ESG Controller: Bringing Order To Disorder

Growing calls for transparency and the looming threat of greenwashing allegations are driving firms to change the way ESG is organized and managed internally. Organizations often struggle to choose the right ESG path to reflect both their current capabilities and their potential for sustainable impact. In an effort to scale up commitments, firms are creating new job titles that combine finance, compliance and sustainability – such as the ESG controller, which reflects the increasing gravity of ESG.

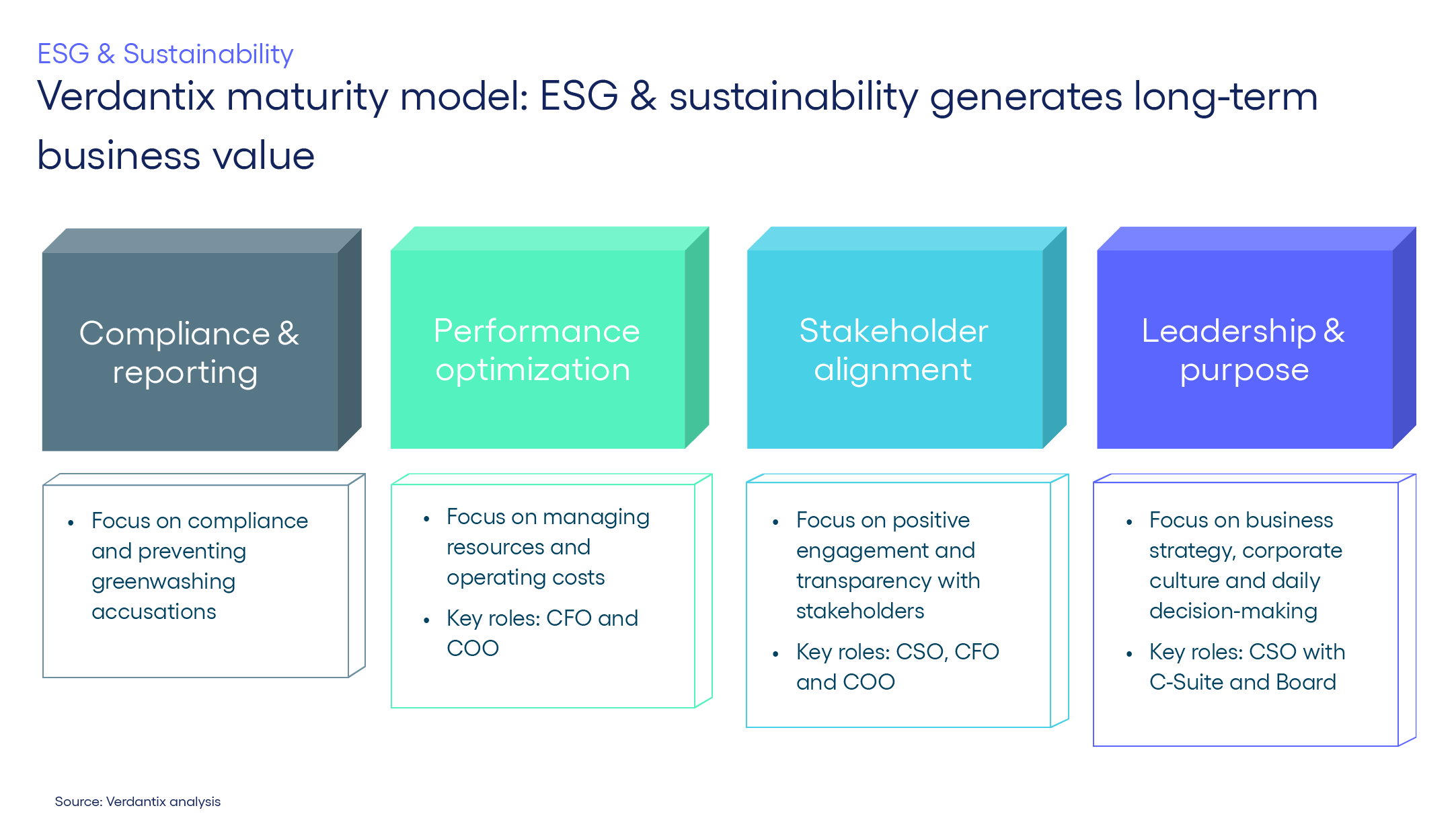

To start, organizations must be honest about their prioritization of ESG issues. We see four levels of ESG maturity, depending on organizations’ exposure to sustainability risks, regulations and stakeholder pressure:

- Level 1 – ESG is a compliance and reporting obligation: Common in heavily regulated markets such as the European Union, ESG is a compliance requirement to avoid any litigation, reputational or financial risks.

- Level 2 – ESG is a motivating factor for performance optimization: Rising energy prices and supply chain disruptions are among the many factors pushing firms to develop new technologies and processes that optimize overall performance and simultaneously benefit sustainability.

- Level 3 – ESG is a means to align with stakeholder demands: ESG is a source of competitive advantage. Organizations can seek engagement with stakeholders in sustainability issues and leverage ESG commitments to achieve industry leadership.

- Level 4 – ESG is an element of leadership and business purpose: ESG is a core element of business purpose. ESG becomes part of daily decision-making as a driver of innovation, organizational change and business value.

Firms positioned across these four maturity levels must recognize the need to undergo an internal organizational transformation. For some, compliance reviews have exposed gaps and highlighted the necessity of reforms to their operating model to meet the CSRD requirement to introduce a formal governance framework. For others, surging ESG investment has highlighted the need for an individual to be appointed to manage financial allocations for ESG expenditure.

Against this backdrop, we are beginning to see the emergence of ‘ESG controller’ roles. Alphabet, DuPont and Halliburton have all recently appointed ESG controllers. Responsibilities for this emerging role are still being defined, but generally this is an individual in charge of developing ESG data collection and reporting policies, and identifying and managing ESG-related risks. ESG controllers will likely play a role in conducting internal data reviews and managing external audits, meaning that familiarity with financial data and accounting practices will be a key competency for the role. We also anticipate that this position will play a significant role in coordinating different functional areas and connecting different workstreams across compliance, risk and finance, whilst reporting to the Chief Sustainability Officer.

Establishing an ESG controller role could be the key piece to unlocking a firm’s sustainability potential. Successful ESG strategies depend upon organizations’ ability to embed sustainability purposes in daily decision-making. ESG controllers not only drive risk management and accountability, but can become vital actors in creating a strong corporate sustainability purpose.

To learn more about ESG maturity levels and the integration of ESG into financial disclosures see Verdantix Strategic Focus: Organizations And The Rise Of ESG and Verdantix Strategic Focus: Integrating ESG into Financial Disclosures.

About The Author

Elisa Molero

Senior Analyst

Lily Turnbull

Senior Analyst