Trump, Tariffs And The Future Of The Energy Transition

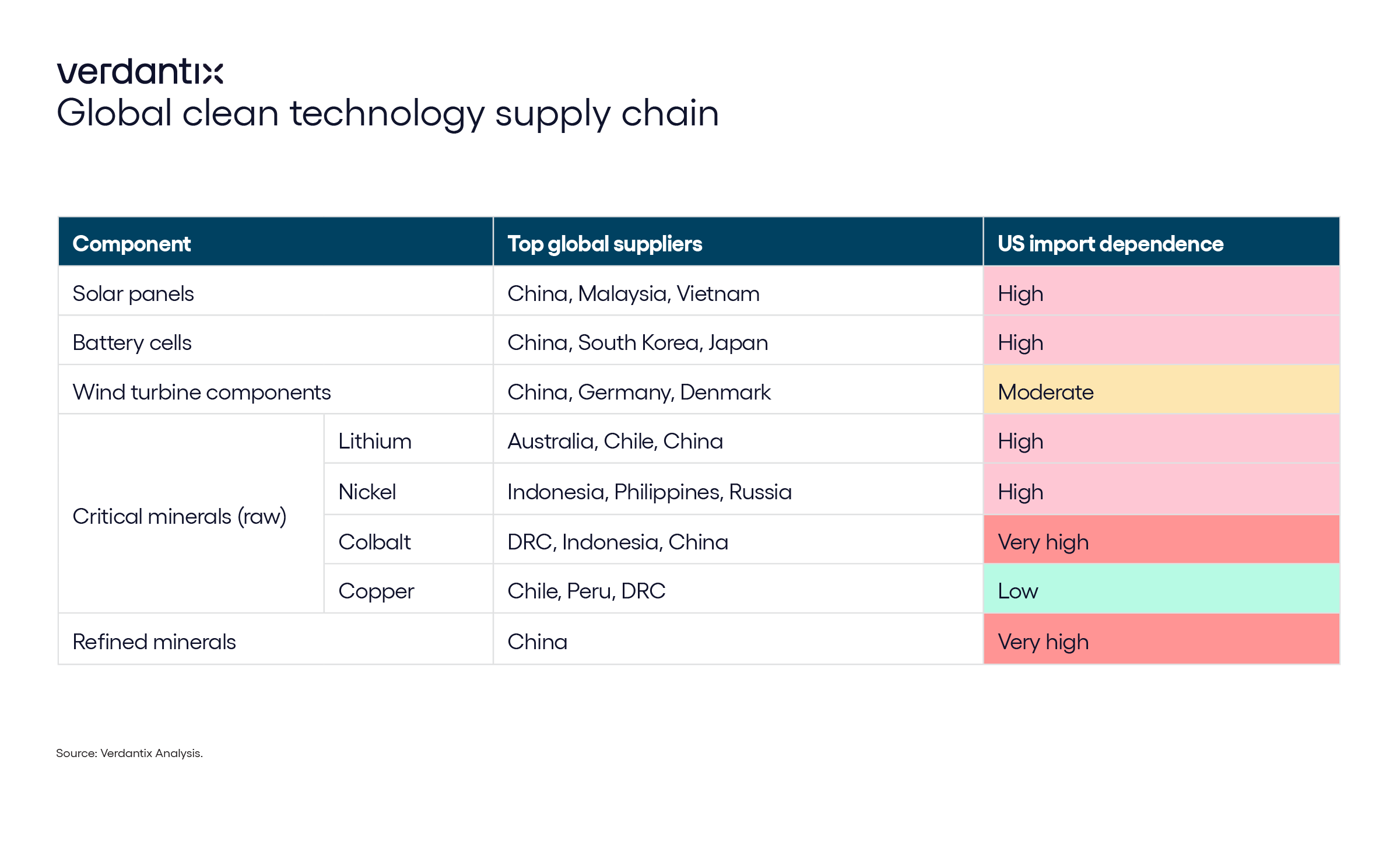

The global transition to clean energy runs on a supply chain stitched together across continents – with China, for instance, producing more than 60% of the world’s solar, battery and wind components in 2023. In 2024 Verdantix predicted how firms in different geographies would respond to the energy transition over the next 10 years (see Verdantix Strategic Focus: Leaders And Laggards Of The Energy Transition 2025-2045). However, the supply chain supporting this transition is now under strain. President Donald Trump has invoked the International Emergency Economic Powers Act (IEEPA) to announce sweeping tariffs, including a 145% blanket tariff on all Chinese imports. While there is currently a 90-day pause on new tariffs for most other countries, import levies remain on Chinese goods, with China’s reciprocal 125% tariffs beginning to spark price volatility and uncertainty across clean energy markets.

The ripple effects are already being felt: renewable energy developers in the US face higher costs and tighter supplies, with projects relying heavily on imported components to meet deployment targets. Further, the weakening of the Inflation Reduction Act (IRA) has lowered government investment in domestic manufacturing. Tariffs on electric vehicle (EV) components, batteries and possibly even critical earth minerals such as lithium and cobalt, threaten to delay projects, elevate consumer prices and erode investor confidence. Below, we explore three scenarios that could shape the trajectory of the energy transition, in the US and beyond.

Scenario 1. Trade barriers are lifted quickly

- Tariff relief brings a quick rebound in solar deployment.

Despite initial cost spikes and equipment delays, a swift lifting of tariffs allows solar supply chains to recover by late 2025. Most IRA-funded projects remain viable, with momentum resuming quickly as imports normalize.

- US EV automakers regain footing after a brief disruption.

Short-lived supply chain shocks give foreign rivals such as BYD a temporary edge, but US automakers recover market share once parts availability stabilizes and costs reduce.

- Battery storage projects stay viable, despite short-term cost increases.

Lithium-ion battery costs increase, but stockpiling in anticipation of tariffs sees most battery energy storage system (BESS) deployments stay on track. Alternative battery chemistries such as sodium-ion may see growing interest, as firms seek long-term supply chain security.

Scenario 2. Trade barriers last 1-2 years

- Higher input costs slow the US solar build-out, while Europe benefits.

Continued tariffs, especially on China, drive up prices for solar panels and inverters, slowing the US utility-scale build-out. Meanwhile, Europe has the opportunity to capitalize on cheaper Chinese tech and gain a competitive edge in renewable energy deployment.

- US brands lose global ground to foreign competitors.

US EV titan Tesla faces dual setbacks after a backlash in Europe and supply chain delays for key models. Global automakers such as BYD, Hyundai and Volkswagen expand their presence in key international markets. However, relaxed EV mandates in response to US tariffs – for example, in the UK – may suggest waning momentum in some markets.

- US battery energy storage faces rising costs and project delays.

With the majority of lithium-ion cells still coming from China, storage developers encounter higher costs and stretched timelines. While firms such as Lyten pursue new chemistries, bottlenecks in raw materials and manufacturing capacity limit alternatives.

Scenario 3. Multi-year trade war

- US solar deployment flatlines as China redirects exports.

A prolonged trade war leads to persistent equipment shortages in the US, stalling solar expansion. Chinese manufacturers pivot to the Global South and Europe, accelerating transitions elsewhere and increasing geopolitical leverage.

- Global EV leadership shifts to China as US adoption slows.

US automakers struggle to remain competitive without access to affordable components. Further, a lack of access to other clean tech (such as batteries) for charging infrastructure slows adoption domestically. BYD and other brands dominate international markets, offering lower-cost models that win over price-sensitive consumers abroad.

- US energy storage build-out collapses under supply chain pressure.

Delays and cancellations in US projects escalate as tariff-driven costs rise and upstream supply chains remain disrupted. Domestic manufacturing fails to scale up sufficiently quickly, delaying the use of renewables and undermining decarbonization goals. Other global markets continue to rely on affordable Chinese battery tech.

The big picture?

If Trump’s tariffs remain in place – or escalate – the US risks isolating itself from the clean energy trade just as the rest of the world accelerates. The US currently lacks the domestic capacity needed for battery cell production, mineral processing and many other clean tech manufacturing processes, with the IRA’s uncertain future casting doubt on the operations of future manufacturing sites. Given China’s dominance in clean tech manufacturing, falling US demand could represent a short-term hit for that country; however, growing reliance on Chinese technology elsewhere might deepen its global market power. Europe, meanwhile, may carve out new supply chain opportunities, but must balance political and trade tensions between the US and China.

More broadly, falling oil prices risk reinforcing fossil fuel use just as decarbonization needs to accelerate. Without deliberate action – through incentives, diplomatic efforts and supply chain diversification – tariffs could become a self-inflicted setback in the race to net zero.

About The Author

Isobel McPartlin

Analyst