Wearables For Buildings: How CPIPs Are Helping Real Estate Get In Shape

When determining what makes the difference between a traditional IWMS and a leading CPIP offering, health-tracking applications can serve as useful solutions from which to draw parallels. Most organizations, and the people charged with managing their real estate, have a patchy view of their portfolio health. They face risks due to a lack of consolidated, holistic views from the multitude of data sources.

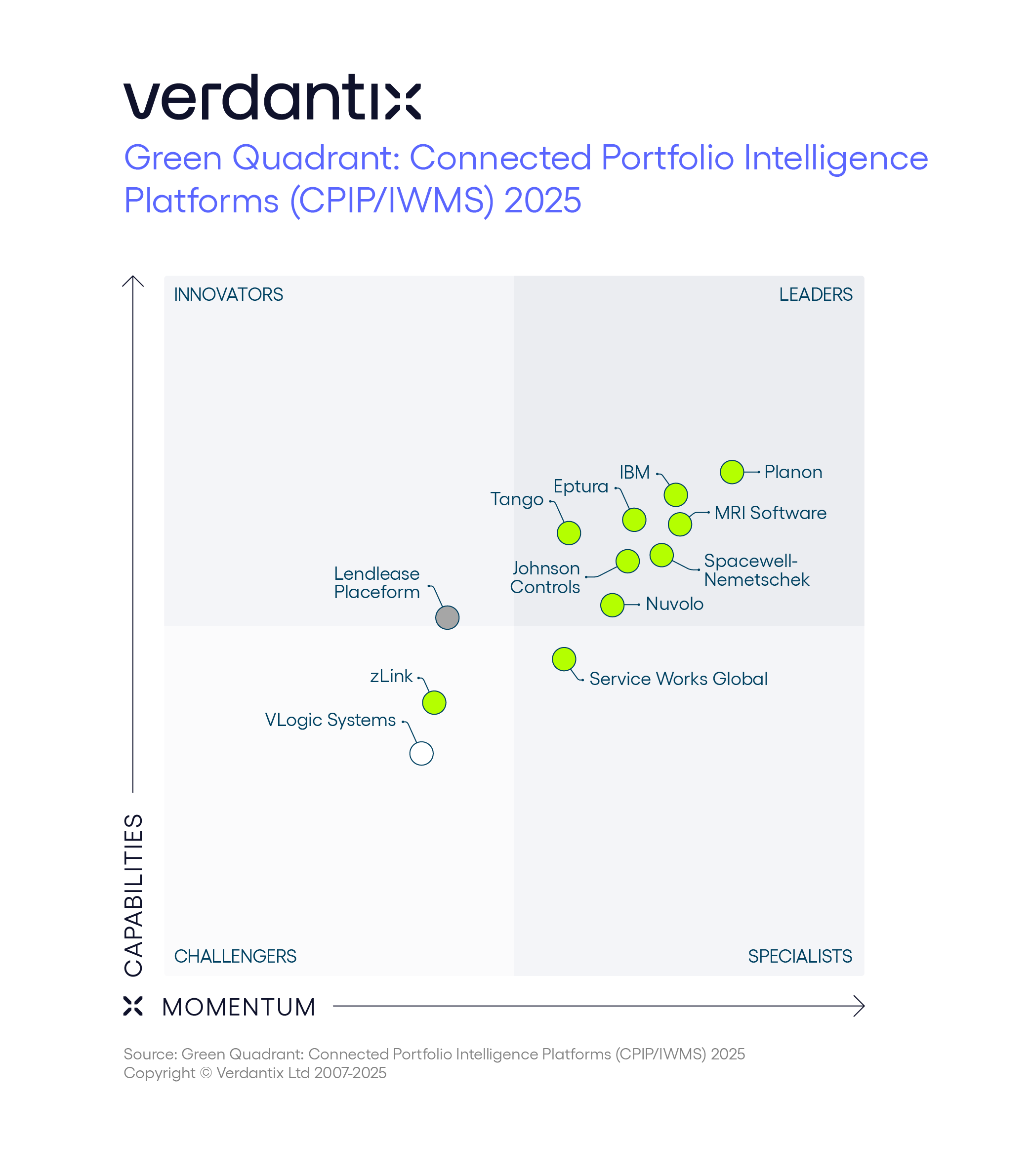

Leaders in Verdantix Green Quadrant report on CPIP/IWMS provide platforms that offer a building health view similar to that of the best fitness and wellbeing apps. Consider the health-tracking apps and platforms on the market today, they:

- Store core user-inputted data such as age, height, weight, medications and health goals (for example, the ideal number of sleeping hours or calories eaten per day).

- Collect different health statistics from other solutions, such as dieting and running apps, and hardware devices, such as number of steps taken, heart rate, blood oxygen levels and sleeping behaviours.

- Combine user-inputted data and third-party data sets to provide alerts, identify trends, benchmark against peers and demographic cohort, calculate averages, find correlations between health statistics and provide recommendations to help users meet their health goals.

Now imagine if real estate executives had a solution like a health app platform, but for real estate and building data. CPIPs have all the hallmarks of a health app, but for portfolio data. The Verdantix Green Quadrant report shows that CPIP/IWMS providers are on the journey to offer CPIPs that:

- Store static portfolio data such as leases, asset warranties, building locations and key stakeholders.

- Collect live data from smart devices, building systems, equipment and third-party solutions.

- Organize, standardize and combine static and live data sets to unearth correlations, identify trends, flag abnormalities, provide recommendations and enable greater automation via smart interconnected workflows across the different modules.

- Improve and provide frictionless workplace experiences for employees via mobile applications, with tools to manage day-to-day processes, such as booking spaces, and drive collaboration.

Vendors offering functionality from over 100 types of apps are undertaking different approaches to transition into CPIP suppliers. Some providers are acquiring point solutions to offer new capabilities and working towards integrating them into their broader CPIP solution. Large building technology firms, such as Johnson Controls, Schneider Electric and Trane Technologies, are entering the market via acquisitions, providing IWMS/CPIP vendors with greater knowledge of operational technology systems. Other players in the market are focusing on building new capabilities in-house from scratch or bringing functionality from other solutions into their existing suite.

Although suppliers are at various stages of the journey, they are all investing in building-out CPIP characteristics to address customer demands for comprehensive portfolio views, automation and data-driven recommendations. As vendors continue to build-out CPIP functionality, the lines between CPIP/IWMS and digital building IoT platforms will continue to blur, positioning 2025 as a critical year for determining building health.

If you wish to learn more about the CPIP/IWMS solutions market and the top market leaders, read the Verdantix Green Quadrant: Connected Portfolio Intelligence Platforms (CPIP/IWMS) 2025. The report provides individuals responsible for selecting and getting value from CPIP/IWMS solutions with comprehensive insights into 12 prominent solution providers.

About The Author

Joy Trinquet

Senior Analyst