Delivering Investor-Grade ESG Data Proves A Challenge For Firms

Lily Turnbull

The ESG and sustainability data landscape is rapidly evolving. The EU’s Corporate Sustainability Reporting Directive (CSRD) and Taxonomy Regulation together have over 3,700 data points. On top of that, firms may receive additional ESG data requests from investors, third-party raters and rankers, customers and partners. Faced with such a deluge of requests, there may be a temptation to sacrifice quality in favour of quantity, thereby heightening the risk of data inaccuracies and misrepresentation of ESG information – otherwise known as greenwashing.

Research published in October 2023 by RepRisk revealed that between September 2022 and 2023, one in every four climate-related ESG risk incidents was tied to greenwashing. For example, in September 2023, German asset manager DWS received a whopping $19 million fine from the SEC for making materially misleading ESG statements.

As greenwashing becomes more pervasive, the vital importance of investor-grade ESG data – which Verdantix defines as accurate, automated, auditable and time-relevant – will increase. Yet our research indicates that:

- Businesses do not feel confident in their ability to provide investor-grade ESG data.

In a Verdantix survey of 400 sustainability executives, 38% of respondents said that their firm did not have the data management capabilities to provide investor-grade data (see Verdantix Global Corporate Survey 2023: ESG & Sustainability Budgets, Priorities and Tech Preferences). This could stem from a combination of factors, involving technological limitations, personnel capabilities and organizational process complexities.

- Firms’ climate disclosures reveal a myriad of gaps.

Data from the Verdantix Climate Benchmark of the insurance sector reveal that, on average, insurance firms are 19% aligned with the Verdantix disclosure best practices framework for Scope 3 emissions and 22% aligned for climate-related risks and opportunities metrics. Incomplete and patchy climate data are undermining investors’ ability to accurately price the physical risks of climate change.

- Organizations are still a long way from digitization of ESG processes.

Verdantix research reveals that 36% of respondents, on average, still rely on spreadsheets for ESG data collection and management. An overreliance on manual data collection and management processes can create risks such as inefficient management of data, excess use of resources, version control complexities and potential inaccuracies due to human error.

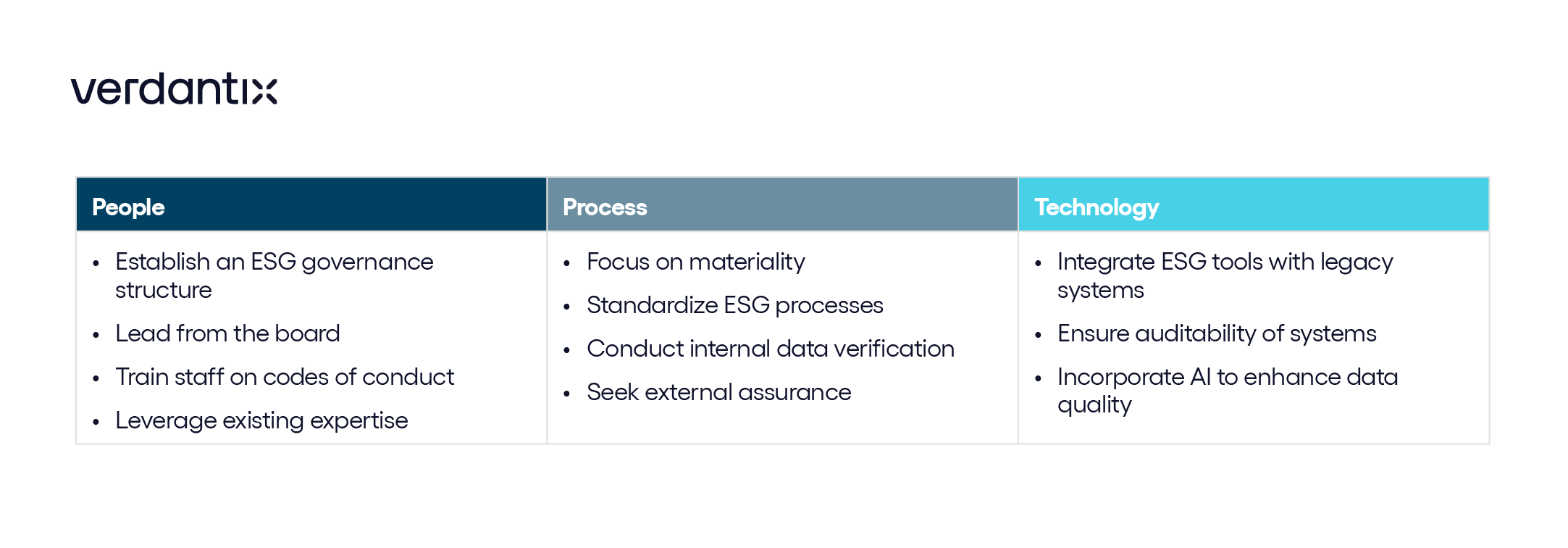

To deliver investor-grade ESG data, firms will need a robust ESG data governance strategy that combines human expertise, streamlined processes and an adaptable information architecture (see below).

For more information on best practices for delivering investor-grade ESG data, see Verdantix Strategic Focus: Delivering Investor-Grade ESG Data.

About The Author

Lily Turnbull

Senior Analyst