Verdantix Green Quadrant Benchmark Highlights Leading EAM Software Vendors

Hugo Fuller

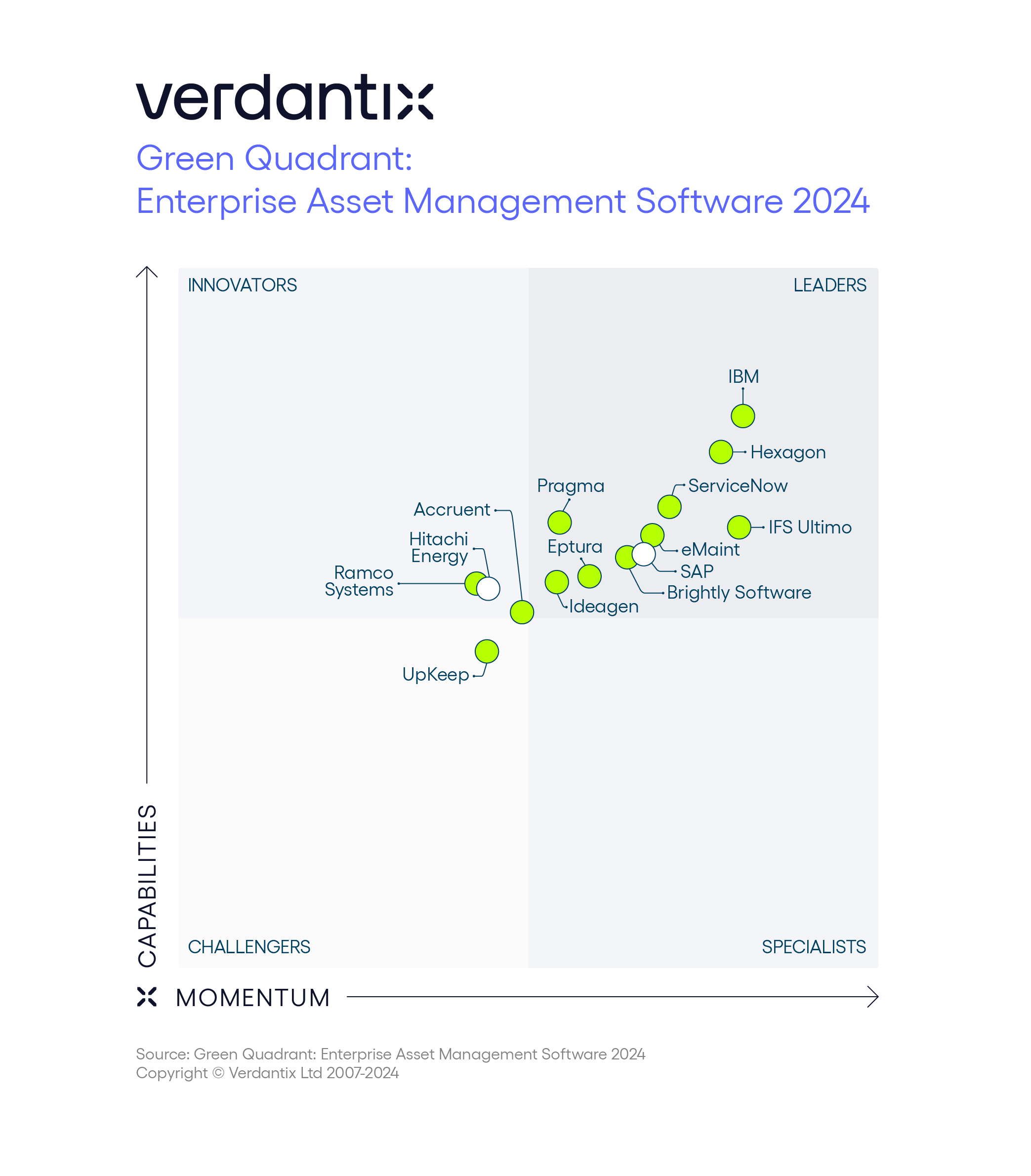

The 2024 Green Quadrant: Enterprise Asset Management Software 2024 report assesses 14 enterprise asset management (EAM) software vendors on their products’ technical and functional capabilities, and their market momentum. Our research entailed two-and-a-half-hour live software demonstrations with participants, responses to a 151-point factual questionnaire, interviews with 14 corporate EAM software buyers and desk research. The study also includes findings from our 2023 operational excellence global corporate survey of 304 operations, maintenance, engineering, IT and process safety decision-makers. Vendors featured in this Green Quadrant are Accruent, Brightly Software, eMaint, Eptura, Hexagon, Hitachi Energy, IBM, Ideagen, IFS Ultimo, Pragma, Ramco Systems, SAP, ServiceNow and UpKeep.

What are the key takeaways from this benchmark of EAM software applications? Our analysis shows that:

- Generative AI is being deployed for limited use cases as vendors focus on R&D.

Many organizations in the broader asset management tech market have turned their attention to GenAI as the envelope-pusher for next-generation products. EAM software providers are no different, with more than half of firms highlighted in the Green Quadrant developing GenAI capabilities – and some firms having already launched them. IBM’s Maximo Application Suite (MAS) 9.0 release includes Work Order Intelligence, which automatically corrects inaccurate failure modes in Maximo work orders. ServiceNow has integrated Microsoft Copilot, which allows users to interact with work orders via a conversational interface. Many other market participants are launching GenAI capabilities in late 2024 or early to mid-2025.

- Mobile applications are still a core developmental area.

In our 2022 EAM Software Green Quadrant, mobile applications were a significant focus area for evaluated firms. Indeed, the mobile experience in computerized maintenance management system (CMMS) and EAM software products has been a major area of disruption over the past decade, bringing with it the success of mobile-first providers such as MaintainX and UpKeep. Mobile user experiences have improved further since our 2022 study, with several firms overhauling user interfaces (UIs) and expanding capabilities. The average score for mobile applications has risen from 1.2/3.0 in 2022 to 2.1/3.0 in 2024.

- Inventory optimization is fertile ground for innovation.

Inventory management has been a core application for EAM software since its inception more than three decades ago. In the past two years, we have seen EAM software providers focusing more attention on differentiation within well-defined inventory management functionality. Several evaluated firms are investigating new out-of-the-box modelling for inventory consumption, while others are focusing on overhauling the UI for inventory management. Fluke, which owns eMaint, signed a partnership with Verusen in June 2024. Verusen provides a maintenance, repair and operations (MRO) materials optimization product, which eMaint will leverage to bolster its inventory optimization capabilities.

To see the full analysis, download the report here.

About The Author

Hugo Fuller

Senior Analyst