A Case Study In Transition Risk: How Extreme Weather Events Accelerated Climate Action In Australia

In 2023, economy-wide failure to decarbonize fast enough lead to a high number of climate-change-driven physical climate damages. It’s widely expected that this pattern will lead to abrupt, and potentially damaging, transitions. Recent events in Australia show this process at work.

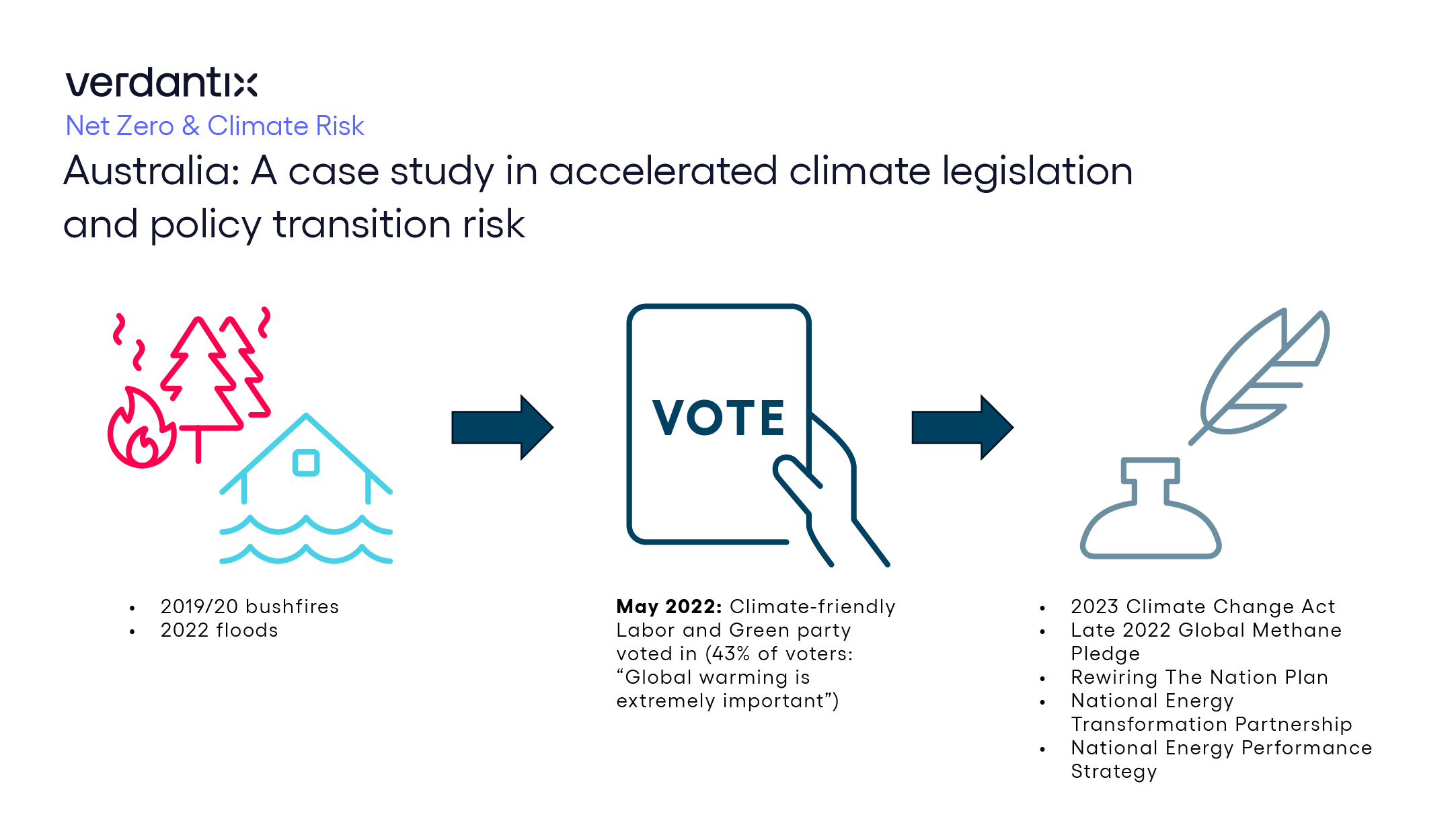

In 2019 and part of 2020, Australia experienced the worst bushfire season in its history (named ‘Black Summer’), causing incommensurable losses to people and nature. During the first half of 2022, the country faced unprecedented health events and floods, disrupting local communities and economies. A harsh wakeup call for the country that, in 2021, was the second most dependent on coal for power generation across the OECD, but still retained the same modest net zero targets from six years prior.

Yet, in 2022, Australia saw one of the highest absolute drops in emissions, with over 13% of energy generated by solar power. Such a drastic shift in climate change priorities and strategy can be attributed to an increased public concern towards environmental issues. Australia Institute’s data show that in 2022, 42% of respondents were “very concerned” about climate change, compared to 24% in 2017. The increased public awareness towards global warming was a critical factor shaping the 2022 federal election, where the climate crisis was identified as one of the top two issues that convinced voters to swung Labor.

Throughout 2023, the new government launched several initiatives to be at the forefront of climate action and accelerate the net zero transition. In June, the government allocated $20.5 billion, as part of the clean energy programme Rewiring the Nation, to the Clean Energy Finance Corporation to invest in renewable energy and energy efficiency. With more ambitious decarbonization targets, the new government mandated Australia’s financial regulator to consider climate risk and promote transparency. As such, it announced the introduction of mandatory climate-related financial disclosure requirements, based on the International Sustainability Standards Board (ISSB) standards, starting as early as July 2024. The new rules will cover firms with over 500 employees, over $500 million and assets over $1 billion first, then medium and smaller entities in 2026 and 2027.

With a sudden change of direction towards climate action, Australian firms need to act now to reduce and report their emissions. Consulting partners and dedicated software vendors are developing their offerings not only to support organizations with their disclosure reporting, in line with the ISSB, but also to develop a robust net zero strategy, and to implement it at the asset level. Global firms are acquiring specialist providers to gain customer presence in Australia, such as WSP with Calibre and IBM with Envizi, and develop industry-specific expertise.

To learn more about what to consider when building a transition plan, read our Strategic Focus: Transition Risk Primer.

About The Author

.png?sfvrsn=db470322_1)

Alessandra Leggieri

Senior Analyst