Data Centres Are The Epicentre Of Industrial And Real Estate Design, Engineering And Construction Software Convergence

Catalysed by the seismic impact of the AI infrastructure boom - evidenced by US data centre construction starts almost doubling in 2025 compared with the same period in 2024 - the global data centre sector is poised for continued expansion. At the same time, long-standing silos across real estate and industrial design, engineering and construction (DEC) software are dissolving, as vendors that have historically competed in narrow verticals expand into adjacent arenas, with the data centre sector presenting an attractive entry point.

Driven primarily by owner-operators, the interconnection between industrial and real estate DEC software is becoming increasingly complex as firms seek richer operational data from industrial assets, and real estate portfolios expand to include industrial and logistics properties. This is prompting vendors to develop modular platform functionality that caters to both verticals. Take AVEVA, Dassault Systèmes and Hexagon: traditional industrial software players that are making inroads into the real estate sector, leveraging their operational expertise while adapting to real-estate-centric processes. Construction in modern data centres never truly ends, with operators continually upgrading technology inside live facilities. Therefore, the distinction between construction and operations is blurred, making data centres one of the clearest examples of an integrated asset life cycle.

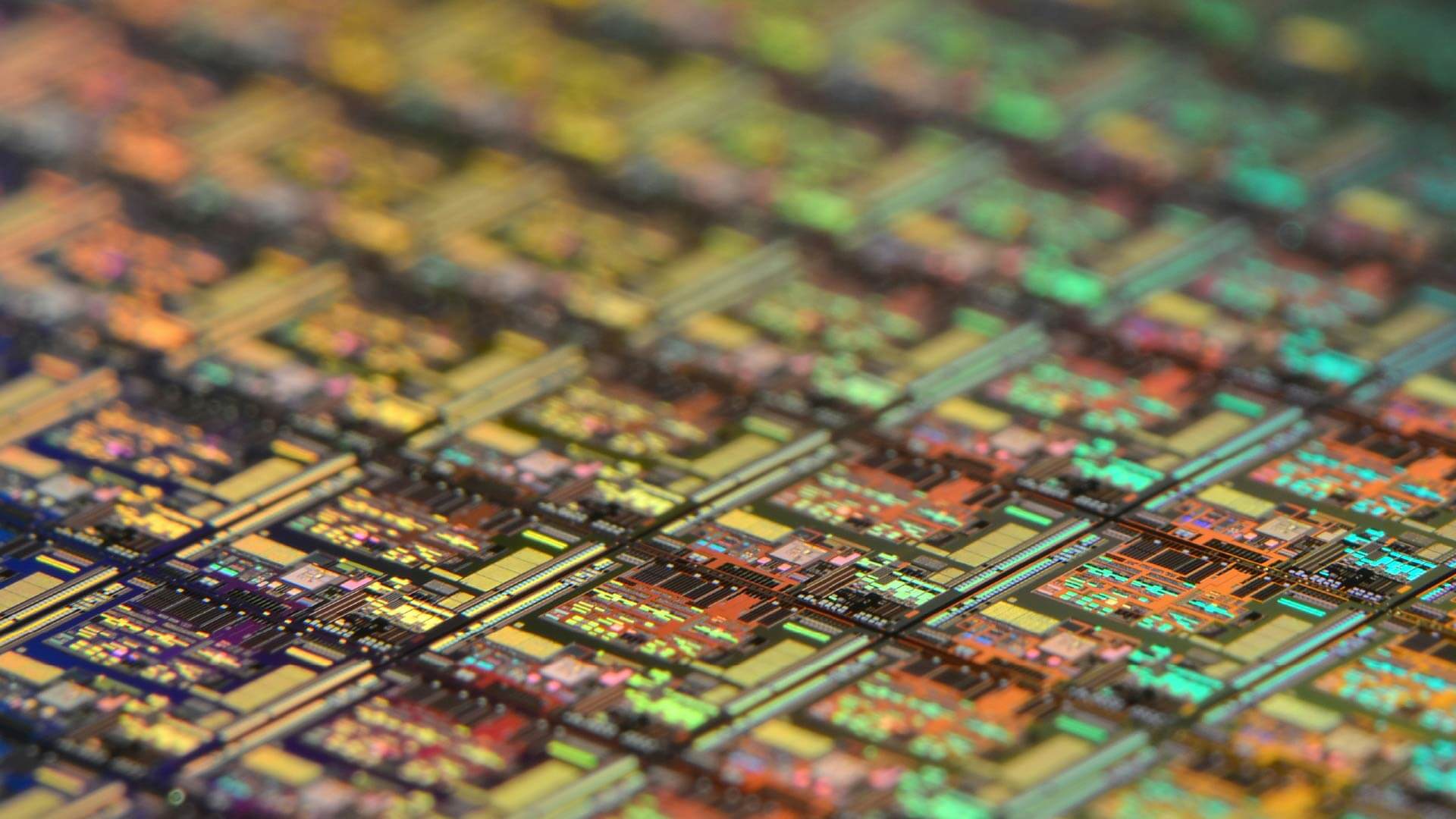

Data centres sit at the intersection of industrial-scale engineering rigour and real estate delivery models, combining complex mechanical, electrical and process-intensive systems with campus-style real estate development, planning approvals and lifecycle asset management. Their capital intensity, energy sensitivity and uptime requirements demand industrial-grade simulation, digital twins and operational data continuity, while their delivery depends on AEC-led design coordination, permitting and phased construction. By standardizing workflows, teams can blend prefabrication techniques from the more digitally advanced industrial sector with AEC building design. For software vendors, this repeatability lowers adoption risk and creates a scalable route into adjacent asset types such as logistics, life sciences and manufacturing facilities.

A key example of the benefits of blending real estate and industrial project workflows can be seen in Start Campus’s SINES data centre project in Portugal. Start Campus implemented Autodesk tools including Revit, BIM Collaborate Pro and Navisworks to coordinate complex architectural, structural and MEP designs and to support simulation-led design validation, clash detection and change management. Design-build contractors are reinforcing this convergence by adopting industrialized construction and prefabrication workflows. As data centres necessitate comparable engineering rigour, the software maturity gap between industrial and real estate DEC markets is narrowing.

With the IEDC software market on a strong growth trajectory and the real estate CMS market growing at a CAGR of 12% to 2030, the maturation of DEC technologies will continue to unlock opportunities for the real estate sector to adopt proven industrial practices in modular data centre construction for more repeatable and scalable construction delivery. At the same time, these technologies provide the flexibility to learn from past mistakes and keep pace with evolving data centre specification requirements.

For a deep dive into the current structure of the industrial and real estate DEC markets, the drivers of their convergence and future trajectories, check out Verdantix Strategic Focus: Mapping Industrial And Real Estate Design, Engineering And Construction Software.

About The Author

Sophie Planken-Bichler

Industry Analyst