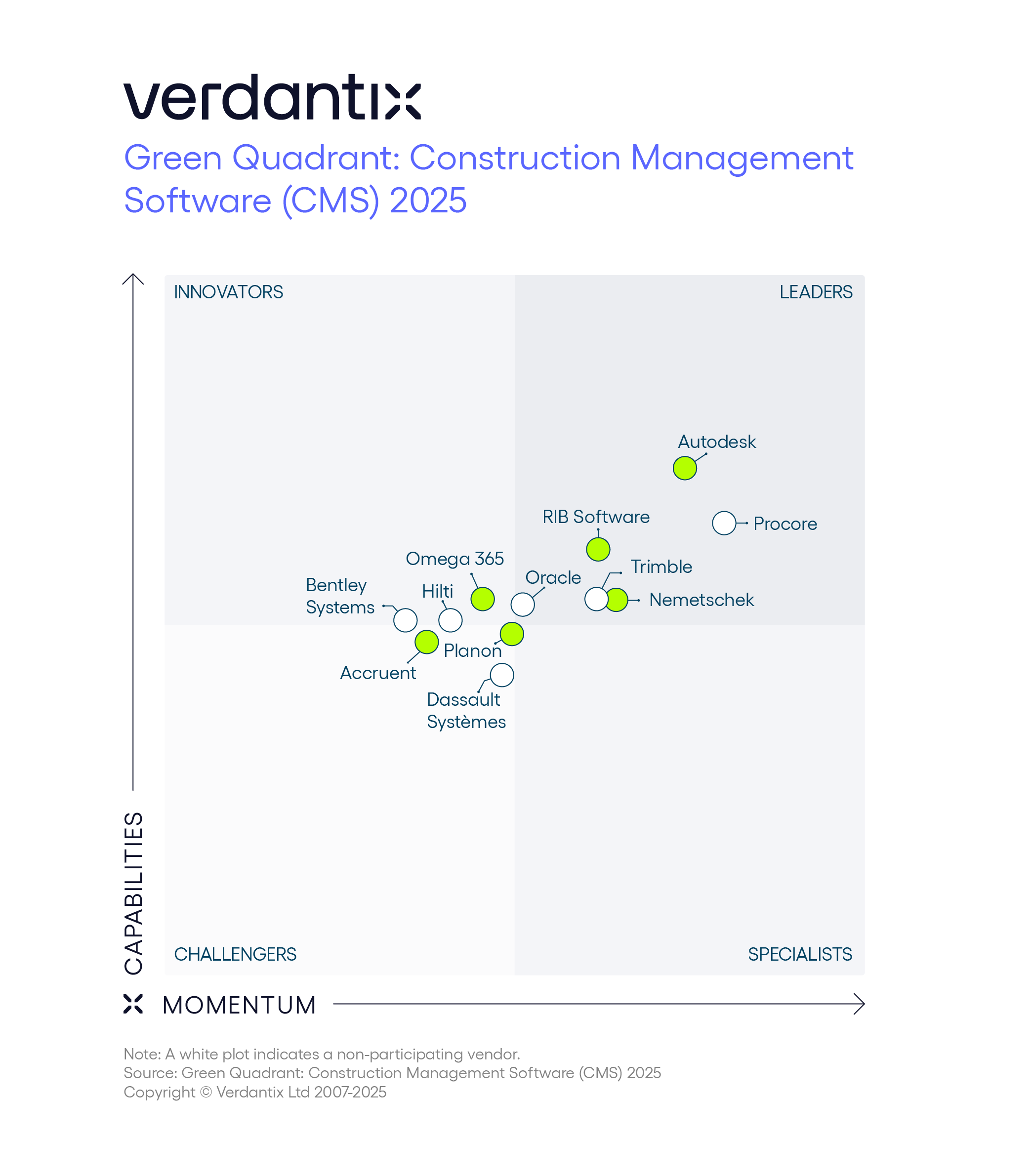

The long-awaited inaugural Verdantix benchmark of construction management software (CMS) providers, the Green Quadrant: Construction Management Software (CMS) (2025), has officially hit desks. Facing diminishing project profit margins, mounting volumes of data and heightened scrutiny around regulatory compliance, firms are racing to digitize construction processes. This report provides a deep analysis of the functionality and market momentum of 12 leading vendors in the space – Accruent, Autodesk, Bentley Systems, Dassault Systèmes, Hilti, Nemetschek, Omega 365, Oracle, Planon, Procore, RIB Software and Trimble – based on an 83-point factual questionnaire, live briefings and customer interviews. Drawing on our extensive research, the Green Quadrant reveals that:

- Consolidation amongst CMS giants risks stifling innovation and buyer choice.

Aggressive M&A strategies by leading CMS providers are strengthening their market dominance and innovative functionality, widening the gulf between established brands and smaller players. In 2024 alone, data show that the real estate and construction technology sector saw M&A deal values of over $14 billion across 292 deals, up from $11 billion in 2023. Driven by notable transactions such as Nemetschek’s acquisition of Manufacton in 2025, Autodesk’s purchase of Payapps in 2024 and Trimble’s procurement of Flashtract in the same year, buyers face a shrinking vendor pool. Despite this, the platformization of CMS solutions remains nascent; while often marketed as ‘connected ecosystems’, many have grown inorganically through acquisitions – resulting in solutions that lack cohesion and prioritize market control over user experience. Buyers should challenge the assumption that bigger is better and scrutinize the trade-offs between functional breadth of the solution suite and ease of use. - Gaps between product marketing and buyer needs are eroding trust.

Our interviews revealed a stark disconnect between customer demands and vendor roadmaps, particularly in areas such as platform configurability, pricing and training requirements. It appears that some CMS providers are missing the mark by chasing innovation and breadth of functionality, rather than solving day-to-day pain points for users. For example, many vendors lack embedded tools for sustainability tracking, but preach ESG claims. Similarly, one buyer was forced to switch providers because of a lack of transparency around pricing, highlighting how false marketing claims can negatively impact customer retention. Buyers must be cognizant of potentially misleading messaging, and challenge vendors to demonstrate real-world proof points and examples. - AI functionality is moving beyond automated admin.

In a market filled with noise about the transformative power of AI, it can be hard for buyers to cut through the hype. Findings from our report suggest that vendors are moving beyond the overuse of AI as a buzzword and are beginning to deliver more sophisticated capabilities than basic task automation. Omega 365 is an exemplary case study of a vendor positioning itself to ride the wave of increasing demand for advanced AI capabilities. The firm’s extensive investment in its in-house AI assistant, Omega 365 GPT, is driving its success amongst customers managing complex construction projects. However, vendors who prioritize rapid feature releases risk overwhelming users and steepening learning curves; our interview insights reveal that site teams sometimes struggle to keep pace with solution updates. Providers are therefore urged to prioritize usability for daily users.

Market maturity is some way off; however, our analysis takes a deep dive into the first signals of platform consolidation and emerging features of differentiation. With the CMS market poised for strong growth, understanding the unique strengths of each provider is critical to making informed decisions. To keep up with the latest developments in the CMS market, read the full Green Quadrant benchmark report here.

About The Author

Sophie Planken-Bichler

Analyst