Savvy EMS Buyers Want More Than Data: Here’s What They’re Asking For In 2025

In 2025, energy management software (EMS) is expected to do far more than visualize energy use or generate carbon reports. As firms grapple with concerning grid constraints, tighter ESG regulations and rising performance expectations, EMS is becoming a core part of the operational tech stack, linking energy, carbon and financial data into a single system of action.

The central question is shifting from “Do we need EMS?” to “What do we need it to do?”

What’s driving fragmentation – and what comes next?

The EMS market today is fragmented because buyers are at different stages of digital and operational maturity:

- Some firms prioritize insight delivery, focusing on diagnostics, benchmarking and transparency.

- Others demand automation, seeking fault resolution, asset control and integration with distributed energy resources (DERs).

But expectations are beginning to converge Over the next three to five years, EMS buyers will increasingly look for platforms that combine:

- High-quality insights with built-in automation.

- Real-time optimization across energy, carbon and cost.

- Scalable, integration-ready design that supports large, diverse portfolios.

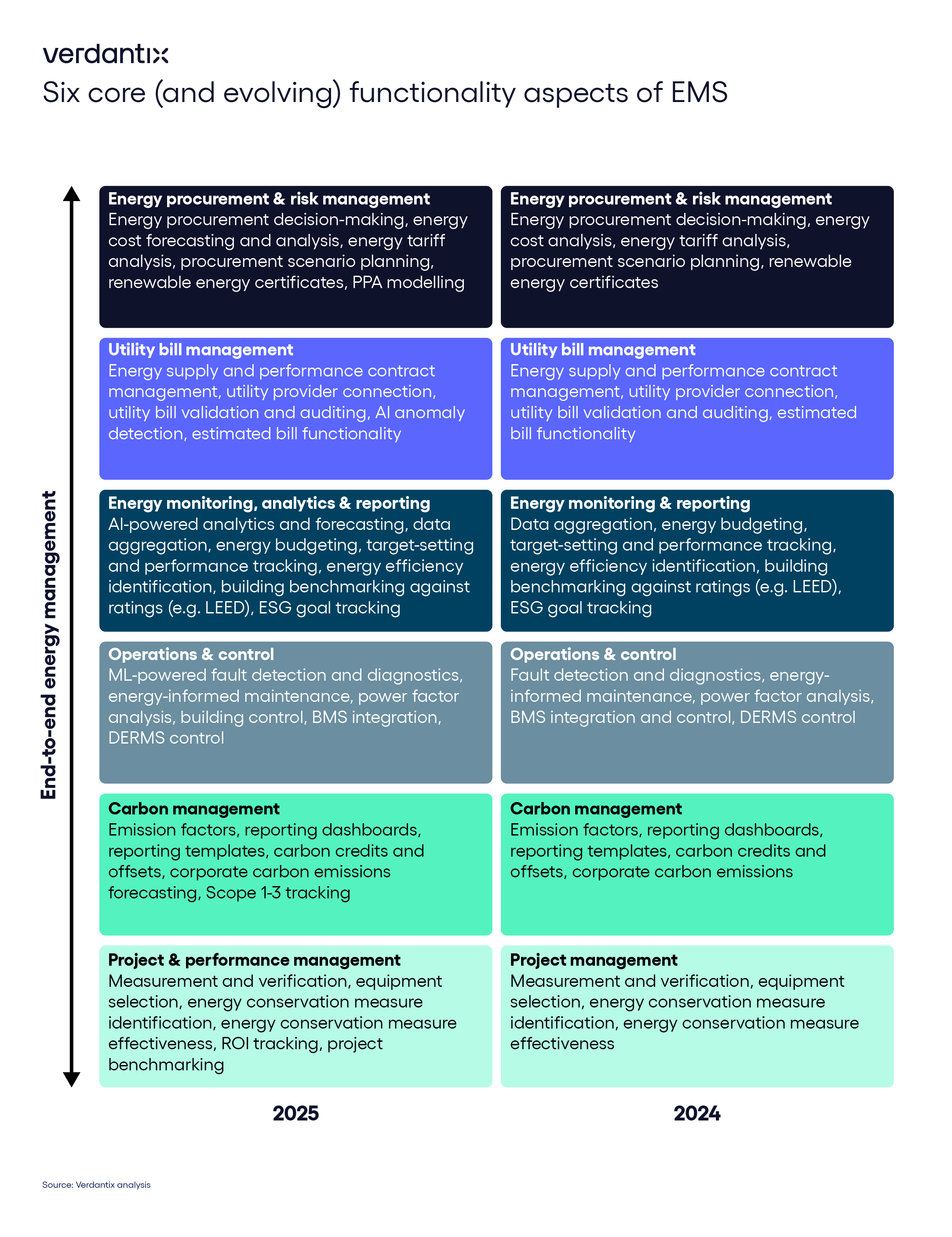

Six functionality areas, reshaped by innovation

To bring clarity to this shifting landscape, Verdantix assessed 47 EMS vendors against six core (and evolving) functionality areas. These functions have materially advanced since 2024, driven by innovation in AI, automation and integration.

Key shifts include:

- Energy procurement & risk management → Expanded into scenario modelling and clean energy certificate planning.

- Utility bill management → Enhanced with AI anomaly detection and automated auditing workflows.

- Monitoring, analytics & reporting → Now AI-powered, with contextual benchmarking and forecasting.

- Operations & control → Moving from alerts to automation, with control logic and DERMS integration.

- Carbon management → Evolving from templates to real-time forecasting and strategic alignment.

- Project & performance management → Now includes ROI tracking and validation of ECM impact.

What the benchmark reveals

To help buyers identify solutions that align with their goals for energy management, the Smart Innovators: Energy Management Software (2025) report offers:

- A comparative analysis of 47 EMS platforms.

- Insight into how vendors are adapting to automation, AI and grid interactivity.

- A structured breakdown of where innovation is transforming buyer expectations.

Whether you’re focused on cost efficiency, carbon strategy or digital operations, this report offers a practical lens to understand what best-in-class EMS looks like today – and what to prepare for next.

Access the full report here to explore the detailed assessment.

About The Author

Henry Yared

Analyst