Verdantix Green Quadrant Reveals Leading Carbon Management Solutions In A Fast-Changing Market

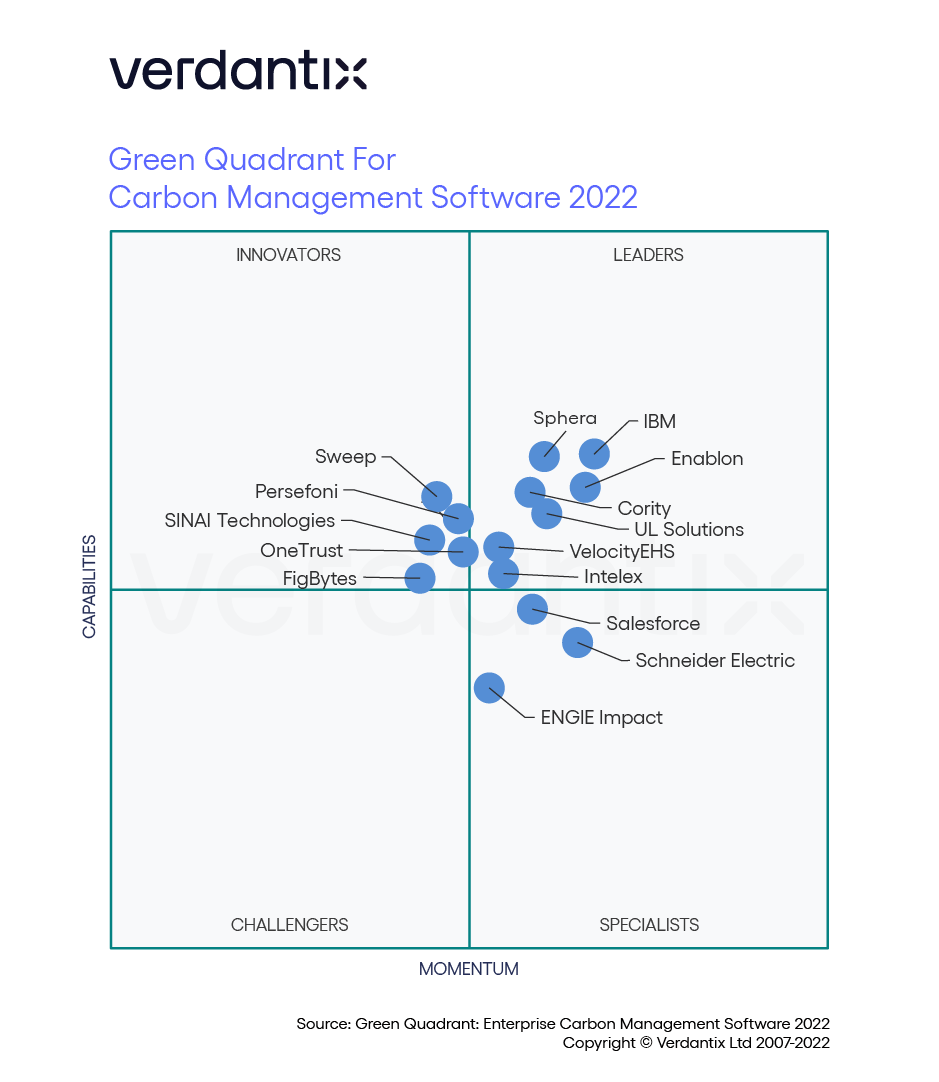

The recently released 2022 Verdantix Green Quadrant: Enterprise Carbon Management Software assesses 15 carbon management software vendors and their capabilities. Our research included two-hour live briefings, desktop research, and vendor responses to a 103-point questionnaire. Vendors included in the study included Cority, Enablon, ENGIE Impact, FigBytes, IBM, Intelex, OneTrust, Persefoni, Salesforce, Schneider Electric, SINAI Technologies, Sphera, Sweep, UL Solutions and VelocityEHS. What are the key takeways from the benchmark of carbon management software firms?

The carbon management software market is rapidly evolving. Carbon management software has existed since the 2000s, but was initially mainly used by emissions-intensive industries to ensure compliance with existing regulations. In the last three years, mandatory disclosures based on the Task Force for Climate-related Financial Disclosures (TCFD) framework and corporate pledges to reach net zero have resulted in booming demand for carbon management software. Additionally, corporates now need their carbon management software to be deployed enterprise-wide and incorporate more forward-looking capabilities, in addition to the carbon calculations and disclosure requirements included in the first generations of the software.

No single software provide currently has a complete portfolio offering across all of the capabilities we included in the Verdantix definition of carbon management software. The 15 vendors in the Green Quadrant are sitting in a strong position to continue to grow in the market, with each having demonstrated capabilities around carbon emissions calculations, modelling Scope 1, 2 and 3 emissions, and data acquisition and management. Seven firms – Cority, Enablon, IBM, Intelex, Sphera, UL Solutions and VelocityEHS – made it into the Leader’s Quadrant, demonstrating breadth of functionality and strong market momentum. However, Verdantix finds that today, no single software provider has a complete product portfolio capable of offering all key elements, including financial management, physical asset climate risk and net zero strategy development and programme implementation.

While the carbon management software market has been dominated by EHS software firms, newer entrants and larger software vendors are driving innovation to meet new use cases. Over the past three years, numerous new vendors that have focused on carbon management have entered the market, such as Persefoni and Sweep. Their innovative approaches have caught the eyes of investors, resulting in a flurry of significant investments. Additionally, existing software vendors, such as Salesforce and Schneider Electric, are leveraging their existing capabilities to develop carbon management software offerings. This mix represents significant innovation to fight for market share.

To learn more about the 15 most prominent carbon management firms in the market and our take on the market, read the full report: 2022 Verdantix Green Quadrant: Enterprise Carbon Management Software

About The Author

Jessica Pransky

Principal Analyst