ESG Pressure Will Drive A Revival Of Interest In Building Certifications Amongst US Landlords

Ibrahim Yate

The recent Verdantix 2021 North America survey of 50 commercial real estate landlords confirms the rise of ESG in strategic decision making. Fifty four percent of respondents see building decarbonization as a top two priority in their objectives between 2022 and 2024. And 40% of respondents say ESG is a significant opportunity for their organization in the next year, ahead of all market factors other than capital availability. This contrasts with our 2019 survey of commercial real estate asset managers, where only 4% saw sustainability of their assets as a significant opportunity.

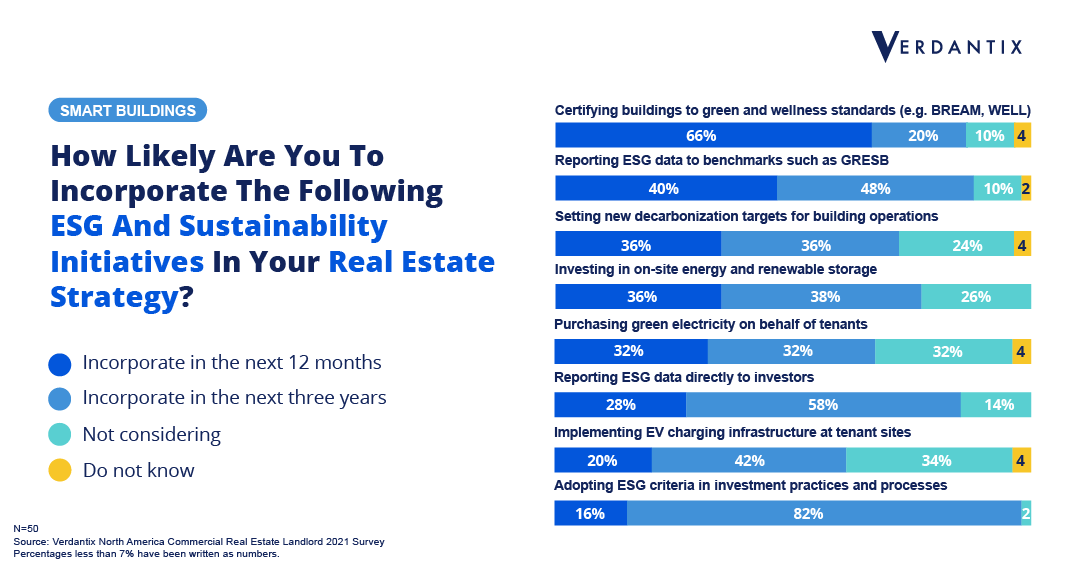

How will this interest translate into tangible actions? The survey finds one focal point of investment will be certifying buildings with green and wellness standards, such as BREEAM and WELL, with 66% of respondents incorporating it as part of their sustainability initiatives in 2022. Landlords also plan to increase spending on ESG reporting software in 2022, with half of respondents growing their investment levels into such solutions, and 22% even growing spend between 5% and 15%. Such software helps capture, process and analyse data that is leveraged as part of an application to become certified in a standard such as BREEAM.

According to JLL research, there is a positive relation between rental income and a building’s green rating, particularly in prime real estate locations. Between 2017 and 2022 in central London, for example, BREEAM certified A-grade buildings collected an average of 8% more annually than non-certified buildings. The research also found that certified properties had a higher leasing velocity, leading to a shorter pay-back period for investors. Moreover, a diversification of certifications into domains beyond environmental performance has recently emerged, as building owners look to showcase the healthiness of their properties. Examples include the new WELL Health-Safety Rating to demonstrate a building’s commitment to COVID-19 outbreak prevention or AirRated’s standard measuring air quality. There is also the fact some of these standards are now available at lower price points, such as FitWel, where certification starts at $5,500 for projects below 50,000 square feet, as well as EnergyStar, which can start from $1,000 and include discounted verifications for K-12 schools and religious buildings.

So, after a plateauing of momentum across building certifications, the Verdantix 2021 survey of commercial landlords indicates that there is fresh interest on the horizon. Commercial landlords that do not certify their buildings risk falling behind ESG market standards in 2022. For more insights into this topic, read our recently published report North America Commercial Landlord Survey 2021: ESG Strategies.

About The Author

Ibrahim Yate

Senior Analyst