Verdantix Green Quadrant Benchmark Highlights Product Innovation Is Redefining The Well-Established EAM Software Market

Hugo Fuller

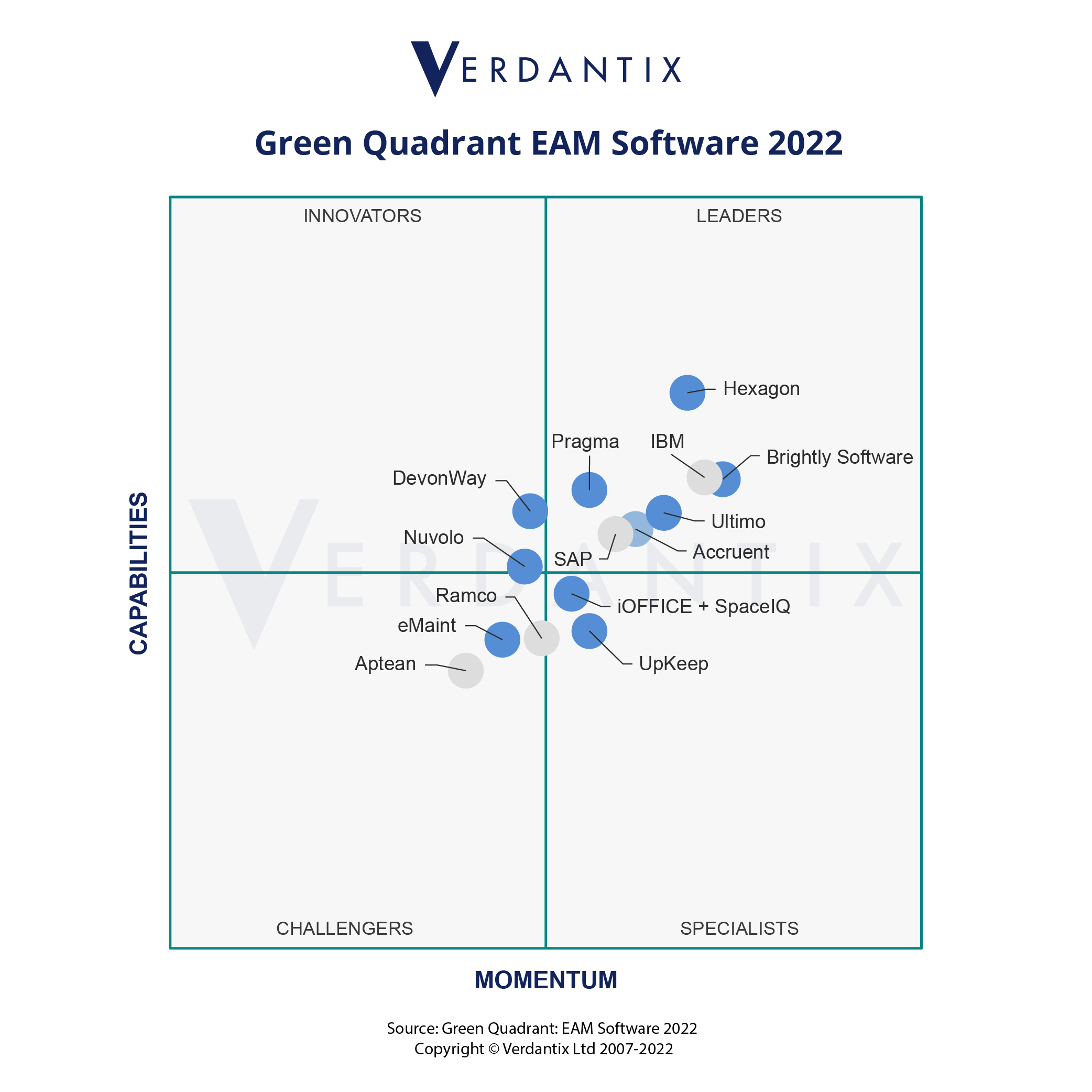

The recently published first edition of the Verdantix Green Quadrant: Enterprise Asset Management Software 2022 assessed 14 enterprise asset management (EAM) software vendors across their product functionality, user interface and market momentum. Our research included two-hour live software demos, desktop research, vendor responses to a 207-point questionnaire and findings from our Global Corporate Survey of 256 operations, maintenance, engineering, and process safety decision makers. What are the key takeaways from the benchmark of EAM software applications?

Firstly, the EAM software market is mature, with potential buyers spoilt for choice. In our benchmark, seven vendors made it into the Leader’s Quadrant: Accruent, Brightly Software, Hexagon, IBM, Pragma, SAP and Ultimo, demonstrating breadth of functionality and strong market momentum. The high number of Leaders reflects the maturity of the EAM software market, with each member of the Leader’s Quadrant having been established for more than 25 years. Among the Leaders, vendors were especially capable in certain areas: Hexagon and IBM demonstrated advanced maintenance analytics capabilities, while Pragma and Ultimo excelled with integrations. Brightly and SAP exhibited strong core EAM functionality, such as for work management, and Accruent’s capabilities for business intelligence, including charting and reporting were refined.

Secondly, the EAM software market is expanding owing to M&A activity and private equity investments. The EAM market is long-established, but demand is still robust, driven by M&A, partnerships and private equity investment. Vendors are using these resources to strengthen the breadth as well as depth of their solutions, as well as expanding into new markets to gain market share. Accruent, Brightly, Hexagon, iOFFICE + SpaceIQ and Pragma have made acquisitions since 2018, while eMaint has been wholly owned by Fluke Corporation since 2016. Nuvolo and UpKeep have each raised more than $30 million in funding since 2020.

Thirdly, EAM software vendors are seeking to innovate through continued development of mobile applications, integrations, analytics and use case coverage. To differentiate, vendors are increasing the breadth of functionality of their EAM software offerings. Mobile applications help to streamline maintenance tasks and are a key investment area for vendors in the EAM space. Integration of existing systems are integral to EAM, but new integrations are being created; for example, Ultimo’s EAM software application integrates with wearables and drones, while Accruent’s Maintenance Connection EAM software integrates with IoT platforms to track and easily locate assets. Analytics is another area of investment for the vendors. ManagerPlus from iOFFICE + SpaceIQ enables the forecasting of spare parts required based either on threshold levels or by taking into consideration active as well as upcoming work orders. Another key innovation area is the incorporation of capabilities which go beyond maintenance processes: for example, DevonWay provides strong operational risk management capabilities alongside its EAM solution, while both Ramco and Aptean’s EAM solutions sit within its larger ERP offering.

About The Author

Hugo Fuller

Senior Analyst