Carbon Dioxide Removals: A Game Of Big Risks And Big Rewards

The CDR market has already experienced some exciting developments in 2024. Global commodities firm Trafigura announced a purchase agreement for credits generated from 1PointFive’s STRATOS DAC facility, which is currently under construction; financial services firm Stripe launched a service to allow buyers to pre-order carbon removals through Frontier; and providers Captura and Octavia Carbon have raised capital to allow scaling of operations. Yet behind this market buzz, endemic issues facing the market since 2022 have yet to be resolved (see Verdantix Market Overview: Carbon Dioxide Removal Technologies). Leading executives responsible for determining and executing carbon removal strategies are faced with critical challenges surrounding how best to de-risk procurement, namely:

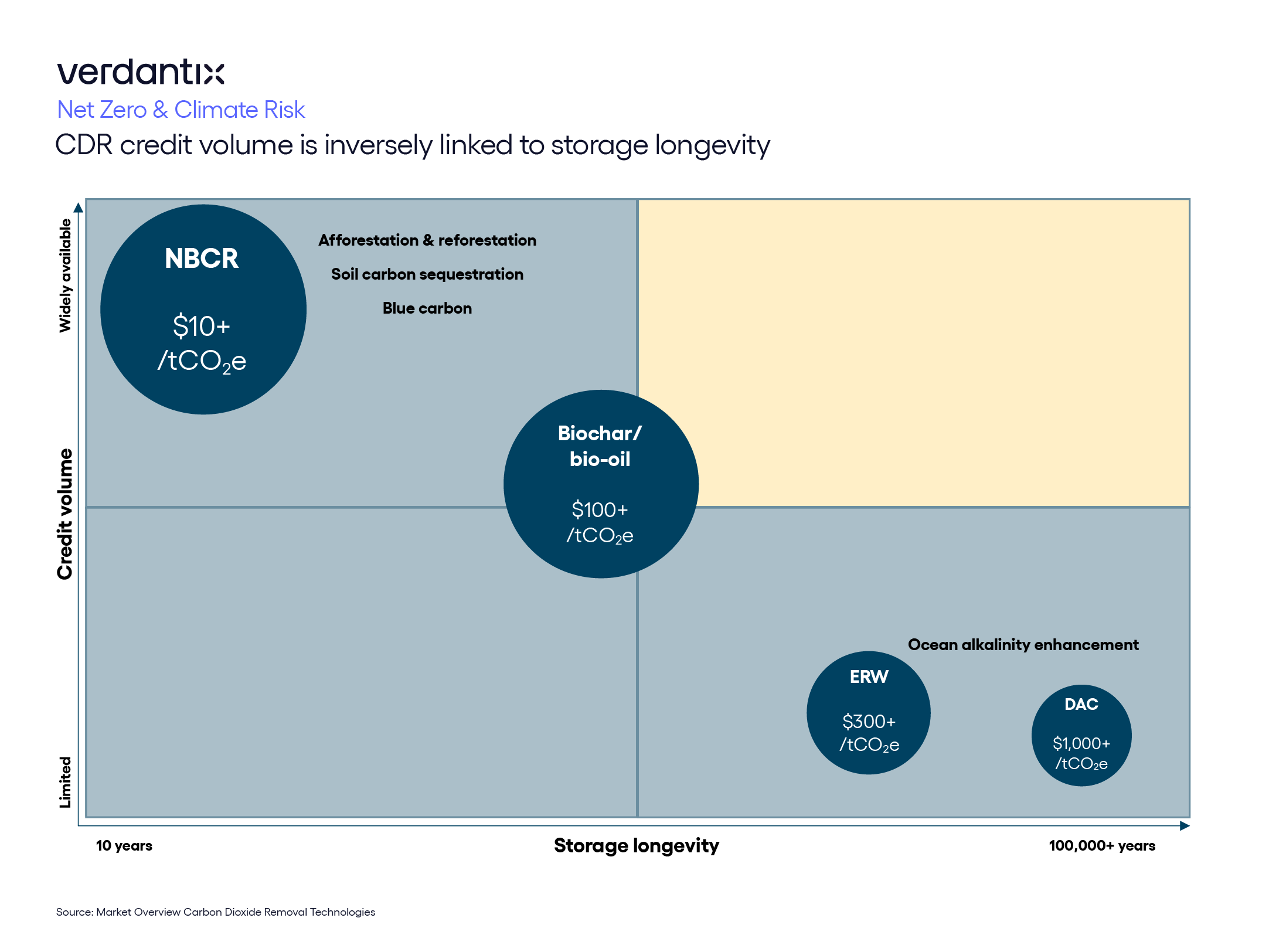

- Balancing the permanence and availability conundrum.

With few exceptions, permanence – the durability of carbon dioxide removals – is inversely correlated with current credit availability and delivery timescales (see below). The most notable example of this concerns nature-based carbon removals. According to carbon market data provider Sylvera, some 99.9% of all removals consist of nature-based solutions, such as ARR. And nature-based solutions are most exposed to reversal risks. Buyers must therefore juggle the dual concerns of offsetting present emissions, while gaining access to future credit delivery from the highest-durability credits, such as DAC.

- Funding expensive, long-term removal purchases.

Carbon removals are significantly more expensive than alternative credit types. According to survey data from cdr.fyi, the majority of buyers are budgeting over $100 per tonne for durable removals; less durable credits trade between the $5 and $10 mark. Barring net zero industry leaders with significant appetite for investment, current price points are a major barrier for many corporates to enter the CDR game. Prospective buyers must raise budget through the allocation of internal carbon prices – or from savings elsewhere, such as through implementing energy efficiency initiatives, as SaaS firm Zendesk did – to fund procurement. Such action requires cross-organization collaboration to raise the required capital to access the CDR market, a significant challenge for many firms.

- Risks surrounding CDR measurement, reporting and verification.

Typical of an emerging climate commodities market, necessary mechanisms to ensure credit quality for buyers have yet to keep up with the pace of innovation from technology providers. Although exciting developments are under way, from registries such as Puro.earth – and even carbon credit investment insurance from Kita – significant gaps exist in the market. This is a clear risk for buyers, who must ask: am I really procuring quality credits, or am I exposing myself to reputational and financial risk?

Join us on February 6th for our free-to-access webinar: Futureproofing Your Carbon Dioxide Removal Strategy, where we will cover how net zero leaders should build resilient and effective carbon dioxide removal strategies.

About The Author

Connor Taylor

Principal Analyst