Verdantix ERM Services Green Quadrant Highlights Tech-Driven Growth, ESG Pressures – And A Battle For Risk Resilience

Renee Murphy

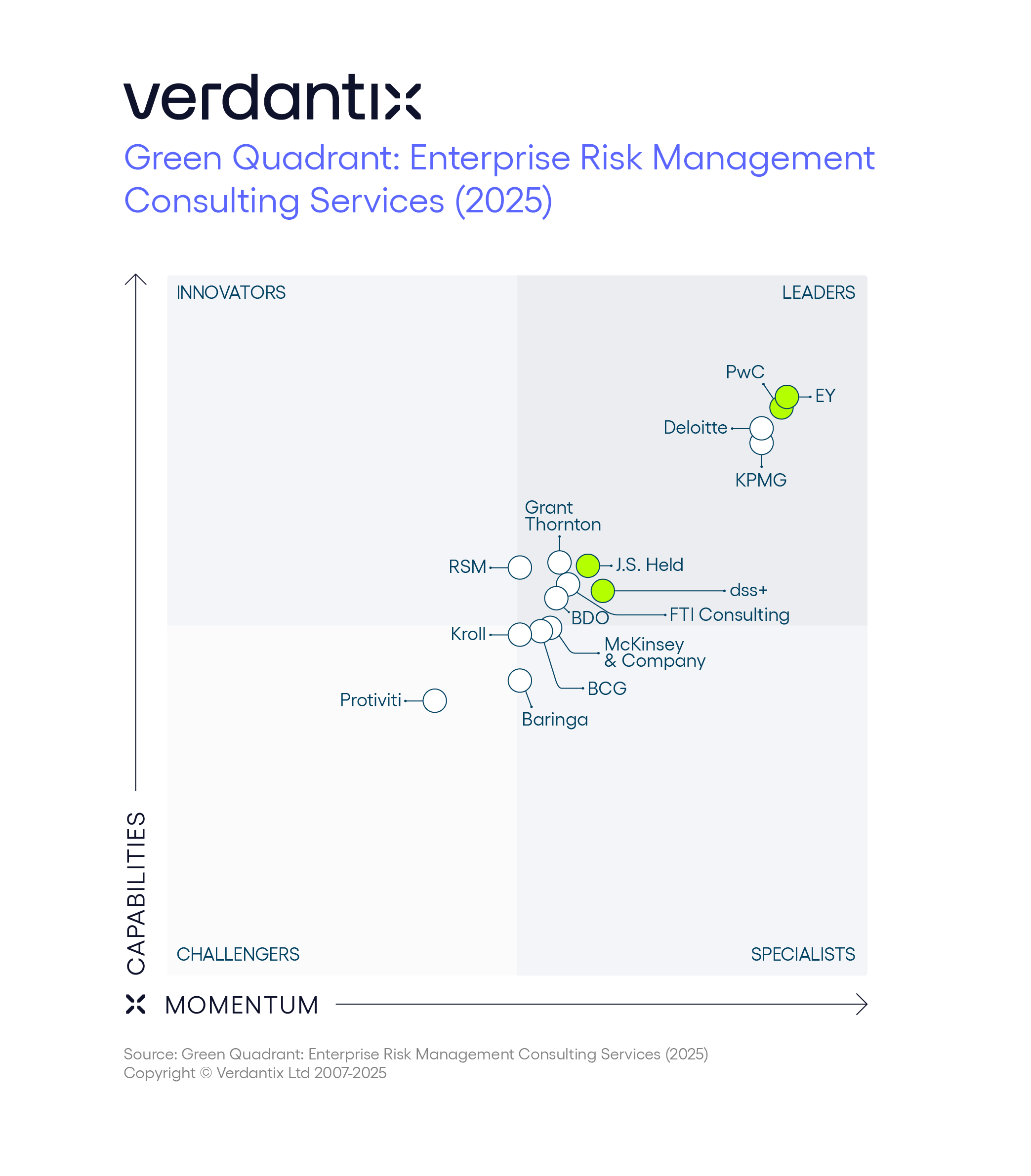

Enterprise risk management (ERM) has evolved into a critical function that goes well beyond preventing compliance breaches. In today’s rapidly shifting environment – marked by accelerating technology adoption, uncertain geopolitical landscapes and a heightened focus on sustainability – firms increasingly rely on ERM to identify both threats and opportunities. As revealed in the 2025 Verdantix Green Quadrant on ERM consulting report, the discipline is quickly expanding worldwide, with technology-driven solutions, ESG priorities and strategic foresight dominating current and future trends. Verdantix evaluated 15 key ERM services vendors using its proprietary Green Quadrant methodology, to provide an objective comparison for buyers seeking the right advisory partner. Key insights from the report show that:

- The ERM advisory market is strong.

The ERM advisory market is growing, as organizations increasingly integrate risk management into strategic decision-making. North America leads in adoption, thanks to regulatory pressures and advanced technologies, while Asia-Pacific is the fastest-growing market. The landscape includes large leading firms such as the Big Four – Deloitte, EY, KPMG and PwC – offering enterprise-wide transformation services, alongside specialized firms such as Baringa, dss+ and J.S. Held, which focus on industry-specific risks.

- Technology and ESG are driving ERM demand.

Technological advancements, including AI and machine learning (ML), are transforming ERM by improving predictive analytics and risk modelling. However, organizations often require external expertise to integrate these capabilities effectively. Firms such as Grant Thornton, KPMG and Protiviti offer AI-powered risk assessments, while BDO and McKinsey & Company focus on aligning risk with business strategy. ESG risk management is a top priority for executives, driving demand for specialized advisory services from vendors such as FTI Consulting, J.S. Held and RSM, to help manage regulatory compliance, sustainability risks and climate-related disclosures.

- Diverse vendor offerings mean that there is something for everyone.

The ERM advisory market caters to a broad spectrum of clients. Large-scale transformations are handled by the Big Four, through enterprise-wide risk strategy, regulatory compliance and cyber security services. Niche providers such as Baringa, FTI Consulting and J.S. Held specialize in areas such as operational resilience, forensic investigations and ESG. Mid-sized firms like Grant Thornton and Protiviti Thornton provide customized ERM frameworks tailored to industry-specific challenges, while Kroll excels in investigative risk management and cyber security. Organizations must therefore align vendor selection with their specific risk priorities and maturity levels.

Despite economic challenges and consulting sector lay-offs, ERM advisory services continue to expand. Although The Big Four faced workforce reductions in 2023 and 2024, they continue to invest in AI, cyber security and ESG services to meet growing market needs. The future of ERM will be shaped by AI-driven risk intelligence, real-time monitoring and holistic risk frameworks that integrate operational, financial and ESG risks. As geopolitical, regulatory and technological risks evolve, ERM advisory firms will play a critical role in assisting business leaders in addressing systemic and emerging risks.

About The Author

Renee Murphy

Principal Analyst