The Market Is Pricing In Climate Risk Faster Than Governments

New research has continued to demonstrate that climate change is a business risk. Economic models developed by Australian scientists warn that the planet warming by 4°C will make the average person 40% poorer, with average global GDP per person being reduced by 16% even if warming is kept to 2°C above pre-industrial levels. Furthermore, recent OECD research finds that one third of global GDP could be lost this century if the climate crisis continues to run unchecked.

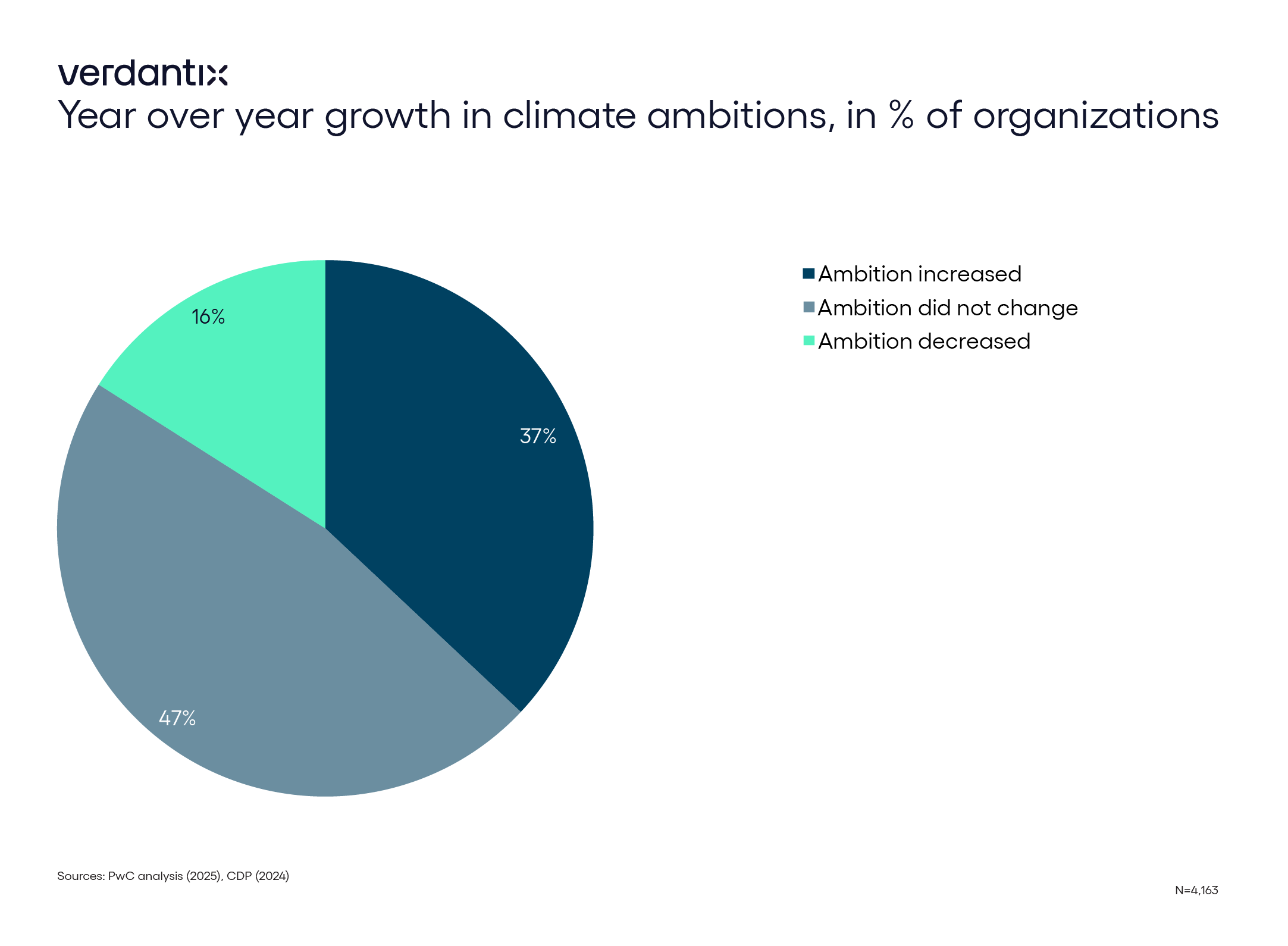

Despite the high stakes, policymakers continue to struggle with slow-moving climate negotiations and regulatory rollbacks – but businesses are quietly moving ahead. New analysis of CDP data from the 2024 disclosure cycle by PwC shows that public firms are more than twice as likely to increase their emission reduction goals than they are to slow them down (see below). Additionally, the practice of setting climate goals is progressing down the value chain as businesses continue to grow their engagement efforts. This shift isn’t driven by regulation alone – but instead by recognition that the financial risks of inaction greatly outweigh the costs of decarbonization, as well as the increasing ease of purchasing renewable energy.

The key takeaway? Markets are adapting to climate realities faster than governments. Organizations that recognize the physical risks – such as supply chain disruptions – are embedding climate considerations into their strategies and betting that emissions reductions will deliver long-term competitive advantages through cost savings and futureproofing investments. Meanwhile, governments and policymakers are struggling to keep pace with the urgency of the climate challenge, whether it’s the Trump administration’s axing of key climate policies and funding, the EU’s Omnibus proposal or the UK’s Labour government sinking a climate and environmental bill.

The firms moving fastest on climate action today will be best prepared not only to mitigate the physical climate risks themselves, but also to respond to potential future market pressures of new carbon pricing mechanisms and accelerated investor demand. Those who are still waiting for clear government direction risk being left at a competitive disadvantage as the window for regulatory catch-up closes.

In an economy increasingly shaped by climate risk, those who act now will not only protect their bottom lines but also position themselves as market leaders. For further insights, see Verdantix Future Of Climate Risk Management.

About The Author

Isobel McPartlin

Analyst