A Wave Of Vendors Opens Up The Green Energy And PPA Market

Since 2020, an increasing number of large enterprise firms have entered into power purchase agreements (PPAs) – long-term contracts to buy electricity from a specific energy generator at a specified price – which have led to high levels of growth. Indeed, in the last seven years the market has grown at a 38% CAGR. Firms such as Amazon, Google and Microsoft are utilizing PPA deals to secure long-term energy procurement, while also attempting to reduce operational emissions to satisfy regulatory requirements and stakeholder pressure. However, barriers to entry for organizations who do not have the capital, long-term security or in-house expertise have meant that it has been difficult for smaller firms to enter into PPAs.

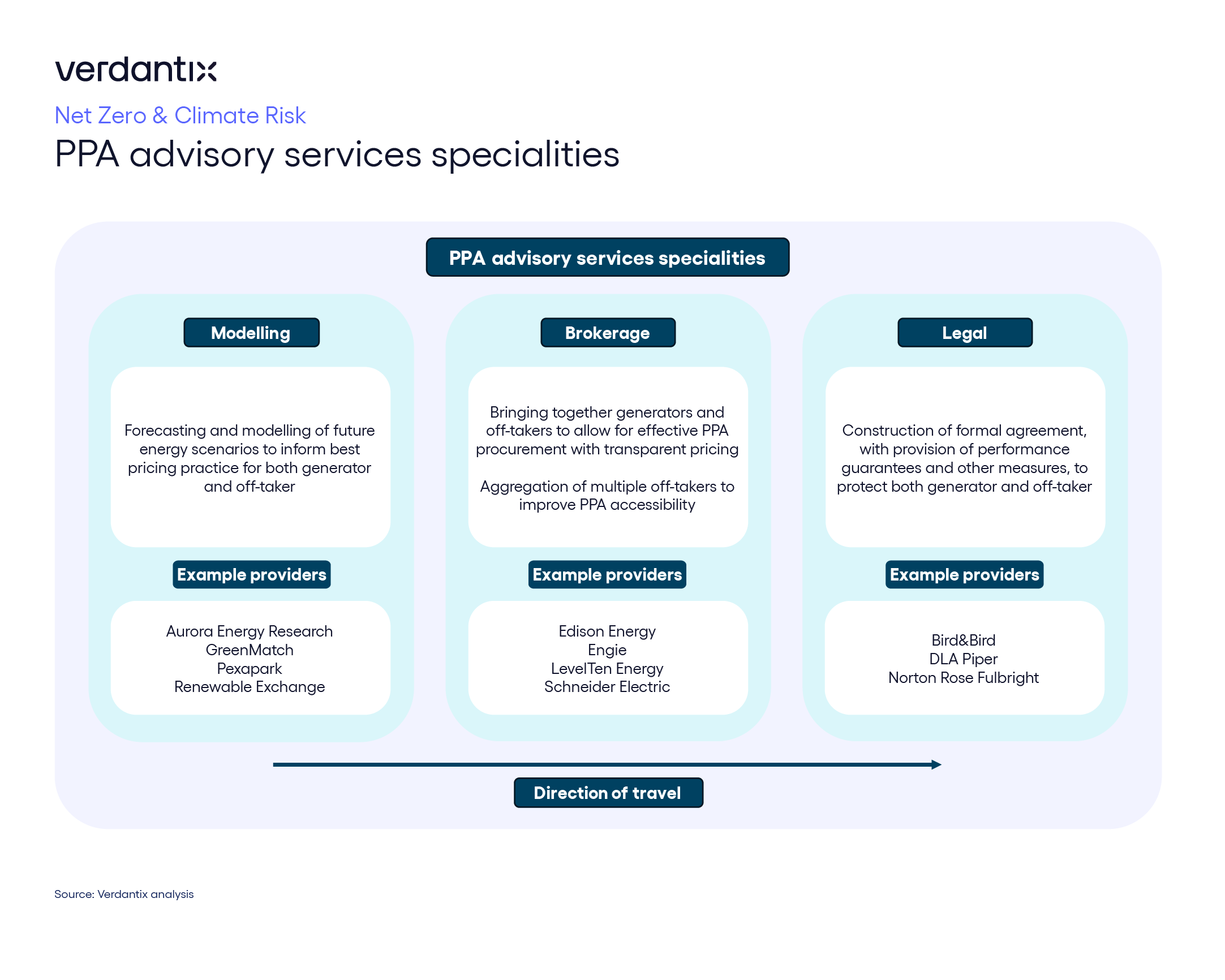

These barriers are now being reduced by a wave of PPA advisory and tech solutions (see below), which are making the market more accessible.

PPA advisory firms are expanding market accessibility by:

- Improving market transparency through online marketplaces. The PPA market has often been accused of being opaque due to a lack of knowledge-sharing around pricing of deals and a lack of standardization of deal processes. However, new online trading marketplaces mean firms can access a whole host of PPA deals and compare prices to ensure they are getting the best deal possible. For example, Zeigo Power has access to over 400 deals and has tendered 2TWh on its platform.

- Streamlining deal processes. A key barrier to entering into a PPA is the technical expertise required to complete these deals. This process can be long, complex and often involves hiring external expertise. However, the increasing standardization of RFPs and contracts means that the process is being simplified and the time taken to complete these processes is being reduced. LevelTen and Google recently partnered to create LEAP, which aims to reduce the RFP time to just 100 days.

- Aggregating firms to buy as one party. Smaller firms often do not have the purchasing power to enter into a PPA deal on their own. As a result, organizations such as Squeaky Energy are helping to bring different firms together to leverage their collective purchasing power and enable them to access renewable energy at more competitive rates than they could achieve individually.

To learn more about the PPA market and to understand if a PPA is a good fit for your firm, see Verdantix Market Overview: Demystifying Corporate Power Purchase Agreements.