Field Service Management Solution Providers Maintain Momentum And Expand Offerings Through Tactical M&A

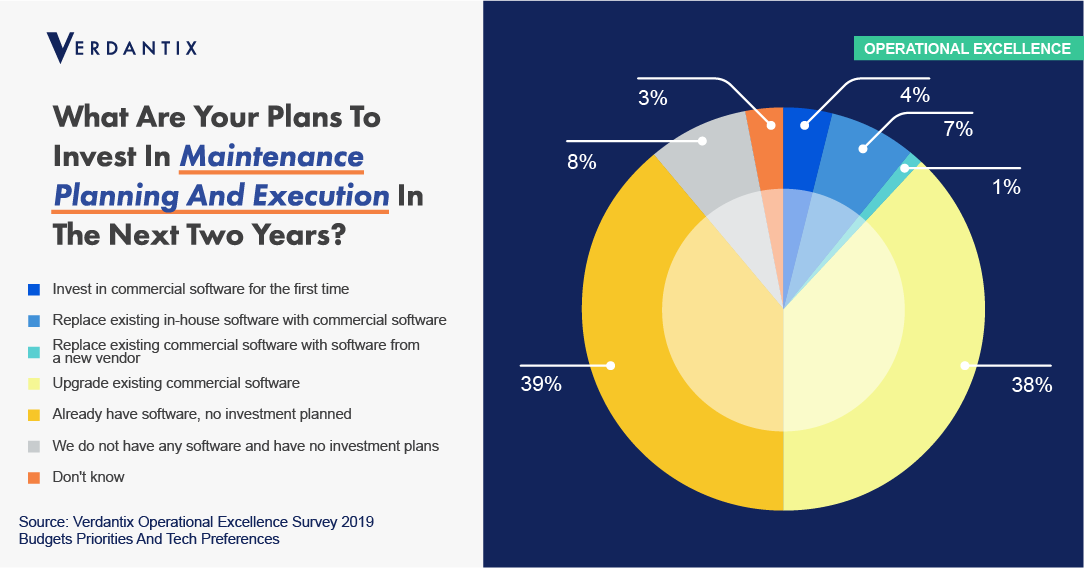

In the Verdantix survey of 284 executives in operations, maintenance, engineering and process safety roles, half of the respondents stated that they expect to invest in software for maintenance planning and execution within the next 2 years. COVID-19 has made coordinated and safe field-service operations even more imperative. The effect of the pandemic, combined with a surge in demand for mobility and real-time workforce monitoring solutions, are expected to fast-forward digital adoption and further drive organizations to seek advanced Field Service Management (FSM) solutions to improve visibility, operational efficiency, and safety of the workforce.

FSM solution vendors are utilizing this new market opportunity to expand their offerings. On July 1, 2020, TotalMobile, a UK-based FSM vendor, acquired Lone Worker Solutions (LWS) and Software Enterprises (the company behind Global Rostering System (GRS)) by attracting external funding support from US-based partners. This double acquisition adds further capabilities and scale to TotalMobile’s comprehensive, end-to-end suite of FSM software. Apart from creating additional revenue growth (estimated to about 25%), these acquisitions help expand TotalMobile’s portfolio, which now includes integrated mobile working, workforce scheduling, job management, data analytics and IoT functions.

In a similarly aligned move to attain financial flexibility and safeguard strategic positioning, on July 14, 2020, private equity firm EQT VII announced the sale of IFS, the Swedish-headquartered FSM software provider to its successor funds (EQT VIII and IX) and TA Associates. IFS reported strong half yearly financial results for 2020 with a notable 26% growth in overall software revenues. Field service solutions account for over 50% of the firm’s total revenues, indicating a growing market demand.

The recent M&A activity and strong financial reports can be attributed to pre-pandemic campaigns and market inertia. However, Verdantix believes that the fragmented FSM market has a fertile ground for a surge in major players, who will be able to outlast the tough competition with integrated FSM solution portfolios.

About The Author

Victor Voulgaropoulos

Director, Advisory Services