What Does Trump’s Second Presidency Mean For Heavy Asset Industries?

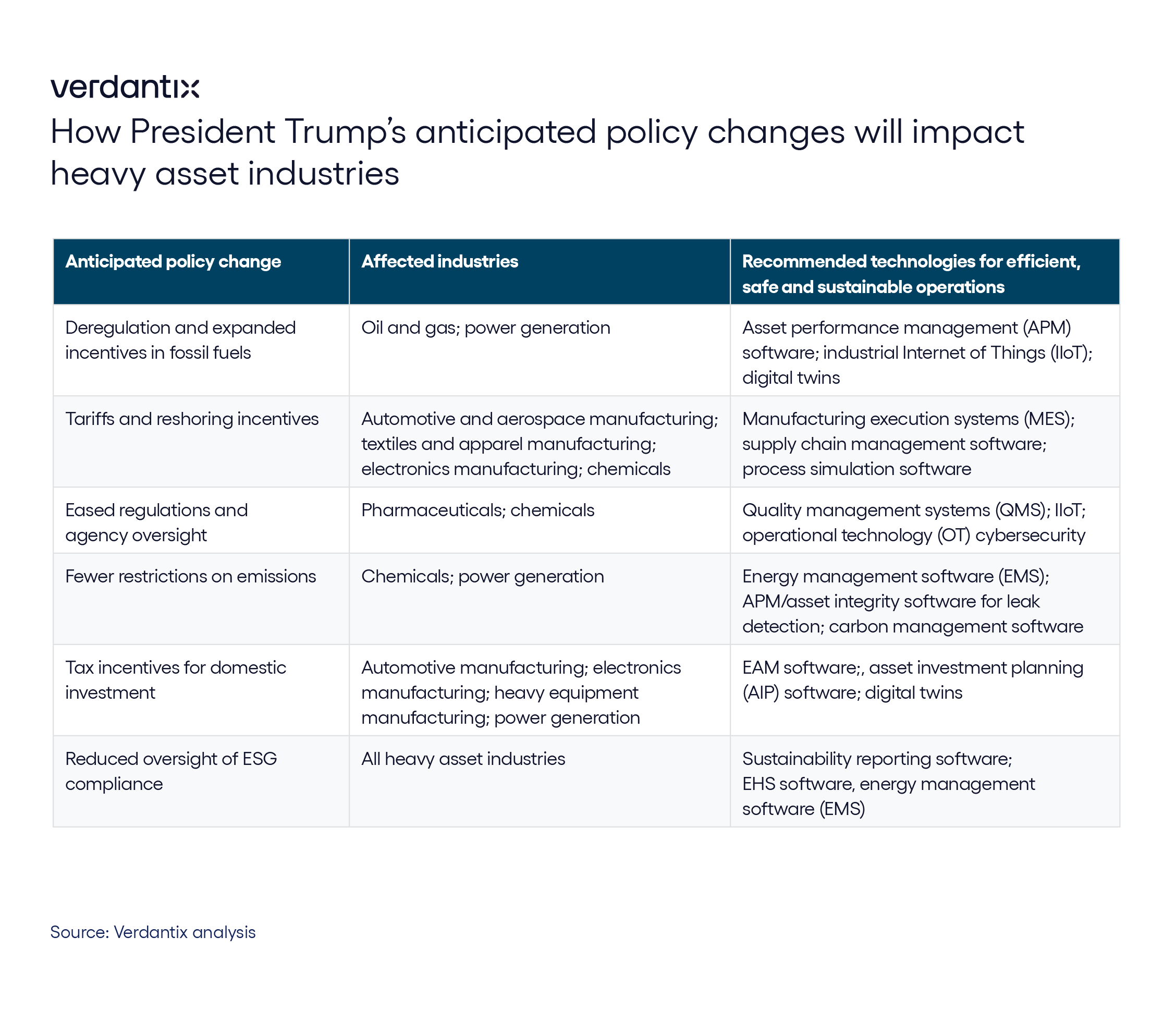

President Donald Trump’s inauguration on January 20, 2025, ushered in a series of executive orders poised to significantly impact heavy asset industries in the US. These directives emphasize deregulation, energy independence, and a shift in federal policies, creating both opportunities and challenges for sectors such as oil and gas, manufacturing, chemicals, power generation and pharmaceuticals. To navigate this evolving landscape, businesses must strategically invest in industrial software to enhance operational efficiency, ensure compliance and drive innovation. Key policy changes and their implications are:

- Maximizing domestic energy output through asset optimization in oil and gas.

In line with his commitment to bolster fossil fuel production, President Trump declared a “national energy emergency” to expedite the development of fossil fuel infrastructure. This initiative encourages energy exploration on federal lands and waters and aims to dismantle subsidies and policies favouring electric vehicles. While the initiative is designed to boost domestic energy output, it may also increase operational complexity and environmental scrutiny. To navigate these challenges, oil and gas firms should invest in asset performance management (APM) and Industrial Internet of Things (IIoT) solutions for real-time monitoring and predictive maintenance, to bolster production efficiency and sustainability. Digital twin platforms will also play a critical role in simulating asset performance, optimizing maintenance schedules and improving overall site reliability.

- Leveraging technology to combat supply chain pressures in manufacturing.

Trump’s reshoring agenda, bolstered by tariffs and updated trade agreements, is likely to drive growth in domestic manufacturing – but will also amplify supply chain costs and complexities. Firms can adapt by investing in manufacturing execution systems (MES) and advanced supply chain management tools, to optimize production and logistics. For energy-intensive operations, energy management software (EMS) can help control costs and align with sustainability goals. Furthermore, AI-driven analytics can deliver predictive insights into production performance, enabling organizations to reduce downtime and improve operational efficiency.

- Accelerating breakthroughs in pharmaceuticals and chemicals under relaxed regulations.

The administration’s deregulatory stance offers pharmaceuticals and chemical firms the opportunity to accelerate innovation and bring products to market faster. However, maintaining global quality standards and market credibility remains critical. IIoT-enabled traceability systems and quality management systems (QMS) can optimize batch quality and ensure compliance, even in a less regulated domestic environment. Meanwhile, as these industries rely more on connected systems, robust cybersecurity solutions tailored to operational technology (OT) environments can safeguard sensitive data and ensure operational resilience.

As industries adapt to these policy shifts, firms must prioritize the integration of diverse industrial technologies to streamline operations, enhance sustainability and ensure global compliance. Tools such as IIoT, enterprise asset management (EAM) software, MES, digital twins and advanced cybersecurity solutions will be essential for addressing operational complexities and aligning with evolving market demands. Beyond technology, firms must adopt strategic priorities such as building supply chain resilience, balancing regulatory shifts with ESG expectations, and strengthening workforce capabilities. Firms that prioritize digital transformation will position themselves as more resilient and aligned with the evolving demands of both regulators and stakeholders.

About The Author

Josh Graessle

Senior Analyst