Verdantix Benchmark Highlights M&A Is Reshaping The IWMS Market

The third edition of the Verdantix Green Quadrant IWMS solution benchmark study was released earlier this week after a five-month intensive research process. The report provides a detailed, fact-based analysis of the 13 most prominent IWMS providers using two-hour live product demonstrations with pre-set scenarios and vendor responses to a 238-point questionnaire covering 13 technical, 13 functional and 7 market momentum categories. In addition, Verdantix analysed data from our Global Corporate Survey of 285 real estate and facilities decision-makers. What are the key insights from the benchmark of IWMS providers?

Firstly, acquisition-led growth has substantially transformed the IWMS vendor landscape. Verdantix identified more than 30 transactions, such as private equity investments and mergers, taking place in the last three years. Examples include FM:Systems acquiring WizzPass to offer visitor management capabilities, Spacewell purchasing DEXMA to build out its energy management offering, iOFFICE and SpaceIQ merging to create iOFFICE + SpaceIQ, and vendors such as MRI Software (MRI) and Planon using acquisitions to fortify existing IWMS offerings. With the flurry of transactions in the IWMS market, buyers should be aware of the extent to which suppliers’ new acquisitions have been integrated with existing systems; acquired offerings can often remain siloed with limited data flow or integration between systems.

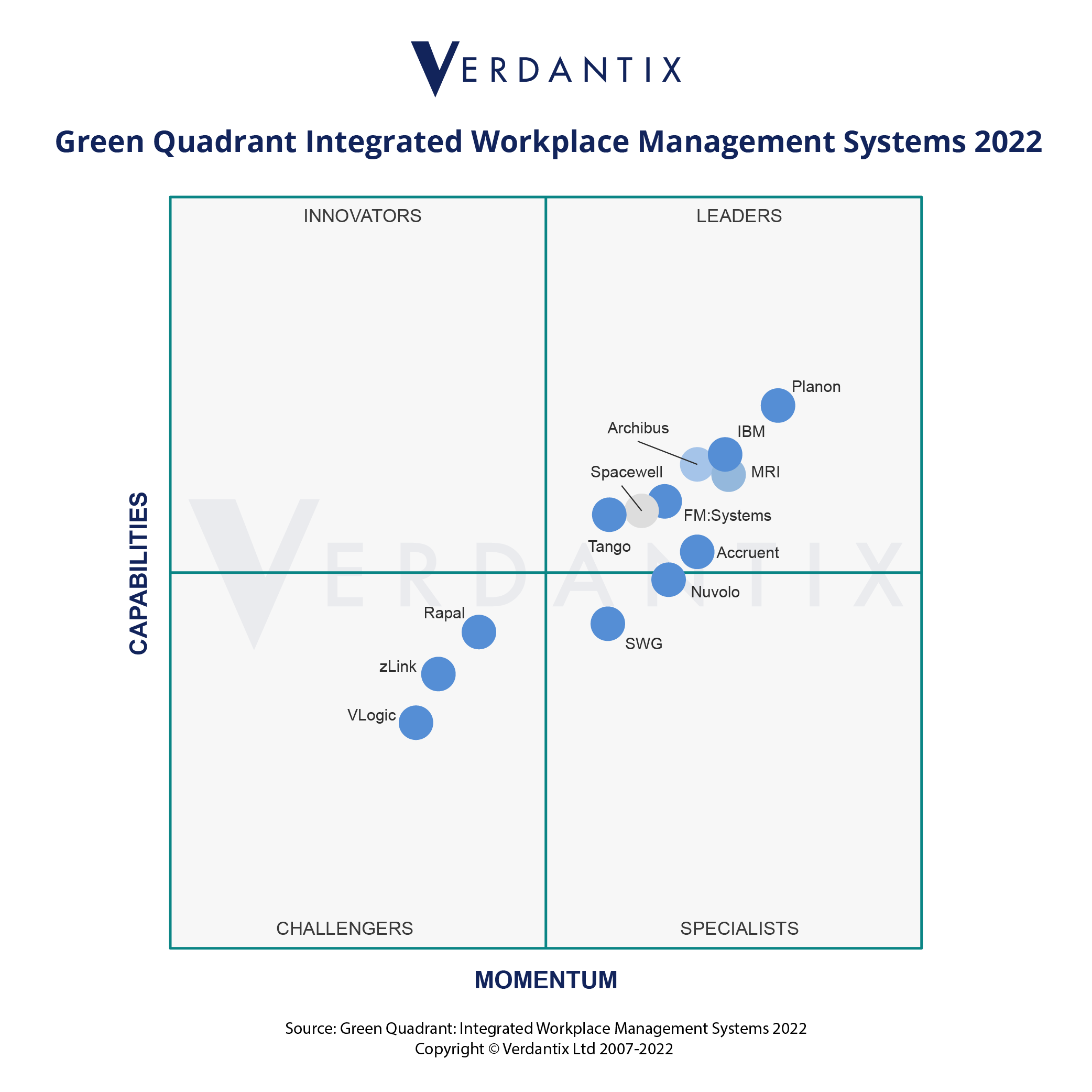

Secondly, buyers looking for a comprehensive IWMS solution to optimize employee experience, maintenance, leases and space usage have significant choices. In our benchmark, eight vendors made it into the Leaders’ Quadrant: Accruent, FM:Systems, IBM (TRIRIGA), iOFFICE + SpaceIQ (Archibus), MRI (ManhattanONE), Planon, Spacewell and Tango, as they demonstrated the most advanced all around IWMS capabilities. iOFFICE + SpaceIQ (Archibus), Planon and Spacewell all scored above average in at least 20 of the 26 platform and application capabilities areas assessed. MRI’s ManhattanONE exhibited market leading capabilities in platform internationalization, real estate investment management and leasing & portfolio management. The analysis also reveals that other providers offer strong propositions in asset and maintenance management, such as Service Works Global (an Addnode Company).

Thirdly, mobile applications, IoT solutions and advanced analytics will continue to drive long-term IWMS innovation. IWMS vendor data collected by Verdantix show that, on average, providers are reinvesting 25% to 30% of their annual revenue into product development. Suppliers are focused on optimizing mobile apps for technicians and occupants, forming integrations with the wider smart building ecosystem and including emerging technologies, such as artificial intelligence (AI), machine learning (ML) and virtual assistants, into IWMS platforms and mobile apps. For instance, Tango’s IWMS platform has AI and ML capabilities built into the platform for key areas of functionality, such as real estate investment and space scenario modelling.

To learn more about the IWMS solution market and the top market leaders, please read Green Quadrant: Integrated Workplace Management Systems 2022.

About The Author

Joy Trinquet

Senior Analyst