Utilities Seek DERMS Innovation On Three Key Fronts

The global momentum towards clean energy is strong and growing, putting pressure on power utilities to adapt how they operate. Distributed energy resource management systems (DERMS) – and the capabilities they offer – promise relief in the form of grid stabilization, market participation and optimization.

At the margins of the market, some renewable energy investments have slowed down, due to radical shifts in policy (such as the US’s U-turn on offshore wind) or high interest rates drying up funding. On the whole, however, this is a sneeze in the face of a storm. Recent analysis by Wood Mackenzie predicted that distributed energy resource (DER) capacity in the US – split between curtailment resources like EV charging and building automation and generation resources like solar and battery – will grow by 217GW, or 70% of new bulk power, by 2028.

Electricity demand is brute-forcing the business case for DER investment, and utilities are racing to keep up. For all the hoopla around DeepSeek’s lower-cost, lower energy form of GenAI, it will in all likelihood lead to greater electricity demand in the medium- to long-term, not less. And, as we have covered in past research, firms across all industries and sectors are investing in electrification, leading to a forecasted 9% demand growth by 2028 and 18% by 2033. This scenario led one utility leader to say: “Build everything you can as fast as you can”. Many utilities see DERs as a core part of that strategy; for example, Portland General Electric expects 25% of its new peak power to come from customers and DERs.

And where utilities fail to keep up with demand, firms are increasingly taking power into their own hands. Driven by state mandates for clean logistics, trucking firms in California are investing in microgrids powered by a mixture of clean and fossil energy. Maersk and Prologis partnered on the Denker site near the port of Long Beach, where they have access to 9MW of power from hydrogen-ready linear generators and batteries.

The DER crunch puts utilities in a somewhat perilous position due to how these resources impact grid stability and frequency management, but also opens a new route to increase resilience, meet decarbonization targets and improve customer service. DERMS technology – an extension of advanced distribution management systems (ADMSs) which allow utilities to connect to DERs, group them and manage them – have been around for more than a decade, but are seeing a spike in interest due to the DER build-out. Leading vendors like ABB, AspenTech, GE Vernova, Hitachi Energy, Itron, Mitsubishi Electric, OATI, Oracle, Schneider Electric and Siemens have implemented DERMS in a number of contexts, helping utilities to stay on top of both utility-grade DERs in front of the meter and commercial, industrial and residential ones behind it.

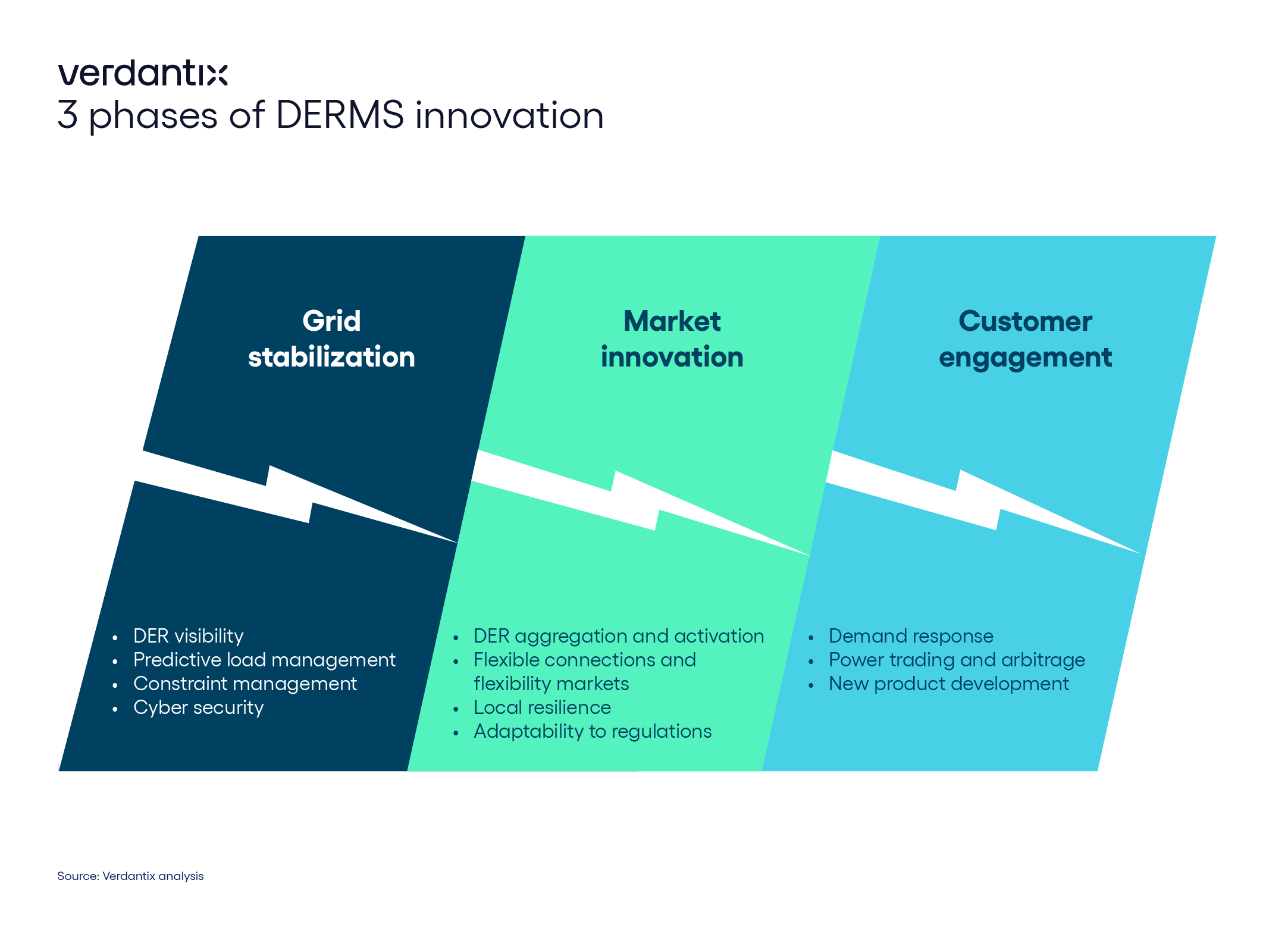

At Verdantix, we’re charting the key innovations in the DERMS space (which will culminate in a Green Quadrant benchmark analysis of the leaders late in 2025), and our early analysis sees three key areas of development and opportunity:

- Stabilization via enhanced grid services.

One of the first and most pressing use cases for a DERMS comes from utilities operations and the control room, where unexpected (and effectively invisible) fluctuations in power and voltage from DER operations create risks for grid stability and associated assets like transformers. DERMS create visibility into the assets causing the fluctuations, enabling operations teams to respond to, or forestall, them more effectively. Innovation on this front is focused on predictive models building from, for example, better weather forecasting that gives utilities a head start of up to a day – or more – to prepare for expected power loads.

- Greater market participation via asset aggregation and visibility.

A DERMS provides not only visibility into the operational status and power generation of DERs, but also the ability to group DERs in the service of curtailment or dispatch for load balancing. Innovation by DERMS in this area often involves increasing the access and intercommunication with a variety of DER assets and their protocols; vendors are rapidly building out their partnerships with a long list of manufacturers of batteries of all sizes, thermostats, solar inverters and turbines. Further, the emergence of flexibility markets – and innovative vendors that support them such as Electron, Nodes and Piclo – are allowing for sophisticated arbitrage opportunities.

- Optimization via engagement and market innovation.

Ultimately, DERMS can enable a host of new products and services from utilities firms, based on better insight into DER operation and engagement with DER owners. For example, UK-based utility firm Octopus Energy is partnering with Chinese automaker BYD and using its home-grown DERMS Kraken to enable homeowners to use their BYD EV as a home battery, charge optimally and trade stored power back to the grid when conditions suit this. These kinds of arrangements create a broad new field of product development for utilities to bring more value to customers and simultaneously enhance their distribution system capabilities.

The expansion and continued rollout of DERs across global markets are creating whole new fields of challenges and opportunities; join Verdantix at our webinar on February 13th to learn more about Technology Trends In The Energy Transition.

About The Author

Ryan Skinner

Research Director