New Directions For Supply Chain Sustainability: From Tony’s Chocolonely To Oritain’s Forensic Science

16 Oct, 2024

Last week, 150 supply chain and sustainability professionals convened in Brussels for the Verdantix Sustainable Supply Chain summit. Framed by wide-ranging Verdantix research on sustainability strategies, emerging European regulations and supply chain digital solutions, more than 30 speakers shared their best practices and pointed to future evolution. What were the key takeaways?

- Momentum is growing.

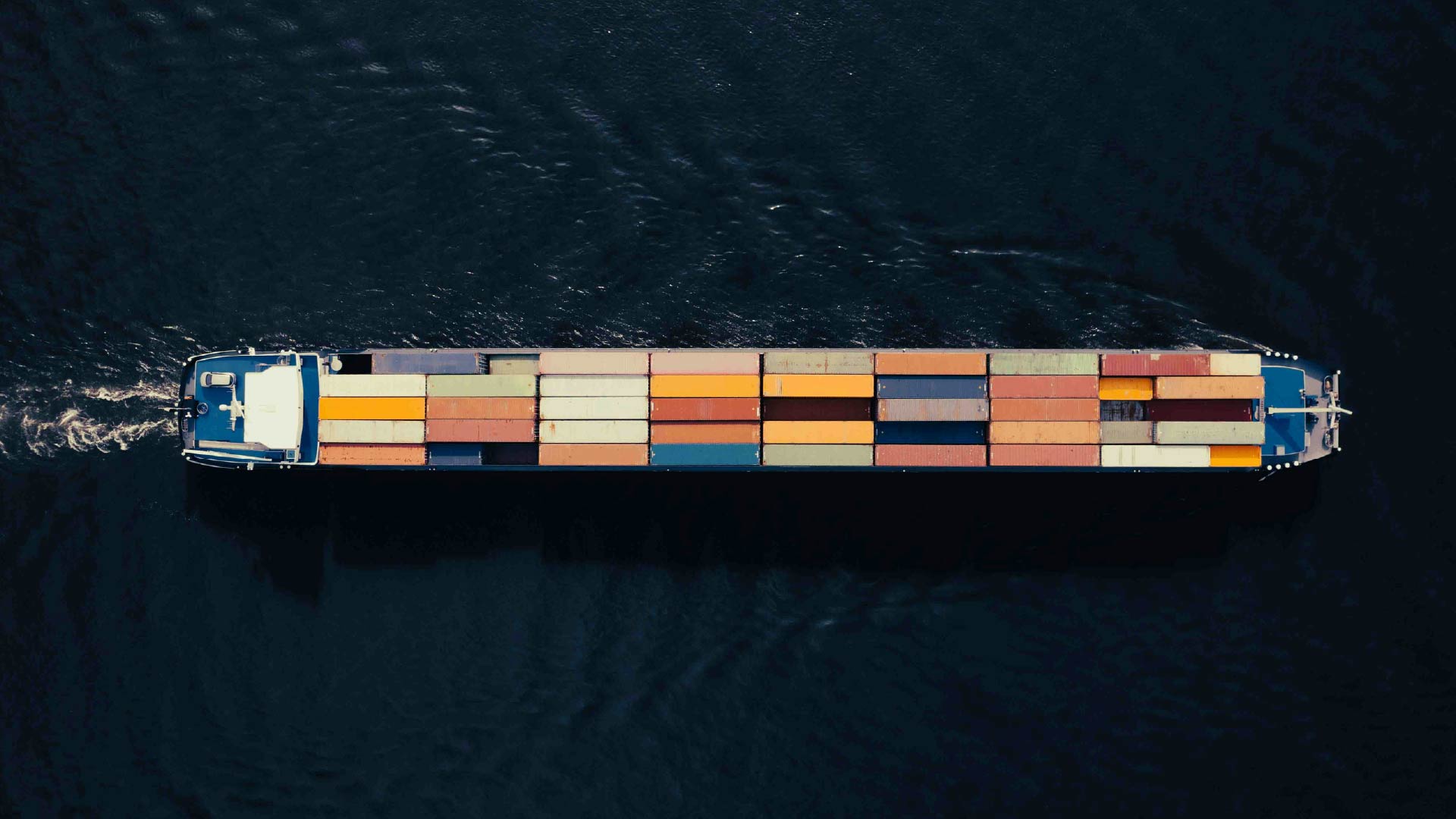

Whether it is the size of corporate teams, spending on sustainability risk management or the success of sustainable products such as Tony’s Chocolonely, the tailwinds are strong. Expenditure is being driven by a panoply of European regulations, increased CEO involvement in sustainability strategy due to the CSRD, and concerns about supply chain risks.

- Industrial CAPEX is increasing.

Firms such as Indorama Ventures are increasing their capital investment to lead the market on plastics recycling. Whether this is building more recycling plants in Europe or acquiring facilities overseas – CFOs are increasingly breaking out revenues and EBITDA for recycled materials and circular business models to close the loop on the CAPEX spend that has been made.

- Operating in multiple countries exacerbates challenges.

Legislation is wildly different in each jurisdiction, which raises problems both for compliance and the creation of global traceability and reporting programmes. Firms are also struggling with different policies on post-consumer waste recycling, limiting the ability to source large volumes of waste for recycling plants.

- Digital tech is getting more attention.

Large chemical firms are setting up small teams to focus exclusively on digital solutions for product sustainability. Without any single tech vendor providing the full portfolio of software, these teams need wide-ranging expertise to assess and deploy different tools for traceability, product LCA and supplier responsibility evaluation. More information on all the tech solutions is captured in the Verdantix Tech Roadmap, freely accessible to all qualifying corporate practitioners via Verdantix Vantage.

- Survey fatigue is shifting attention to automated data.

With more organizations seeking to understand their supplier risk exposure, the volume of surveys being sent to small and medium-sized businesses is soaring. As survey fatigue worsens, alternative approaches to data-gathering are being fired up. This includes a bump in demand for in-person site-level supplier assurance from providers such as LRQA.

- Science is delivering on traceability goals.

For firms seeking better guarantees of origin than supplier attestations and invoice scanning, solution providers such as Oritain offer a combination of forensic science, data collection and digital analytics to protect corporate reputation. Their analytical tools can be applied to cotton, coffee, meat and aquaculture products to verify their origin.

Given the tailwinds in this market, it is no surprise that a recent Verdantix study expects the market for supply chain sustainability digital solutions to be worth $2.87 billion in 2025, with a forecasted growth rate of 29% from 2024 to 2029.

Discover more Corporate Sustainability Leaders content

See More

About The Author

David Metcalfe

CEO and Co-Founder