Elections 2024: The Melting Pot

Daniel Garcia

Managing social and political risk in polarized and volatile times

In Q3 2023, the world entered an electoral cycle in which half of the global population are set to cast their votes for government and parliamentary representatives.

In today's highly polarized societies, these elections – whether free, fair, or both – will have ripple effects across markets and regions, reshuffling foreign policies and redefining the direction of global initiatives.

Examples of these changes are already happening. In October 2023, Poland's ruling party lost control of parliament to the Civic Coalition, reducing momentum for the nationalist agenda. In November, despite losing the popular vote, the Spanish government formed a coalition supported by all minority parties. This coalition promised amnesty to Catalan separatists, which led to days of public demonstrations and raised questions about the legality of such agreements. More recently, in December in Argentina, a 'political outsider' won the presidential election with 56% of the vote, promising to steer the country away from historically failed populist policies and towards a market-oriented and liberal economy.

According to the 2023 Edelman Trust Barometer, Argentina, the US, South Africa, Spain and Sweden are classified as ‘severely polarized’ and Brazil, South Korea, Mexico, France, the UK, Germany, Italy and the Netherlands are at risk of joining this club shortly. Research suggests that increasing polarization is being driven by poor overall economic performance, a lack of institutional balance, class divisions and issues relating to social truth.

In the 2023 Verdantix global risk management survey, published in September, 20% of respondents selected geopolitical risk as a top risk for monitoring in the coming year. After the October events in the Middle East, military action in the Gaza Strip, security issues around the Suez Canal, and a new military exercise in North Korea, geopolitical risk has risen to the top of boardroom agendas once more. For 2024, the Verdantix risk predictions report ranks geopolitical risk and the electoral cycle as two of the top five risks to monitor.

Businesses around the world should be prepared to manage existing geopolitical risks, and the multiple ramifications of the upcoming election results, acknowledging the opportunities, threats and regulatory challenges they pose. The electoral cycle of 2023-24 is particularly important not just because of the internal political dynamics at play, but due to its implications for international foreign policy.

The election roadmap – and its implications

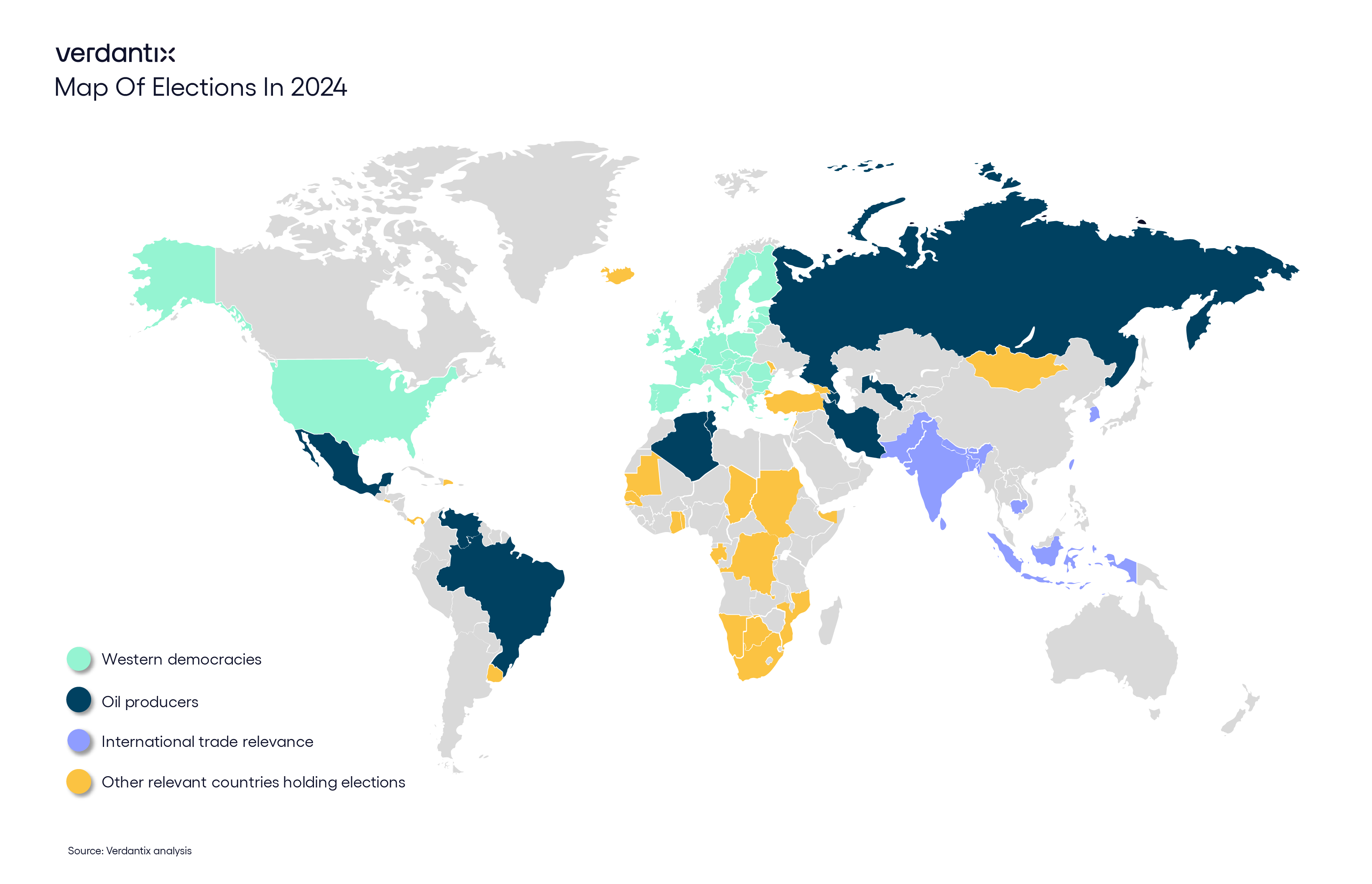

The diversity of nations with election cycles this year is enormous – not just in terms of the freedom or fairness of their systems, but in the type of representatives to be elected. The US, Russia, India, South Korea, Mexico, Taiwan and Indonesia are holding presidential elections. The EU, UK and Brazil are conducting parliamentary or local elections, which equally have the potential to pivot the political agenda in those countries or regions.

To better understand the implications of these elections, countries can be classified into three categories:

- Western-developed markets: with the potential for political shockwaves

EU, UK, US

The eyes of the world are on the electoral event of the year: the US presidential election in November. Potential candidates and frontrunners former president Donald Trump (Republican Party) and President Joe Biden (Democratic Party) differ enormously on topics such as immigration, the environment and sustainability, US foreign policy and international trade, with the election result thus likely to affect not just the country’s long-term vision, but the international political agenda.

In the EU, parliamentary elections are scheduled for June, where euro-centric parties will attempt to counter the rising presence of nationalism. Subjects such as the ESG agenda, economic reforms, the war in Ukraine, and efforts to combat illegal immigration will dominate campaigns.

In the UK, the Conservative Party has been suffering internal turmoil, resulting in three prime ministers holding office in less than two years. This internal political instability, coupled with the cost-of-living crisis, high and persistent inflation rates, and controversial policies around illegal migration, are increasing the polarization level amongst voters. The main opposition Labour Party is ahead in the polls for the next general election, due to be held by the end of 2024. There is the possibility of a reversal of the Conservative agenda thereafter, especially concerning austerity plans and immigration.

- Extracting economies: keeping an eye on energy

Algeria, Brazil, Iran, Mexico, Russia, Tunisia, Venezuela

Numerous countries with a strong dependency on the extracting economy – particularly oil production – are facing elections this year. According to the International Energy Agency (IEA), total combined oil production amongst these countries sums to approximately 22 million barrels per day, equivalent to 23% of global production. In terms of oil reserves, these countries hold some 630 billion barrels – or 41% of global oil reserves – with Venezuela alone possessing 300 billion barrels, Iran 210 billion, Russia 80 billion and Brazil 13 billion. While no drastic political pivot is expected in these regimes’ upcoming elections, their strategic economic and geopolitical relevance will continue to influence the international scene.

The existing conflicts between Ukraine and Russia, and in the Middle East, along with US production restrictions, OPEC production cuts and the revival of global economic growth, are starting to add more impetus to the stirrings of a price rally in oil, with the risk of bringing further economic and inflationary pressures to businesses, households and governments via the supply chain.

- Manufacturing and maritime shipping trailblazers: making waves around the world

Bangladesh, Cambodia, India, Indonesia, Pakistan, South Korea, Sri Lanka, Taiwan

In 2024, several prominent countries in Southeast Asia will head to the polling stations, with almost 2.2 billion people in this region choosing their next heads of government. China’s territorial expansion in the South China Sea is fuelling disputes with its neighbours and leading to the growing involvement of India, as the political influence of the latter rises in the region. Resolution of this dispute is not expected in the near term, with tensions only set to grow over these countries’ desire to 'control' one of the busiest international maritime sectors. According to the UN Conference on Trade and Development (UNCTAD), in 2022 these routes represented 27.6% of total international trade.

In Taiwan, the 'one country, two systems' regime has been openly challenged by mainland China, leading to the rise of internal political movements aiming to reverse it. However, the US is fully backing the independence of the island. Tensions between the US and China on international trade, geopolitical conflicts and Taiwan's pursuit of 'independence' add more pressure to an already challenging agenda, regardless of who takes the White House in November.

Preparing businesses to withstand the 2024 headwinds

Given the complexity, interconnectivity and speed of changes of sociopolitical events, there is a clear call to action for business leaders, as they seek to prepare their firms for the upcoming electoral storm. Verdantix has identified three moves business leaders should take, as part of their risk management strategies for 2024 and beyond. Leaders should:

- Understand how their business is exposed to these markets.

Leaders should consider both their direct operations and their supply chains. They should identify potential vulnerabilities, establish risk tolerance levels, define contingency plans, and constantly monitor and report the evolution of these factors.

- Appreciate how their business is perceived in these societies.

Social dynamics are constantly evolving, and businesses must be aware of social trends. Intentionally or otherwise, a business’s reputation can be adversely affected through social media, especially given the speed of use of digital channels.

- Recognize how technology can support them to take better decisions.

The upsurge of non-financial risk, and the complexity and speed of geopolitical events, require firms to enhance their technological risk management solutions. Emerging technologies – far more than spreadsheets – can prove an invaluable support for businesses in monitoring real-time threats, fostering resilience and preserving business integrity.

About The Author

Daniel Garcia

Senior Manager

-market-for-2025_main-image.jpg?sfvrsn=321a5193_1)