Spend On Asset Investment Planning Software Will Increase In 2022

Kiran Darmasseelane

In a world of aging assets and limited financial and human resources, asset-intensive organizations frequently struggle to optimize CAPEX/OPEX, minimize operational risk from asset failure and identify which investment project will better meet long-term business objectives. At times managers are required to 'compare apples with oranges' to decide which projects bring most value to the company.

With ongoing COVID-19 management, bullish net zero emissions targets, aggressive sustainable development goals and limited available resources continuing to put pressure on the day-to-day operations of businesses, the appeal to adopt asset investment planning (AIP) solutions to help determine how to best spend capital is greater than ever.

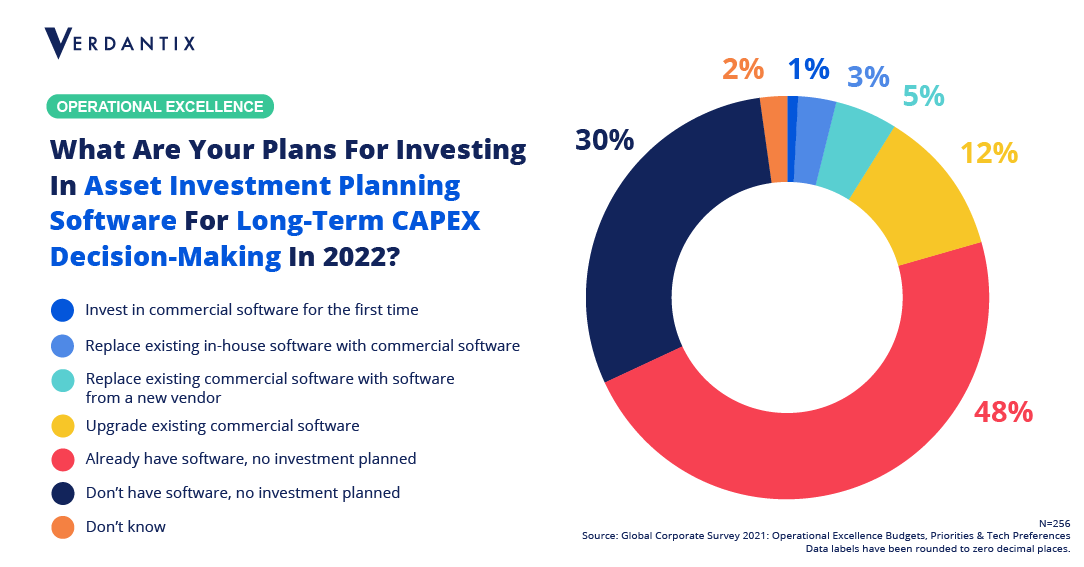

A recent Verdantix survey of 256 executives responsible for operational excellence initiatives showed that 48% of organizations have already implemented AIP software for long-term CAPEX decision-making, while a further 21% were looking to invest or upgrade their existing AIP software in 2022. In tandem with the growing demand for AIP software, 65% of firms are looking to leverage the subject matter expertise of third-party consultants for AIP projects to improve operational performance, enhance time to value and integrate AIP solutions to their existing digital infrastructure.

AIP solutions enable organizations to optimally balance costs, risks, and the operational improvements of differing projects while answering essential decision-making questions, such as how big a capital budget do you need, what initiatives should you spend your money on and which ones should you prioritize?

By using AIP software to develop strategic capital plans, organizations can:

- Create long-term asset investment plans optimized through multiple scenario analysis.

- Incorporate sustainability considerations into decision-making to gain insight into the wider economic, environmental and social impacts of investment decisions.

- Achieve certification from international standards such as the ISO 55000.

The AIP software market is growing at a strong pace with a number of specialist vendors such as Copperleaf, Cosmo Tech and Direxyon looking to provide software as well as services and extensive AIP model libraries to support investment decisions.

In the wake of COVID-19 and growing wave of net zero pledges, Verdantix expects to see industry leaders using AIP software to develop a clear, decisive and actionable plan that will steer them towards ESG growth and business success.

For more information on AIP software, read the following Verdantix reports: Strategic Focus High Value Use Cases And Benefits Of Asset Investment Planning Software, Verdantix Global Corporate Survey 2021: Operational Excellence Budgets, Priorities & Tech Preferences.

About The Author

Kiran Darmasseelane

Senior Manager