The Future Of Utilities: The 2025 ‘It’s Not Going To Be Cheap’ Edition

The UK’s glorious policy vision leads to lots of investment, risks, problems and opportunities that will be partially answered by technology, and partially by smart delivery.

Industry events seldom come pre-packaged with a vision, but so it was for June’s Future of Utilities Summit. This particular vision is courtesy of the UK’s Prime Minister: the UK will have clean power by 2030. (There’s no equivalent aspiration for Team Water, Gas or Sewage, though I might propose ‘have less fatbergs’ as one to consider for next year).

Every presentation, every panel, every keynote and most conversations that took place at the Future of Utilities had the clean power by 2030 vision as its explicit or implicit backdrop. This was particularly clear in the insights from:

- Ofgem’s CEO: Network charges are going to go up (because of clean power by 2030 – requisite investment plans due to publish this summer).

- UK Power Networks’s Director of Finance: We’re going to enable a lot more self-service through AI (because clean power by 2030 means a lot more people doing a lot more stuff with us).

- National Grid’s Director of Infrastructure Development: We’re going to install 6 times more overhead lines in the next 5 years than we’ve done in the last 30 years (to move around the power driven by clean power by 2030).

- Scottish Power’s Smart Solutions Director: We’re effectively going to double the number of homes in our portfolio with low-carbon technologies (batteries, EVs, connected HVAC, etc.) by 2030 (because of clean power by 2030).

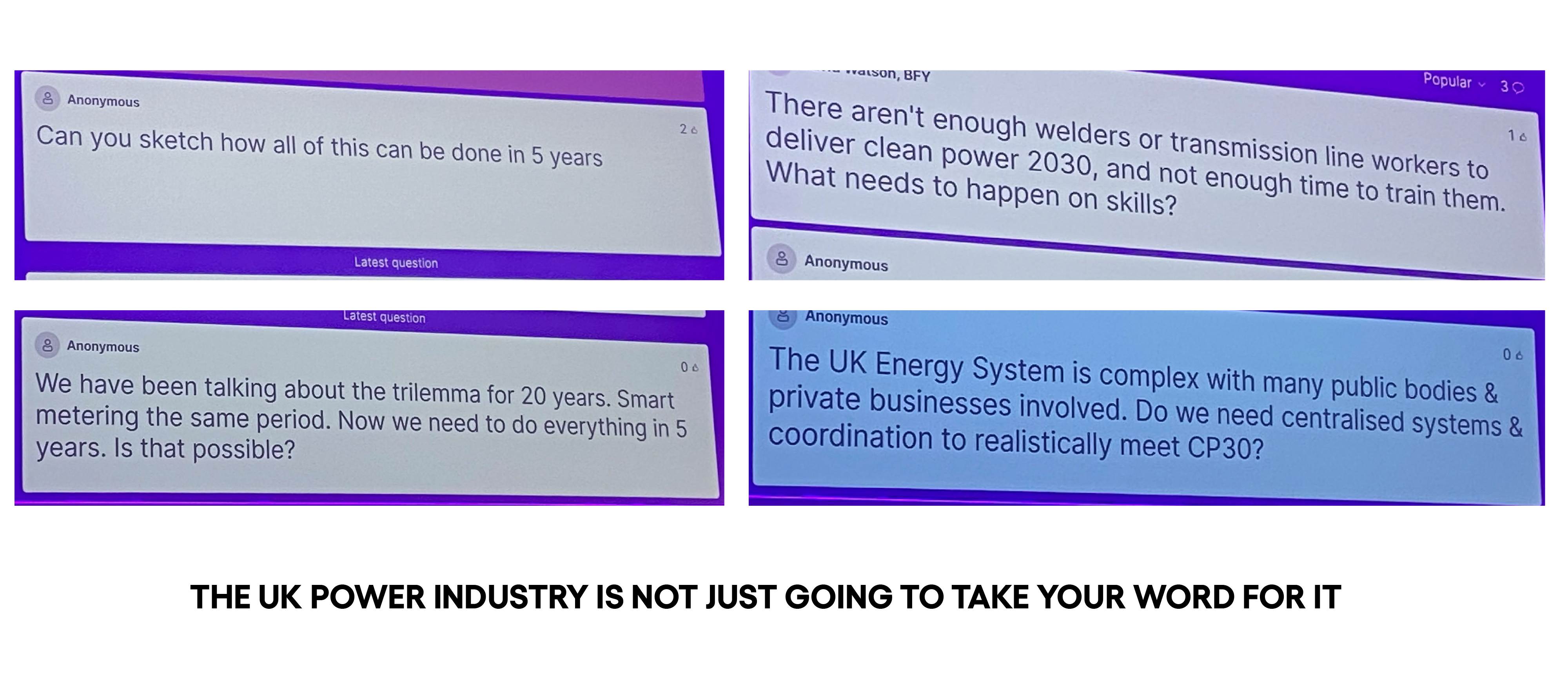

The general takeaway could be summarized as “we’re going to be spending a pile of money on this for at least five years, and – let’s admit it – probably many more beyond that, and please let there not be any policy changes that should change the payback on those investments”.

Which is why I found it disconcerting that no one brought up the fact that one of the UK’s most popular parties by surveyed preference has this as one of its ‘CRITICAL REFORMS NEEDED IN THE FIRST 100 DAYS’: “Scrap Net Zero and Related Subsidies”. Sure, unless Keir Starmer goes full Liz Truss there won’t be a general election until August 2029 – add 100 days and you’re already at 2030. However, presumably it’s that post-2030 timeframe when the payback from net zero power investments will be recouped, so policy reversals would still very much be a problem.

Even if it wasn’t an explicit topic, this line of thinking was not lost on attendees. There were two sub-themes to the event: policies that ease the cost burden of the energy transition, and technologies that enhance the benefit of it. This latter area of focus brings me to the most interesting and compelling a-ha moments for organizations in the energy technology space:

- The National Grid speaker said that, as part of their long-term innovation plan, they’re looking into an upgrade on the 1950s supergrid concept to an ultra-high-voltage onshore DC power network, which they’re calling Ultragrid. Aside from the stellar Iron Man vibe, this shift to underlying DC transmission could finally unleash a broader shift to a DC grid that everyone agrees makes sense, but no one wants to start investing in.

- There were a number of small vendor attendees with very interesting propositions, which is not surprising to find in a dynamic space. One offering, Decisio, allows utilities to consider the rapidly changing asset investment environment they find themselves in, and model out any number of outcomes. Another, Volteras, provides a way for utilities to connect directly to their customers’ EVs through backend OAuth and provide grid-connected services. A third, Eliq, plugs into energy companies’ consumer apps to provide those consumers with tips on how to save and use their energy wisely.

- Utilities are (for reasons fair or no) antonymous with mind-blowing innovation – but they’re now a major vector for it, thanks to the energy transition. This can lead to hiccups. One interesting example shared by IFS: US utilities offering lower cost energy tariffs based on the potential to constrain usage at times of need flexed this constraint so rarely that consumers forgot about it, then freaked out when their power was constrained (although it’s what they signed up for). The takeaway: implement more frequent, even artificial, constraints. Another hiccup – there’s a risk that utilities pitch consumers on energy transition investments that make sense in a short-term environment of incentives, but become painful in a long-term BAU environment.

The power industry is reckoning with a very particular future, and all of its connected issues. Those involved responded to the full day of tackling this in true and time-tested practical utility guy and gal fashion: they hit the open bar. This vision’s going to take some creativity!

Our 2025 and 2026 coverage is well-stocked on energy transition and key sub-topics like DERMS, EV charging, DERs and microgrid technologies. If that’s your jam, let’s talk.

About The Author

Ryan Skinner

Research Director