Decarbonization Deferred: How Hybrid Working Hurts Adoption Of Low-Carbon Technologies

Ben Readman

The pressure for the real estate industry to decarbonize is higher than ever.

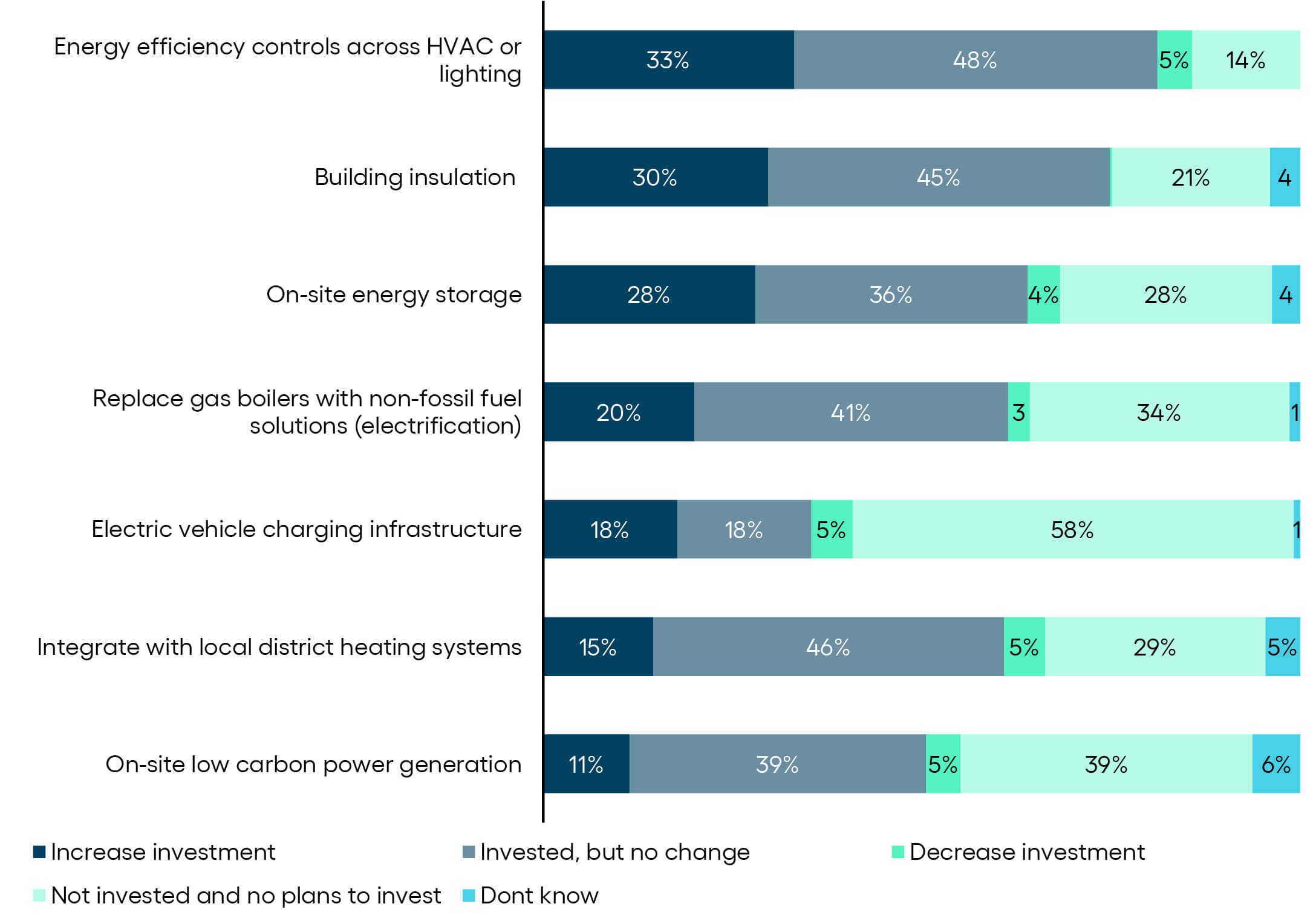

This is driven by market pressures, energy price volatility, net zero targets and building regulations and energy codes that are slowly coming into effect. Rapid and deep shifts to zero-carbon-ready technologies are required for buildings to reach net zero by 2050, according to the IEA. Many of these technologies are currently available on the market. So, are corporate real estate and facilities budget holders heeding the warnings and investing to decarbonize their portfolios? Verdantix asked 350 corporate real estate and facilities managers about their investment plans for select decarbonization and energy efficiency technologies and initiatives over the next 12 months. The results were surprising.

The planned uptake of many key decarbonization technologies required for net zero, a shift from fossil fuels or boiler replacement, was disappointingly low. Instead, budget holders are opting for initiatives that deploy tried and trusted energy efficiency controls and building insulation, which many were already doing.

A few bright spots appeared: Sectors such as Consumer and Retail (32%), and Healthcare Pharma & Biotech (35%) intend to respond to the challenge by investing in on-site storage systems for their complexes. Take the consortium formed of Ameresco, Bloom Energy and Concept Clean Energy, which installed a microgrid at Taylor Farms in California, enabling the food producer to bypass the grid entirely.

This hesitancy is caused by the air of uncertainty surrounding long-term portfolio-sizing strategies. Corporates experiencing chronically low occupancy levels are unsure of their long-term real estate plans. Combined with rising inflation rates, the result is more tentative investment in decarbonization technology. Only 11% of our survey respondents are planning to increase spend on clean generation technologies. This is despite the cost of solar PV hitting an all-time low in 2021, between $1.45 and $1.56 per kWh in the US, just before wholesale energy prices started to soar. On paper, the business case has never looked better.

Yet, the payback on these projects only makes sense if firms remain in their buildings for the full life cycle of their investments. Few know for certain whether that will be the case. The impacts of hybrid working are many and unclear. Our research suggests that until corporates gain clarity over which buildings they are likely to keep in the long term, they are unlikely to invest heavily in the short term.

Any thoughts or feedback on this blog? Get in touch with us by emailing [email protected]

About The Author

Ben Readman

Industry Analyst