Everyone Needs A Helping Hand Every Now And Then: Why Industrial Organizations Are Looking To Service Providers To Overhaul Asset Maintenance Strategy

Hugo Fuller

Asset maintenance technology has rapidly evolved over the last decade. The availability of industrial internet of things (IIoT) sensors has risen while prices have dropped. Mobile applications for frontline workers now provide more oversight into and data about day-to-day maintenance work. Automation of workflows and analytics, in part owing to the accessibility of artificial intelligence (AI), is becoming standard. For industrial organizations, knowing when to take the plunge on emerging tech for asset maintenance programs is an ever-present challenge.

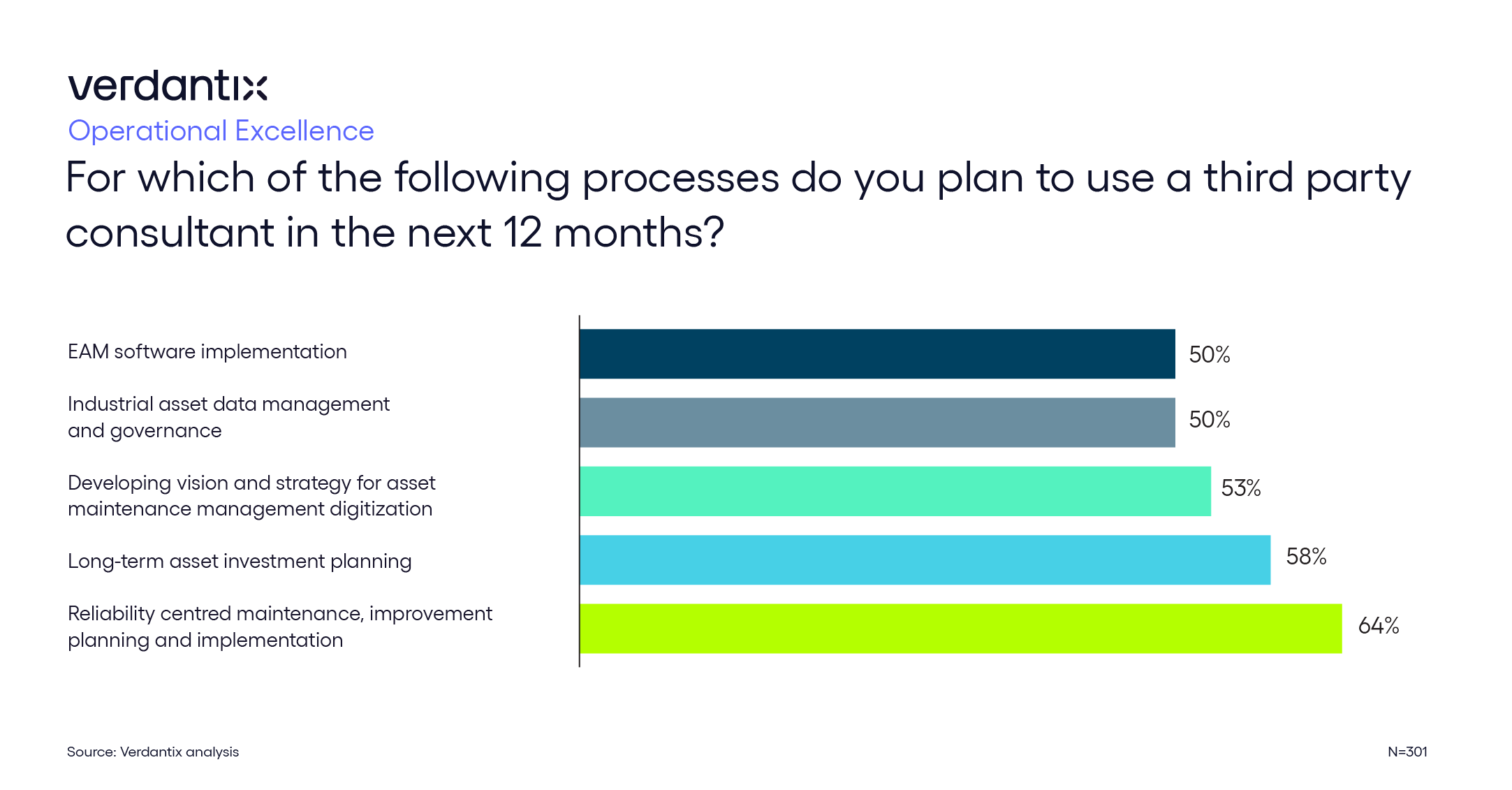

How can firms get the timing right? Increasingly, the answer is external services firms. Fifty-three per cent of the 301 respondents in the Verdantix 2022 global corporate survey noted that they plan to hire third party consultants for developing asset maintenance strategy and vision in 2023. Services firms are typically selected based on subject matter expertise: in our 2020 corporate survey, 93% of respondents highlighted expertise as important when selecting service partners for asset management digitization projects.

Long-standing expertise is becoming increasingly rare in the industrial world. Average worker tenure has decreased substantially in manufacturing over the last decade, falling from 6 years in 2012 to 5.2 years in 2022. In 2017, nearly one-quarter of the sector’s workforce was above the age of 55. Across the industrial world, replacing the most knowledgeable workers is an ongoing and intensifying challenge.

Maintenance functions are not insulated from lost expertise. Additionally, macro-economic and environmental factors are forcing maintenance strategy evolution at an unprecedented pace. Investor and governmental pressure is underscoring asset reliability and efficiency, as industrial facilities look to eek out as much remaining useful life as possible before assets become unviable owing to low emissions efficiency. Organizations turning to new technology to cover staffing and knowledge shortfalls face supply-chain interruptions for physical solutions. Supplies of IIoT sensors, for example, are not meeting demand.

In torrid circumstances, services firms with expertise and the big picture perspective can help augment existing maintenance strategies to integration tech led processes, which can partially make up for low availability of skilled workers. Service providers are responding to this demand: Bentley Systems recently announced its digital integrator business unit, Cohesive Group, had acquired Vetasi, a global consultancy firm with focus on enterprise asset management (EAM) software implementation. IBM has undertaken 25 acquisitions since April 2020, of which several have bolstered consultancy headcount and expertise. Verdantix expects further consolidation in the asset management services space throughout 2023 as firms increasingly seek tech led solutions to the worker skills shortage.

To learn more about how industrial firms will leverage consultants in 2023, read the Verdantix Operational Excellence Global Corporate Survey report.

About The Author

Hugo Fuller

Senior Analyst