Survey Insight: Corporates Prepare For Significant Increases In Software & Services Spending To Align With Mandatory ESG Disclosures On The Horizon

Sam Renshaw

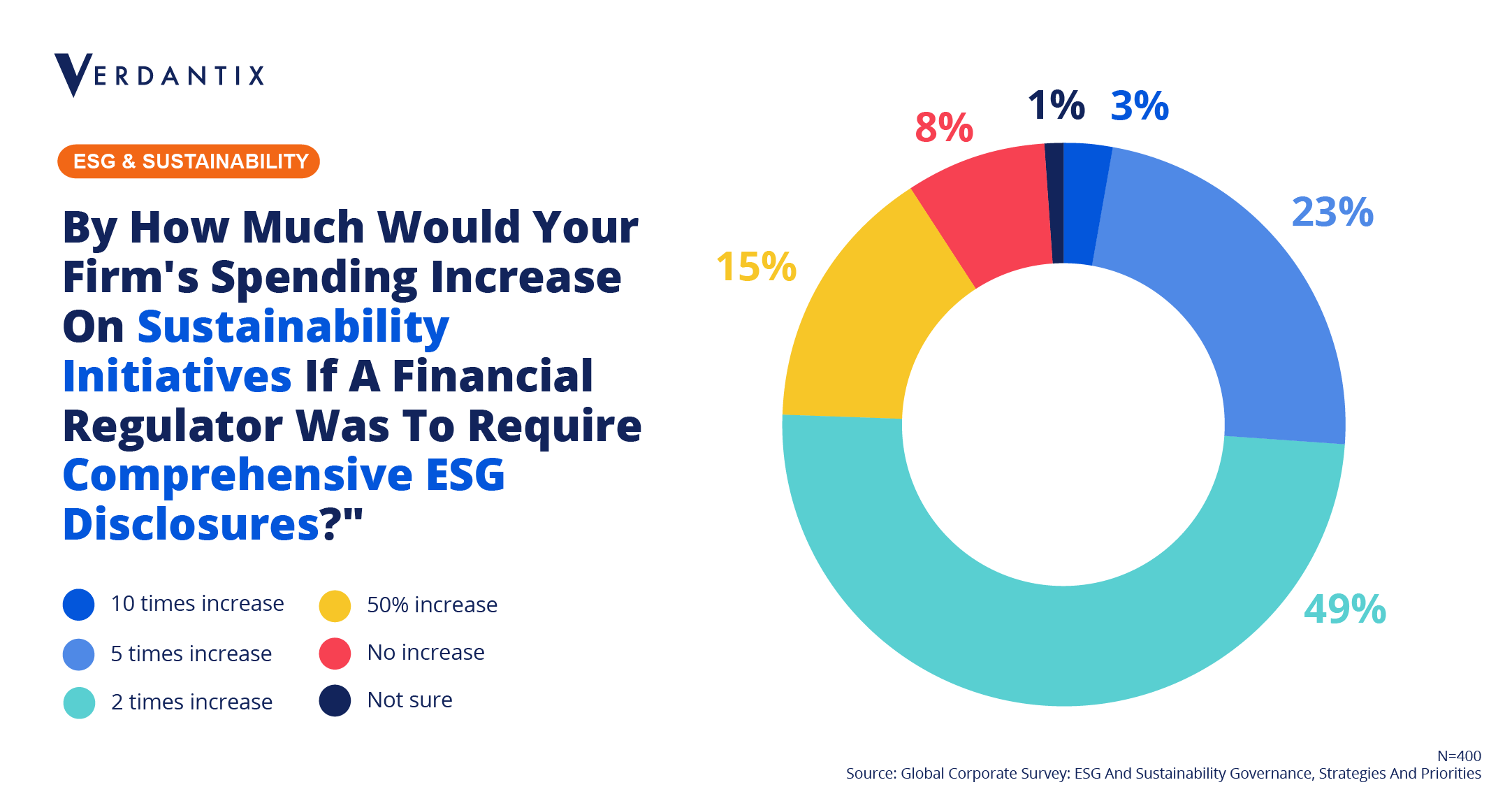

Verdantix will release the ‘Global ESG and Sustainability Governance, Budgets and Priorities Survey 2021’ next week - collating interviews from 400 respondents in senior sustainability roles across 30 countries and 25 industries. One of the headline findings was the prominence of ESG disclosure requirements influencing corporates' decision making - 75% of respondents outlined at least a two times increase in spending on sustainability initiatives if a financial regulator was to require comprehensive ESG disclosures. Noticeably, this was seen as a more significant factor influencing spending than responding to sustainability strategies by competitors and stakeholder ESG demands.

In major jurisdictions, regulators are in the midst of overhauling mandatory ESG disclosure requirements. The SEC will outline their proposed climate and ESG disclosure rules in the coming months - representing a landmark shift of ESG disclosure in the US to granular decision-useful qualitative and quantitative data. As of April 2021, the EU Commission proposed the Corporate Sustainability Reporting (CSR) directive – which will require approximately 49,000 firms to disclose sustainability data. According to the EU commissions estimates, at least $2.4 billion in corporate spend will be required on software and service providers across 2022 and 2023 for alignment to the directive.

As corporates start to substantially ramp up spending to achieve ESG disclosure alignment – software and service providers must finalize their offering for the start of 2022 to ensure they play a leading role in the corporates regulatory transformations.

About The Author

Sam Renshaw

Industry Analyst