Finally! The SEC Approves A Diluted And Delayed Climate Rule

On March 6, the SEC approved its long-awaited climate-related disclosures rule. A lot has happened in the regulatory disclosure environment since the SEC first announced its proposed rules in March 2022. The EU has enacted the CSRD and California has passed climate-related legislation, both of which will require some large firms in the US to disclose carbon emissions (including Scope 3 emissions) and certain climate-related risks. While the SEC’s rule is not as expansive or detailed as these regulations – essentially requiring firms to report on the bare minimum – it signals the importance investors are placing on climate-related data. What are the key elements and takeaways from this rule?

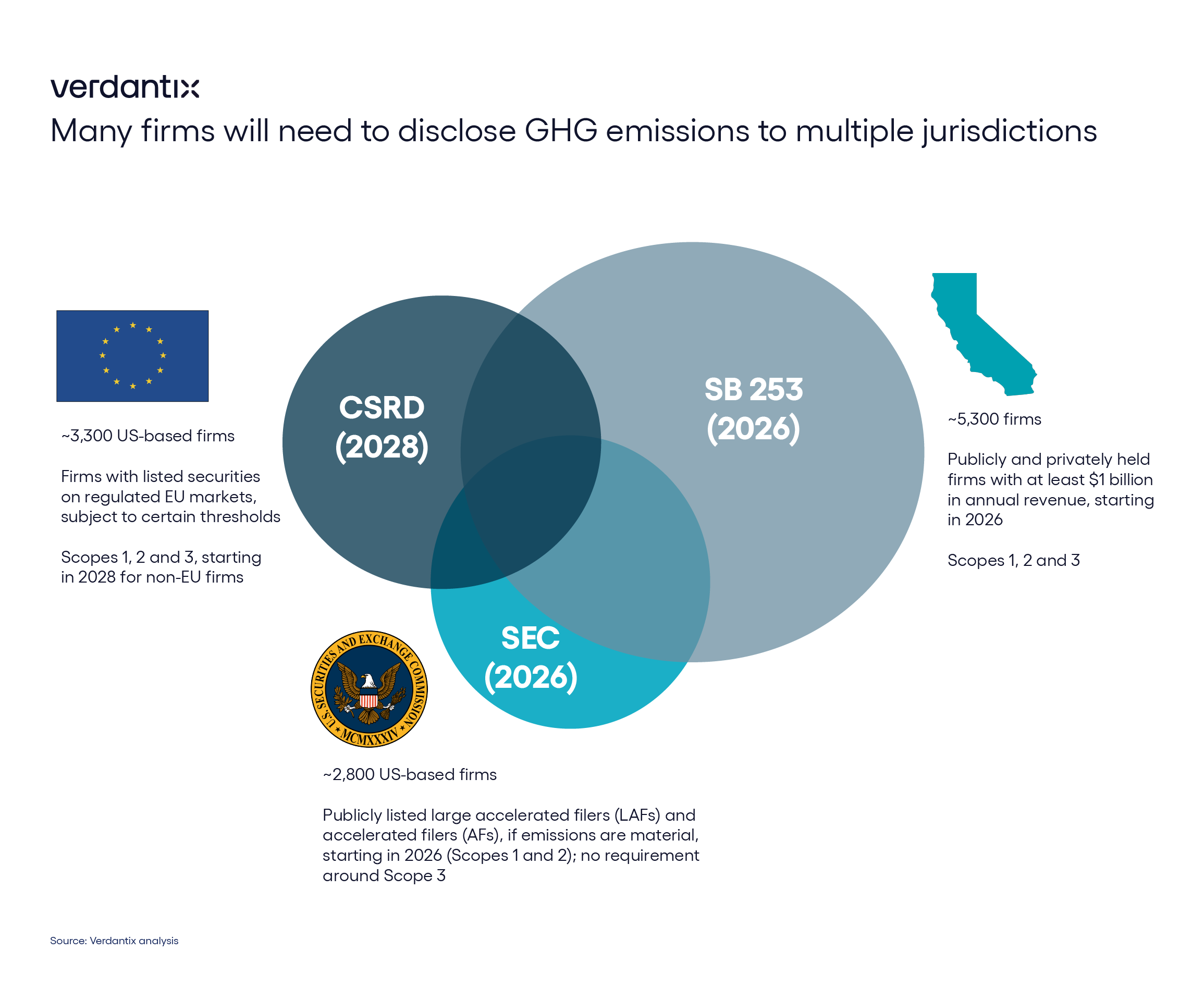

- Scope 3 emissions disclosures are out, and Scope 1 and 2 emissions disclosure requirements are significantly weakened. Although not entirely surprising, the SEC dropped its proposed requirement for firms to disclose Scope 3 emissions, which was a huge point of contention (see Verdantix Strategic Focus: Complying With The SEC Climate Disclosure Rule). Additionally, large accelerated filers (LAFs) and accelerated filers (AFs) will only need to disclose their Scope 1 and 2 emissions if they are deemed material. The rule completely removes the reporting burden for non-accelerated and smaller reporting organizations and provides some wiggle room for subject firms in determining what is material. However, many larger, publicly-listed firms will also be subject to emissions disclosure requirements under the CSRD or California’s SB 253.

- Firms will be required to report certain climate-related risks and losses associated with severe weather events. The SEC will require firms to disclose certain climate-related risks and the activities taken to mitigate or adapt to those risks, such as transition plans and scenario analysis. Organizations will also need to disclose any losses resulting from severe weather events and other natural conditions, subject to a 1% and de minimis threshold. Given the increase in such weather events in the past year – ranging from wildfires in Hawaii to flooding across the country – this will likely increase transparency about the economic realities of our changing climate.

- This ruling’s timing is much slower than initially anticipated. The SEC’s rule has a phased-in approach to reporting GHG emissions, with the first disclosures due in 2026. The largest firms won’t require limited assurance until 2029 and will then have until 2033 to obtain reasonable assurance – AFs won’t be required to obtain limited assurance until 2031, and won’t be required to obtain reasonable assurance at all. By the time even limited assurance is required, we expect many larger firms in the US will already be subject to the strict reporting and assurance requirements of the CSRD.

Although the SEC’s rules are a watered-down version of what we were expecting, navigating the complex regulatory landscape will continue to be a daunting task for many firms. Given insufficient internal expertise and bandwidth, we expect many organizations to turn to climate change services providers to help determine if their Scope 1 and 2 emissions meet the SEC’s definition of material and to help evaluate climate risks. Additionally, firms that must disclose their Scope 1 and 2 emissions should evaluate digital solutions to automate their carbon footprints and digitize their workflows. Verdantix originally forecast that US firms’ investment in the climate change consulting space to be roughly $12-14 billion by 2028, with spend towards carbon management software amounting to approximately $400-450 million over the same time period; we expect these ranges to be reduced slightly given the more limited requirements of the SEC’s rule.

After two years of waiting, many organizations will breathe a sigh of relief. While the SEC’s ruling will certainly impact firms’ disclosure and audit processes, most of the organizations required to disclose their GHG emissions will already be doing so, either based on California’s requirements or voluntary commitments such as the ISSB. Investors will benefit from the transparency and availability of this data through the SEC, but still have a long time to wait – especially if the legislation is challenged or delayed in courts, which it almost certainly will be.

For more information about the service providers and software vendors in the market, please see Verdantix Green Quadrant: Climate Change Consulting 2023 and Verdantix Green Quadrant: Enterprise Carbon Management Software 2023.

About The Author

Jessica Pransky

Principal Analyst