Verdantix EHS Software Green Quadrant: Market Is Teetering On The AI Innovation Precipice

13 Jan, 2025

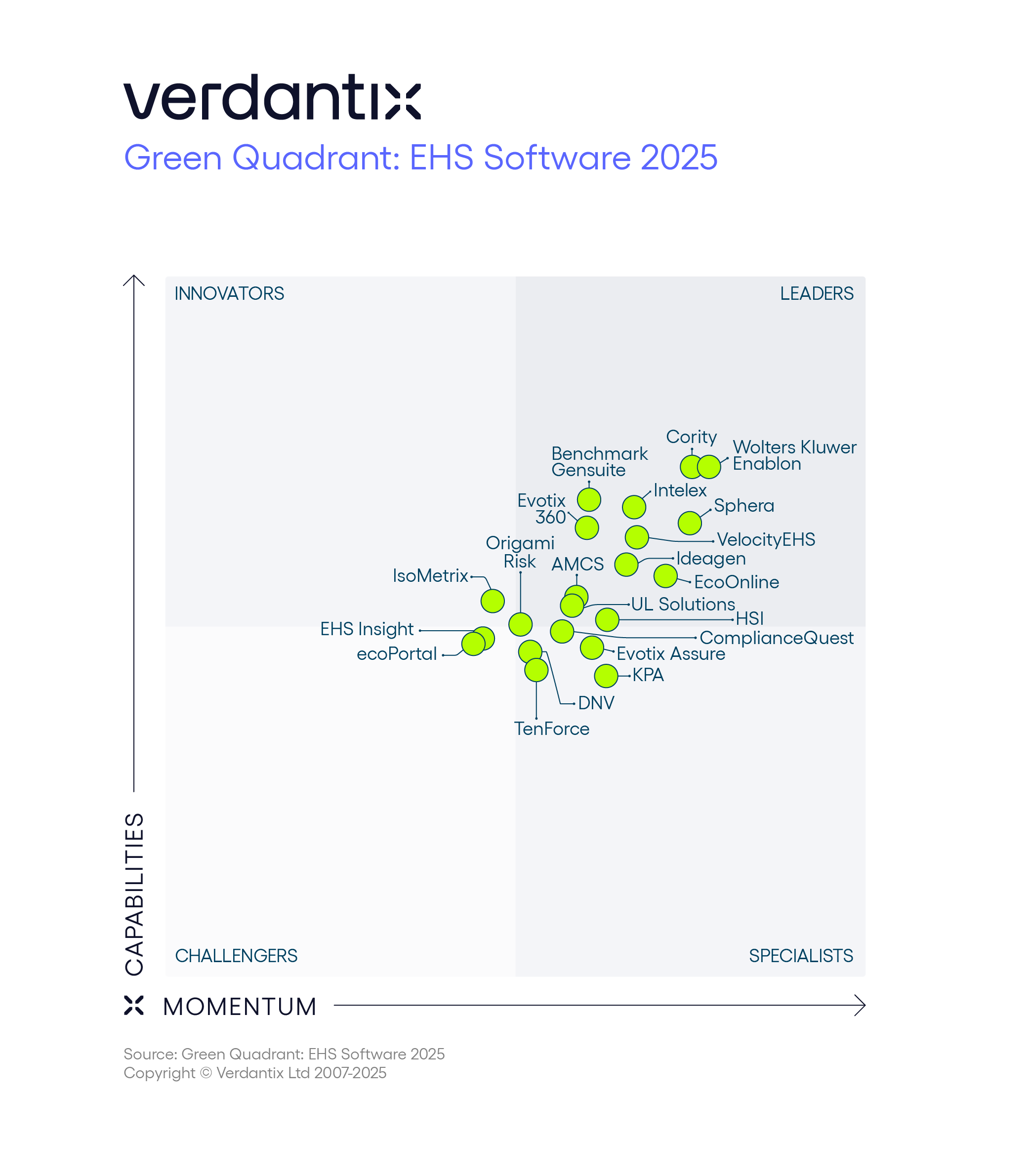

The recently released 2025 Verdantix Green Quadrant: EHS Software report evaluated both the capabilities and market momentum of 21 prominent EHS software solution providers. The analysis combined a 323-point questionnaire; a two-and-a-half-hour live demonstration from each vendor; and more than a decade of EHS technology market research. Verdantix also conducted interviews with vendors’ customers and reviewed the data from our global survey of 301 EHS decision-makers. What are the key findings we gained from this benchmark study of EHS software vendors?

- 13 vendors place in the Leaders’ Quadrant.

With hundreds of EHS software solutions vying for buyer headspace, the Verdantix EHS software Green Quadrant (GQ) uses strict inclusion criteria to only accept large, broad management platforms. To be selected, firms must have revenues exceeding $10 million, offer broad capabilities and have the human, financial and technological resources to meet the needs of diverse customers for the foreseeable future. Of the 21 solutions benchmarked, 13 vendors placed in the highly coveted Leaders’ Quadrant – AMCS (formerly Quentic), Benchmark Gensuite, Cority, EcoOnline, Evotix 360, HSI, Ideagen, Intelex, Origami Risk, Sphera, UL Solutions, VelocityEHS and Wolters Kluwer Enablon.

- Market is on the edge of an AI innovation precipice, with core use cases becoming clear.

Given the breadth of functionality available through EHS management platforms, the potential AI use cases are immense. Throughout the past two years, EHS software providers have been innovating and trialling scattered AI features. Entering 2025, high-impact AI use cases are coming into focus, with EHS virtual assistants leading the charge. Vendor AI maturity remains diverse: prominent examples of innovation are Benchmark Gensuite’s AI Advisors, VelocityEHS’s automated ergonomic assessments, and Ideagen’s pervasive use of AI. Other vendors with notable ‘AI integration’ scores are EcoOnline, Evotix 360, HSI and Wolters Kluwer Enablon.

- Vendors re-focus development efforts on nailing EHS software foundations.

Like tectonic plates, EHS software buyer priorities slowly evolve, with shifts only becoming noticeable over prolonged periods. The most important factor influencing purchasing decisions is the user interface (UI), with 19% of our survey respondents ranking this as the most important factor. Many GQ vendors are investing significantly to refine and improve their UI for ease of use, accessibility and consistency. For instance, ecoPortal and Ideagen recently announced UI enhancements. AMCS, KPA and EHS Insight also received well above-average UI scores. Platform architecture, scalability and interoperability have recently climbed up the agenda, prompted by widespread M&A activity and a shift to broader deployments.

To learn more about the 21 most prominent EHS software firms and our take on the market, read the full report and join the upcoming webinar.

Discover more EHSQ Corporate Leaders content

See More

About The Author

Chris Sayers

Senior Manager