Innovation, Investment And Intense Competition: The Energy Management Landscape Enters A New Phase

Ben Hext

Surging energy prices and long-term decarbonization pressures have sparked a need for energy management software (EMS), as commercial real estate operators urgently search for ways to mitigate exposure in their portfolios.

Global energy prices are at an all-time high, with wholesale prices tripling in many major markets since 2021, according to the International Energy Agency (IEA). The Russian invasion of Ukraine and severe weather has cut supply to major economies, triggering a global crisis. German power breached $800 per megawatt hour for the first time ever in August 2022, ten times greater than 12 months ago. In China, severe drought has cut electricity production by 51% at the Three Gorges hydroelectric dam, the world’s largest power plant. This drastic shortage is forcing the shutdown of industry and pushing governments to limit energy usage in buildings. Kosovo became the first European country to instate six-hourly rolling blackouts in August 2022 and the UK is planning for blackouts over winter.

Decarbonization requirements are adding slow-burn pressure to the energy headache. Almost all governments have now committed to the Paris Agreement, creating net zero targets that must be met between 2030 and 2050. This is cascading down to real estate investors and corporate occupiers, who are forced to closely consider the carbon emissions of their real estate portfolios due to new ESG disclosure requirements (see Verdantix Strategic Focus: Responding To ESG Disclosure Requirements In Real Estate).

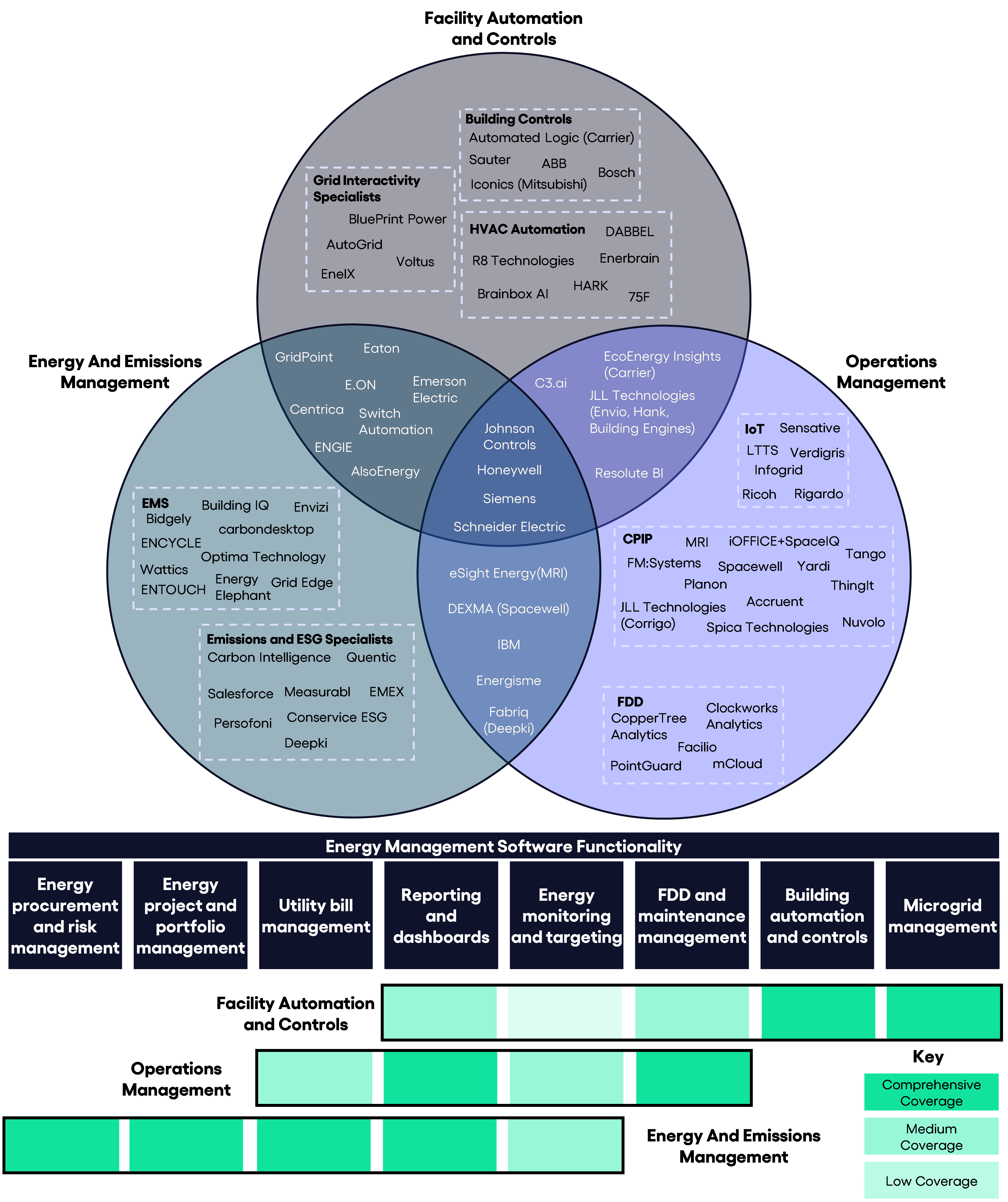

This cumulation of factors is creating a resurgence in need for EMS in real estate. A decade of technological developments and new entrants has shaped a new era of EMS, where vendors from multiple backgrounds are offering a broad range of functionalities (see Figure 1). The result is a complexifying market and a new phase of competition that will emerge amongst building technology providers, almost as intense as the battle between Edison and Tesla over AC and DC.

New, well-funded players are throwing their hats into the ring. Integrated oil and gas majors have started deploying their big balance sheets with investments into promising technology startups that support the shift towards grid-interactive facilities and electric vehicles. Private equity firms are also on the hunt for EMS vendors. Partners Group acquired a majority stake in Budderfly, an energy and efficiency management provider, for $500 million in July 2022.

Long-term energy and decarbonization pressures will continue to build, forcing firms to invest in technology that monitor, analyse and manage consumption. Buyers now have an extensive range of options on offer to support their journey. Find out more on the EMS landscape and the future of this market in the latest Verdantix report The New Landscape Of Energy Management Software.

About The Author

Ben Hext

Industry Analyst

.jpg?sfvrsn=c008f75f_1)