Verdantix Green Quadrant Benchmark Highlights Leading ESG & Sustainability Assurance Providers

Lily Turnbull

Over the last five years, firms have faced heightened scrutiny of their ESG and sustainability performance. Regulators, investors and customers are demanding more and better-quality sustainability data. Sustainability assurance has emerged as a critical tool to help businesses build trust with stakeholders, as well as a way for regulators to safeguard consumers and end-users against greenwashing. To help firms select the best-fit provider, the Verdantix Green Quadrant: ESG & Sustainability Assurance Services 2024 report evaluates 14 of the most prominent sustainability assurance firms in the market today.

While the sustainability assurance market has been around for over 20 years, it has, until recently, been predominantly voluntary and stakeholder-driven. In January 2023 the EU’s Corporate Sustainability Reporting Directive (CSRD) came into effect, requiring large and listed European firms – and non-EU firms with substantial revenue in the EU market – to disclose sustainability information and obtain external assurance. The EU’s CSRD has set the standard for ESG reporting and assurance globally, with countries such as Australia, the US and India set to follow suit by mandating assurance.

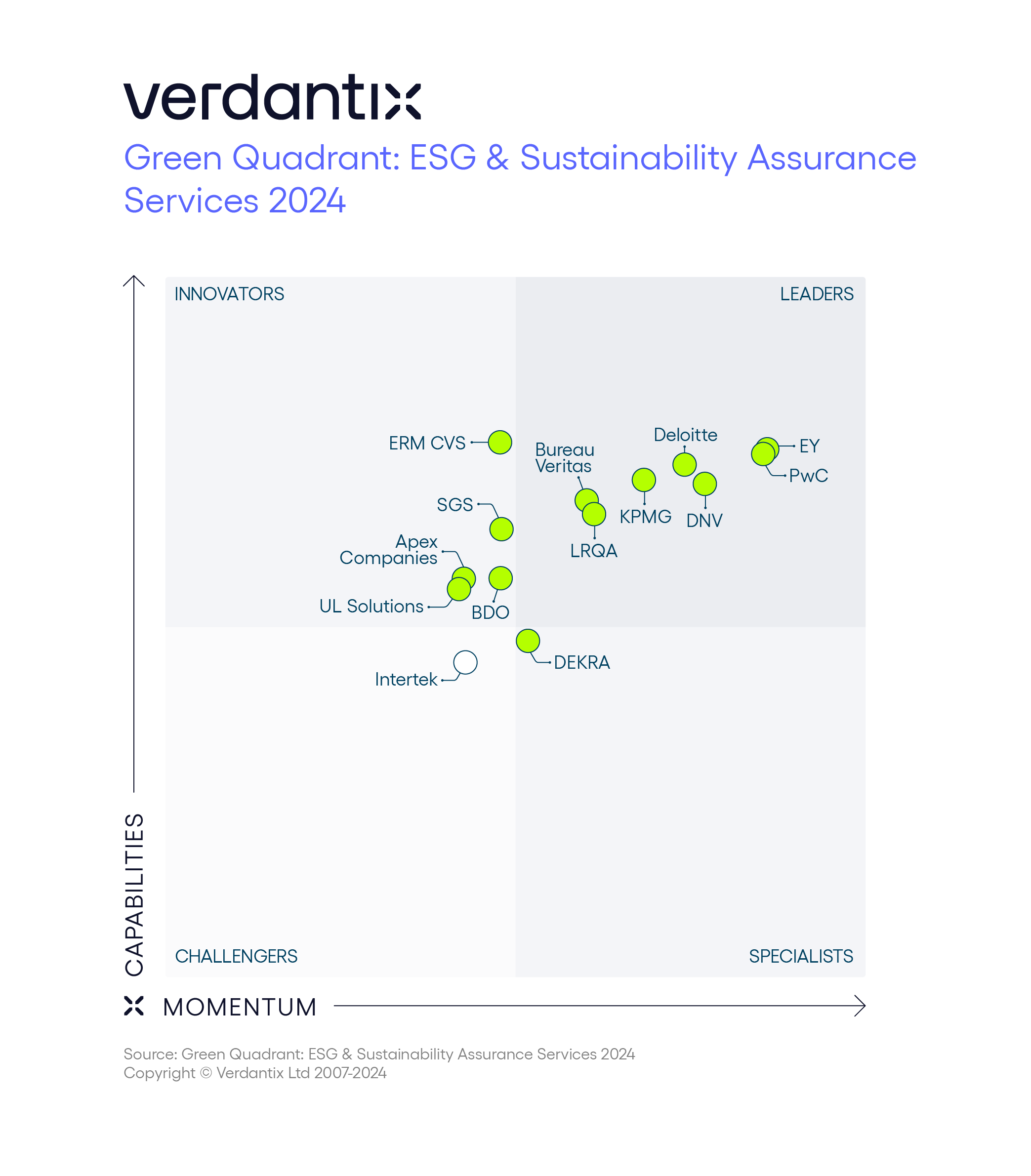

Our research – based on the proprietary Verdantix Green Quadrant methodology – encompassed two-hour live briefings, desk research, customer references and vendor responses to a 51-point questionnaire, covering five capabilities and three market momentum categories. The scores for these categories generated our Green Quadrant graphic, which features Apex Companies, BDO, Bureau Veritas, DEKRA, Deloitte, DNV, ERM CVS, EY, Intertek, KPMG, LRQA, PwC, SGS and UL Solutions.

Our analysis of the market reveals that:

- Pre-assurance is gaining traction as more firms seek ESG assurance for the first time.

Given the scale of regulations such as the CSRD – which will impact businesses of all sizes – many firms will be seeking sustainability assurance for the first time. Our research indicates a rise in the number of assurance readiness projects, with 58% of firms having completed (or being in the process of completing) a pre-assurance assessment with an external provider within the last 12 months.

- Scope of sustainability metrics assured is expanding.

As a result of increasing regulatory pressure and evolving stakeholder demand, the scope of sustainability metrics subject to external assurance is expanding from GHG emissions to encompass broader environmental and social impact metrics. In response to this, assurance providers are broadening their skillsets through hiring, reskilling and training, to ensure they have expertise in areas such as water stewardship, biodiversity, product claims and human rights, as well as developing topic-specific sustainability committees to help with knowledge dissemination.

- New technologies are improving efficiency, automating workflows and enhancing insights.

Sustainability assurance firms are increasingly leveraging digital technologies to improve efficiency, automate workflows, reduce client burdens and strengthen analytical procedures. Many of the firms in this Green Quadrant mentioned continuing to invest in emerging technologies and artificial intelligence (AI) to drive automation and advanced analytics.

Spend on ESG and sustainability assurance services will continue to grow in 2025, as the number of firms needing to demonstrate compliance expands, and as transparency, trust and accountability become more important. To learn more about the market for ESG and sustainability assurance services, download the report here.

About The Author

Lily Turnbull

Senior Analyst