Is It Finally Time To Bet On Predictive Maintenance?

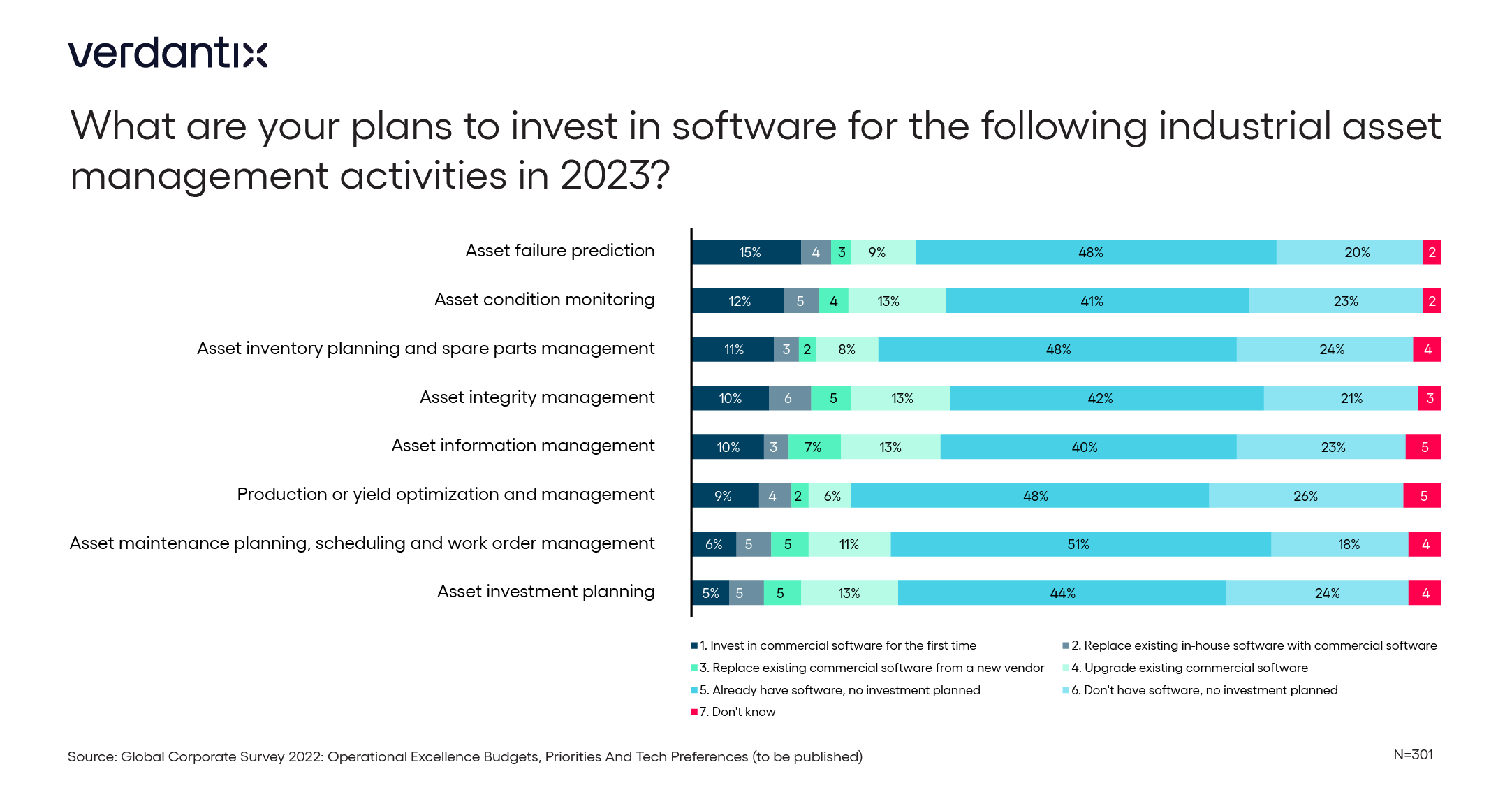

In the face of continued economic turmoil, global supply chain instability, and decarbonization pressures, asset managers turn to predictive maintenance solutions to minimize maintenance costs, unplanned downtime and emissions. According to the upcoming 2022 Verdantix operational excellence global corporate survey, out of the 301 operations, maintenance and engineering executives interviewed, 19% are planning new investment in commercial asset failure prediction software in 2023 – a 15-percentage-point increase as compared to 2021. Similarly, 17% and 16% of respondents mentioned plans to invest in software for asset condition monitoring and asset integrity management, respectively.

Intertwined with the performance of critical assets, predictive maintenance tools from asset performance management (APM) vendors such as AVEVA, Baker Hughes and GE Digital are providing organizations with the capabilities to safeguard against unplanned downtimes by offering robust capabilities to capture and integrate data, understand asset health in real time, predict failures and optimize maintenance regimes. A recent Verdantix predictive maintenance benchmark which evaluated 15 APM software providers against 18 assessment criteria and found that 14 of the 15 vendors provide strong predictive maintenance functionalities. Key findings include:

- AVEVA, Bentley Systems and GE Digital offer a suite of asset libraries and failure modes to monitor asset health and forecast failure prediction.

- AspenTech and Baker Hughes rely on simulation-based optimizations to quantify failure impacts and assign associated maintenance tasks.

- Cognite and IBM offer strong data management capabilities to better understand the health of an asset and the likelihood of future failures.

Alongside the growing APM vendor landscape, a flurry of AI specialist firms such as 3D Signals, Augury, C3 AI, Dingo, Flutura and Seeq have entered the predictive maintenance software market with self-service analytics and configuration capabilities to ease adoption barriers for firms of any digital maturity.

With so many sophisticated predictive maintenance solutions on offer, industrial firms are spoilt for choice; and yet only 38% of surveyed firms have currently invested in AI analytics software for predictive maintenance and associated workflows.

Verdantix anticipates that with the proliferation and increasing credibility of predictive maintenance software providers across all industries, it is only a matter of time for the remaining firms to commit to a predictive maintenance strategy, with key barriers to adoption shifting from technology availability to quickly seeing ROI and scaling up to multiple assets.

For more information on the adoption of predictive maintenance technologies and the software market dynamics, please read the following Verdantix reports: Verdantix Green Quadrant: Asset Performance Management Solutions 2022, Verdantix Product Benchmark: Predictive Maintenance Functionality Of APM Software and Verdantix Best Practices: Transitioning To Predictive Maintenance For Enhanced Asset Management

About The Author

Kiran Darmasseelane

Senior Manager