Introducing The Emissions Data Chain: A New Disclosure Paradigm

Investment decisions by financial institutions are currently based on bad data. The 2° Investing Initiative estimates that more than 70% of PCAF disclosures (the best-in-class method for estimating financed emissions) are reliant on sector and regional economic activity averages. This means that when a bank reports its emissions footprint, it is in effect disclosing only its industry and geographic investment focus, not its actual decarbonization performance. How can financial institutions gain better access to direct emissions data?

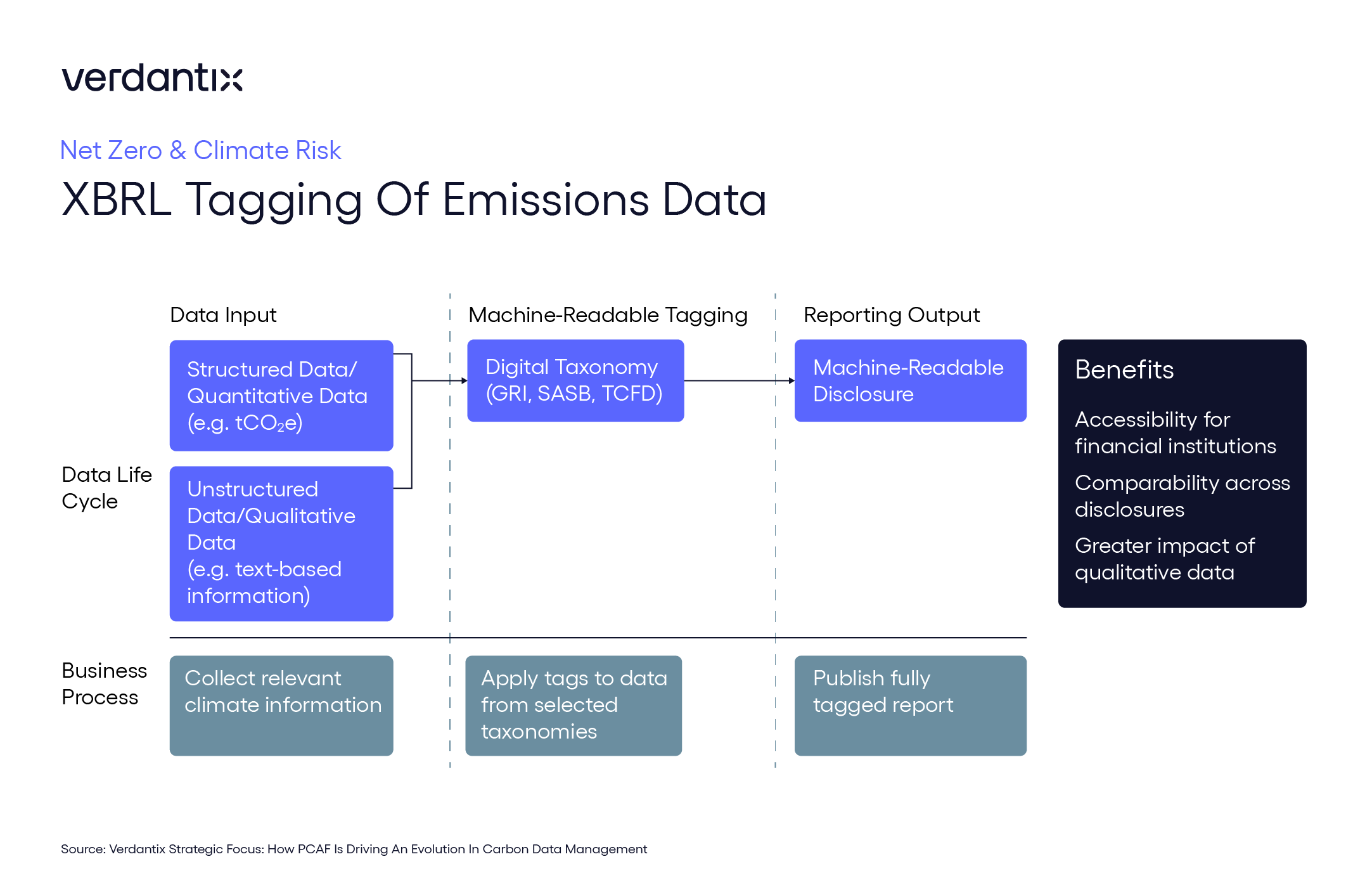

Currently, corporate emissions disclosures are both inaccessible and too bespoke to allow for easy performance comparison (see Verdantix Strategic Focus: How PCAF Is Driving An Evolution In Carbon Data Management). However, this disclosure paradigm is now undergoing a significant evolution towards a new emissions data chain, which will improve accessibility, reliability, and comparability of corporate reporting.

This new emissions data chain makes corporate disclosures machine-readable by financial institutions, in much the same format as financial reports. Relevant emissions data – both qualitative and quantitative – are digitally tagged through frameworks such as the SASB Standards XBRL Taxonomy. This tagged report can then be automatically parsed by financial institutions, which can incorporate the data into decision-making. Progress towards this development is well underway; both Etsy, Inc. and Gap Inc. have published such machine-readable reports.

It's clear to see the benefits for financial institutions: they will be able to substitute inaccurate activity information for direct data, straight from source, and therefore improve their own disclosure quality and understanding of net zero progress. But corporates will benefit too; by demonstrating performance to financial institutions, they will be able to capitalize on decarbonization initiatives and gain better access to capital.

The new emissions data chain requires considerable investment on the corporate side. For one, firms will need a solution that has the capability to treat emissions data with the same rigour as financial data. Luckily, such platforms already exist, including Workiva and Novisto. There is considerable regulatory pressure pushing disclosures in this direction; witness the SEC’s proposed requirement for data attestation and inclusion of climate-related data in 10-K filings. Firms seeking to use net zero performance as a competitive differentiator would do well to lay the groundwork needed to benefit from the new emissions data chain.

About The Author

Connor Taylor

Principal Analyst