Without Better Verification Mechanisms, The Nascent CDR Market Won’t Scale

The carbon dioxide removal (CDR) landscape has drawn significant corporate interest over the past 12 months. Climate change leaders eager to demonstrate their ambitions – such as Microsoft, Shopify and Stripe – have invested significant capital in the market through future purchase agreements in CDR providers such as Climeworks, Heirloom and UNDO Carbon. Total transactions have jumped from approximately $330 million in January 2023 to over $2.5 billion at present. It sounds promising, but across diverse technologies – from direct air capture (DAC) to enhanced rock weathering (ERW) – there is a systemic lack of measurement, reporting and verification (MRV) frameworks to support corporate buyers.

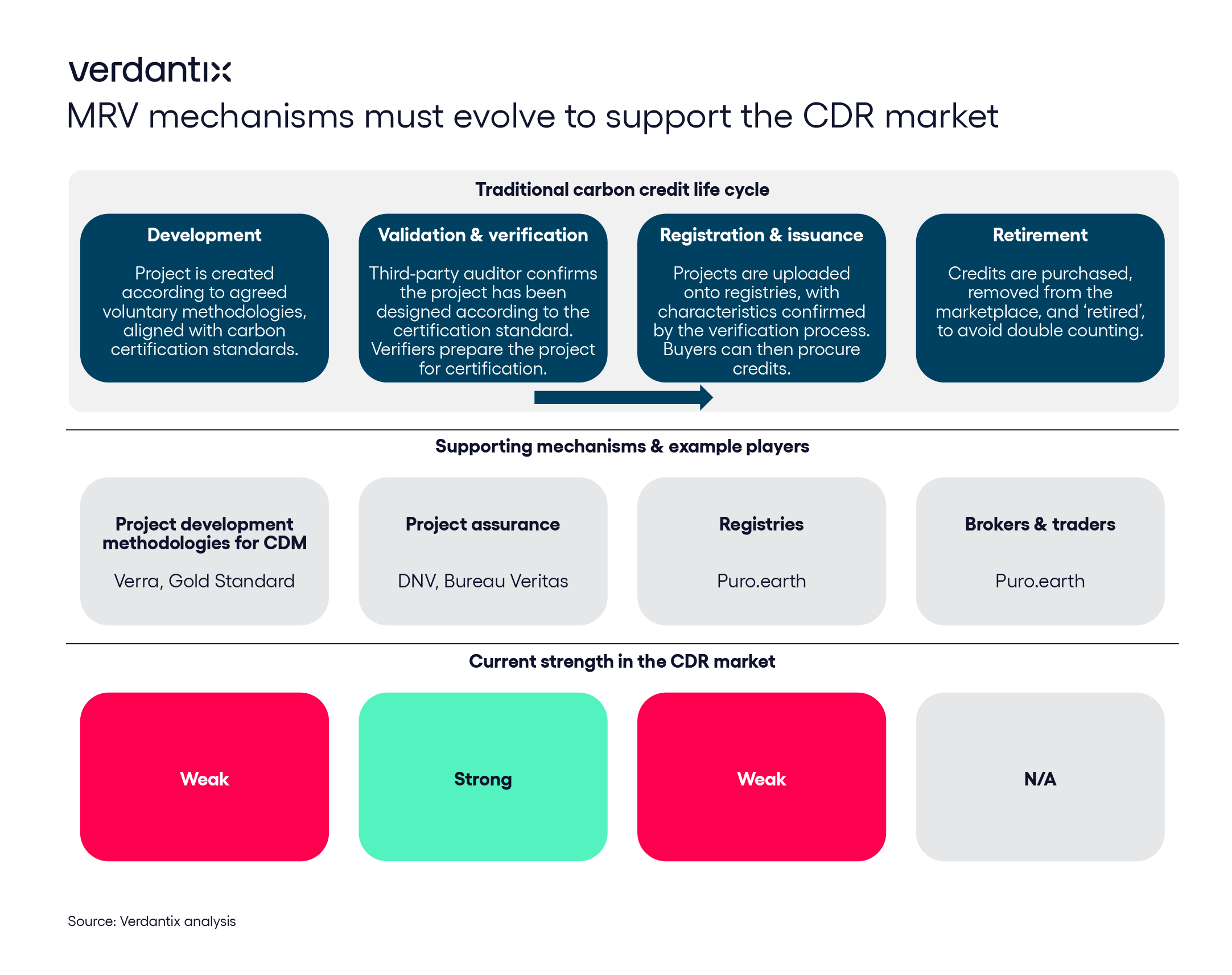

Why is this a significant barrier to scaling the market? MRV mechanisms support buyers by ensuring that a carbon credit actually represents a tonne of emissions removed from the atmosphere. When the market loses trust in MRV mechanisms, confidence in credits is lost, and their value as a climate action commodity vanishes. Certifiers play a particularly important role in the MRV apparatus, as they certify credit suppliers and typically then list ensuing credits on proprietary registries (see below). This enables the credit to be traded as a commodity, with issuance and retirement dates recorded – a critical step the CDR market has yet to reach.

But the situation is changing. Puro.earth is the foremost certifier and registry provider servicing the CDR market, supporting diverse CDR technologies such as biochar, DAC and ERW through the Puro Standard. Each credit generated by certified suppliers is issued through the Puro Registry as a CORC (CO2 Removal Certificate), allowing buyers to retire credits and make climate action claims. Carbon credit certifiers like Verra and Gold Standard are also playing an important role in certifying nature-based carbon removals (NBCR), such as reforestation and blue carbon projects.

There are risks to accepting a market in which MRV mechanisms are solely private; the foremost of which is that certifiers are essentially financially incentivized to certify projects. Governments are also looking at CDR MRV with interest, considering the way they could contribute towards ITMOs (internationally transferred mitigation outcomes). On October 24th 2023, the EU upheld plans to certify carbon removals and “regulate a market that has been plagued by greenwashing, lack of clarity and distrust”.

CDR buyers are currently happy to bet capital on a small coterie of providers they deem trustworthy. But if the market is to expand this must change, to democratize access to expensive and limited high-quality CDR credits. Certifiers face a major challenge in that the CDR market consists of radically differing technologies, with idiosyncratic certification challenges; there is little in common between DAC and biochar, for example. The market is currently one NGO exposé away from serious reputational backlash; in the short term buyers must preferentially invest in providers that are engaging with certifiers, such as Climeworks, to de-risk investments.

About The Author

Connor Taylor

Principal Analyst