New Benchmark Study Assesses 10 Prominent Climate Financial Data And Analytics Providers

Emma Cutler

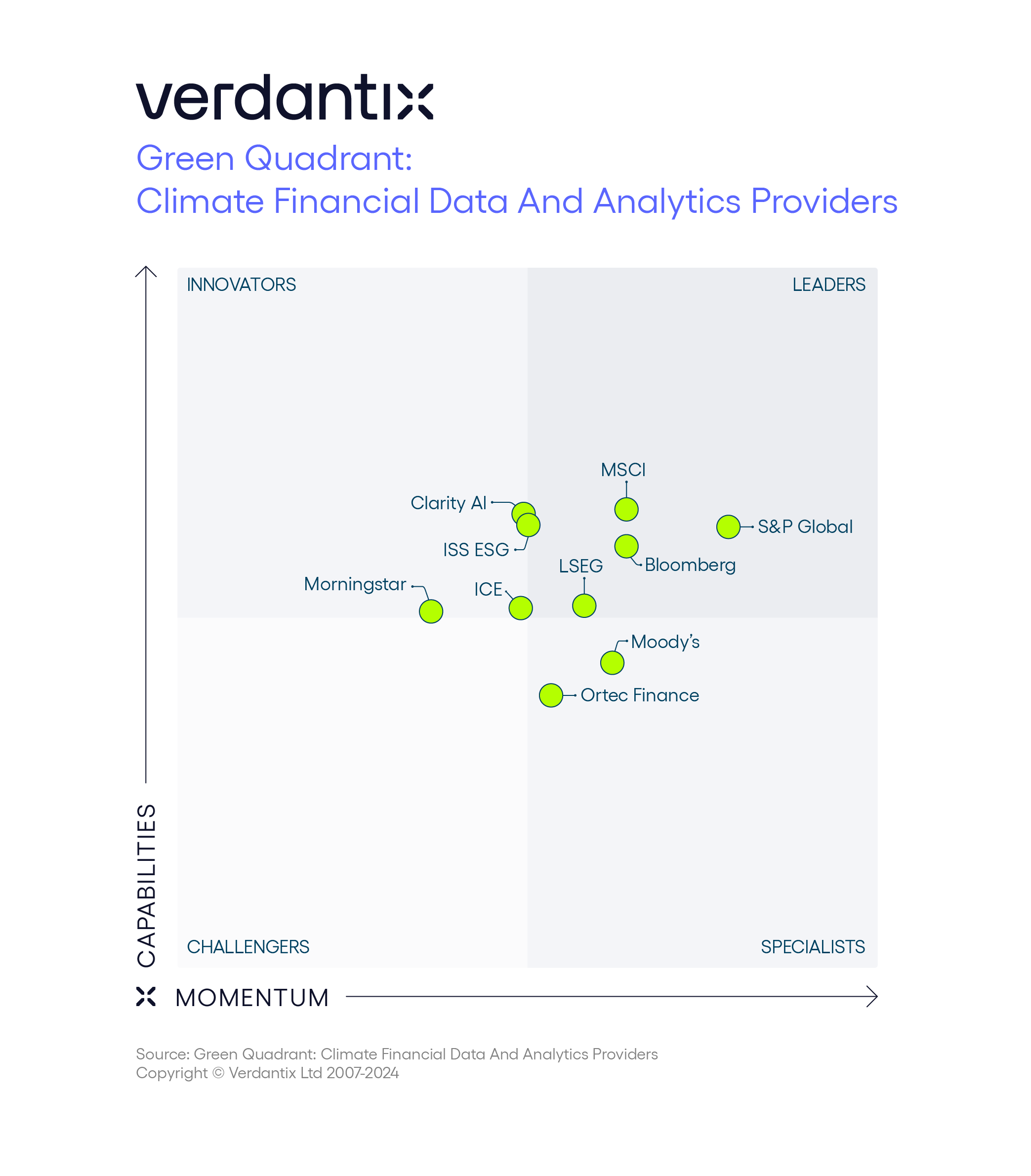

Verdantix published its Green Quadrant: Climate Financial Data and Analytics Providers report on September 13th. The report assesses 10 leading vendors that offer data and analytics addressing climate risk, GHG emissions, renewable energy, and nature and biodiversity. The ten vendors showcased are: Bloomberg, Clarity AI, Intercontinental Exchange (ICE), ISS ESG, London Stock Exchange Group (LSEG), Moody’s, Morningstar, MSCI, Ortec Finance and S&P Global. The report specifically focuses on vendors offering these solutions to financial market participants to support decision-making for financial product development, investment allocation, portfolio optimization, climate-related risk mitigation and valuations.

The vendors included in the analysis completed a 50-point questionnaire and provided live product briefings. Our analysis also drew on customer interviews and previous Verdantix research, such as the Verdantix Market Size And Forecast: Climate Financial Data And Analytics 2022-2028 (Global) and Verdantix Smart Innovators: Net Zero Financial Data And Analytics Providers reports. Our analysis finds that:

- Financial institutions are becoming more mature in their climate-related needs.

Climate knowledge within financial institutions has grown tremendously. Compared with several years ago, buyers now have a much better understanding of how to use climate data. They recognize that climate financial data are far from perfect, but nevertheless have value for their business. As firms move beyond a disclosure mindset, they are looking for information that can support climate risk management and net zero goals, to bolster their investment decisions, product development and operations. - Transparency is key for climate financial data and analytics.

Regulatory demands require financial services firms to explain the data and models they use. For example, buyers want to be able to trace analytics back to source data. Thus, particularly at large financial institutions, there is growing demand for raw data that analysts can use in house. However, this type of information is not always available. Many firms, particularly those that are privately held, do not report climate-related data, and even when data are reported, they are often low-quality. Buyers, therefore, look for vendors that can quality-control data and fill gaps with transparent and defensible models. - Innovation addresses decision-relevant climate and nature information.

There is growing interest in integrating climate data into existing workflows, to bring climate considerations into every decision that financial institutions make. This requires metrics that can be combined with traditional financial data. For example, portfolio analysis is key for understanding GHG emissions, physical risk and transition risk – considering not only financed emissions, but the financial impacts of shifting markets, emerging technologies and new policies. Finally, vendors are rapidly scaling up their nature and biodiversity offerings to better meet the needs of firms that wish to report in line with the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD).

To see the full analysis, download the report here.

About The Author

Emma Cutler

Principal Analyst