Uptick In Spending On Asset Investment Planning Will Alter The Dynamics Of The Software Supplier Landscape

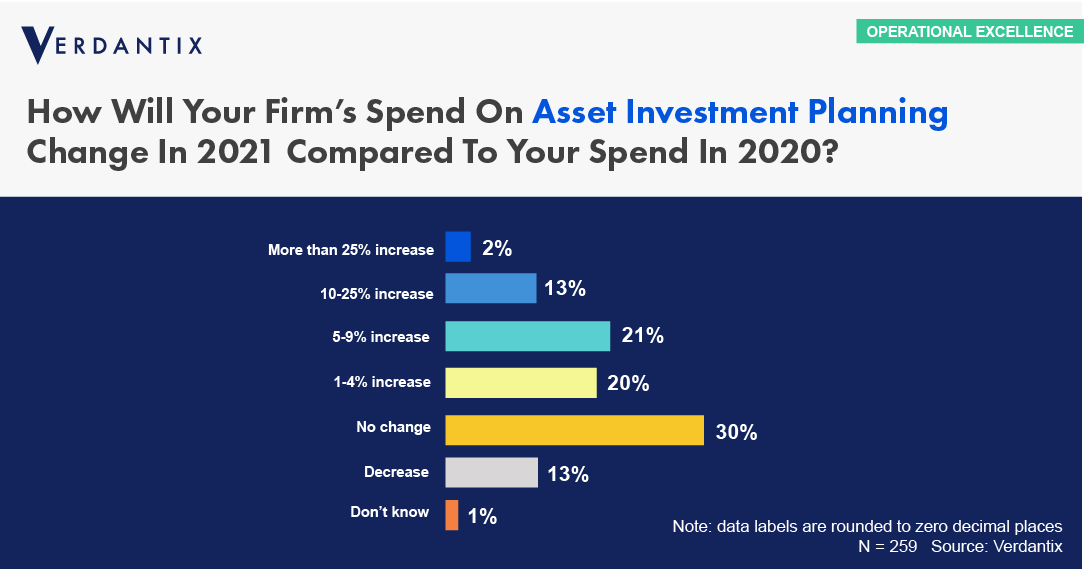

In the 2020 Verdantix global corporate survey, we asked 259 executives in operations, maintenance, engineering and process safety roles how their firms’ spend on asset investment planning (AIP) was expected to change in 2021 as compared to 2020. Forty per cent of the respondents stated that they were planning to increase spending between 1% and 9%, while 15% stated that their increase in spending would be in double digits. Australia’s appetite for investment in AIP activities was especially prominent, as three in four respondents stated that they will increase spending. From the 14 industrial sectors surveyed, chemicals and food and beverage (F&B) stood out with the highest expected AIP investment growth, followed by the asset-intensive power and water utilities sectors.

Our research also found out that 76% of the industrial firms surveyed worldwide are already using commercial software or in-house developed tools to satisfy their AIP needs. The highest adoption of AIP software was encountered within the digitally lagging but regulations-bound power and water utilities sectors, while the F&B and chemical sectors came next. Interestingly, about 20% of all respondents stated that they plan to replace their commercial AIP software with software from another supplier in 2021. AIP software had the highest such conversion rate among the 11 industrial software applications looked at. This behaviour highlights the importance of the technical and functional capabilities of this still nascent technology and is a stark warning for the competing AIP software suppliers, who will have to work hard towards increasing their customer retention rates.

The AIP software market has been building good momentum over the last two years. AIP specialists such as AssetWorks, Copperleaf, Cosmo Tech, Deighton, DIREXYON and PowerPlan have all been looking to capitalize on the rosy market prospects. AIP tools, however, require both qualitative and quantitative asset information (e.g., asset health measurements, maintenance and inspection information) to make better predictions. APM and EAM software suppliers can provide such data and they will seek to exploit their positioning, using acquisitions or partnerships with AIP specialists as a market-entry strategy to the bolstering AIP market. The market already witnessed such a move in March 2020, when Dude Solutions, a US-based CMMS and EAM software provider, acquired Assetic, an Australian-headquartered AIP software supplier, and we expect more such moves to materialize over the next years.

For more information on asset management technologies and the software market dynamics, visit the Verdantix Operational Excellence research portal.

About The Author

Victor Voulgaropoulos

Senior Analyst