Adapting Carbon Accounting For A Net Zero World

The pre-eminent carbon accounting methodology – the Greenhouse Gas Protocol – may no longer be fit for purpose; or, rather, the purpose of carbon accounting may be changing. This will give rise to new methodological approaches.

Carbon accounting is the process through which organizations measure and track their greenhouse gas emissions. The GHG Protocol, which is the most commonly used global framework for this, was designed by the World Resource Institute in 2001 to help firms understand their own impact, and set idiosyncratic decarbonization goals. But, over the last 20 years, attitudes towards decarbonization have shifted from awareness (inventories) to action (reduction). Businesses are now being pressed by stakeholders and regulators to demonstrate Paris Agreement-aligned decarbonization progress.

In this new context, the GHG Protocol status quo is no longer suitable – at least in its current format. The GHG Protocol standard is undermined by its very design. From the outset, it was designed to enable the broadest number of institutions, across varied industry verticals, to quantify their emission footprints. It therefore allows a great degree of flexibility over how carbon accounting is carried out; one prime example is the use of location- or market-based emissions factors in calculations. Two firms in the same sector, with similar activity profiles, could have widely different emissions footprints under this standard. This was not a problem in the voluntary reporting landscape in the 2000s and early 2010s, but this inherent lack of comparability undermines attempts by stakeholders to measure actual emissions performance and enables – unintentionally or otherwise – corporate greenwashing.

What does the future hold for carbon accounting?

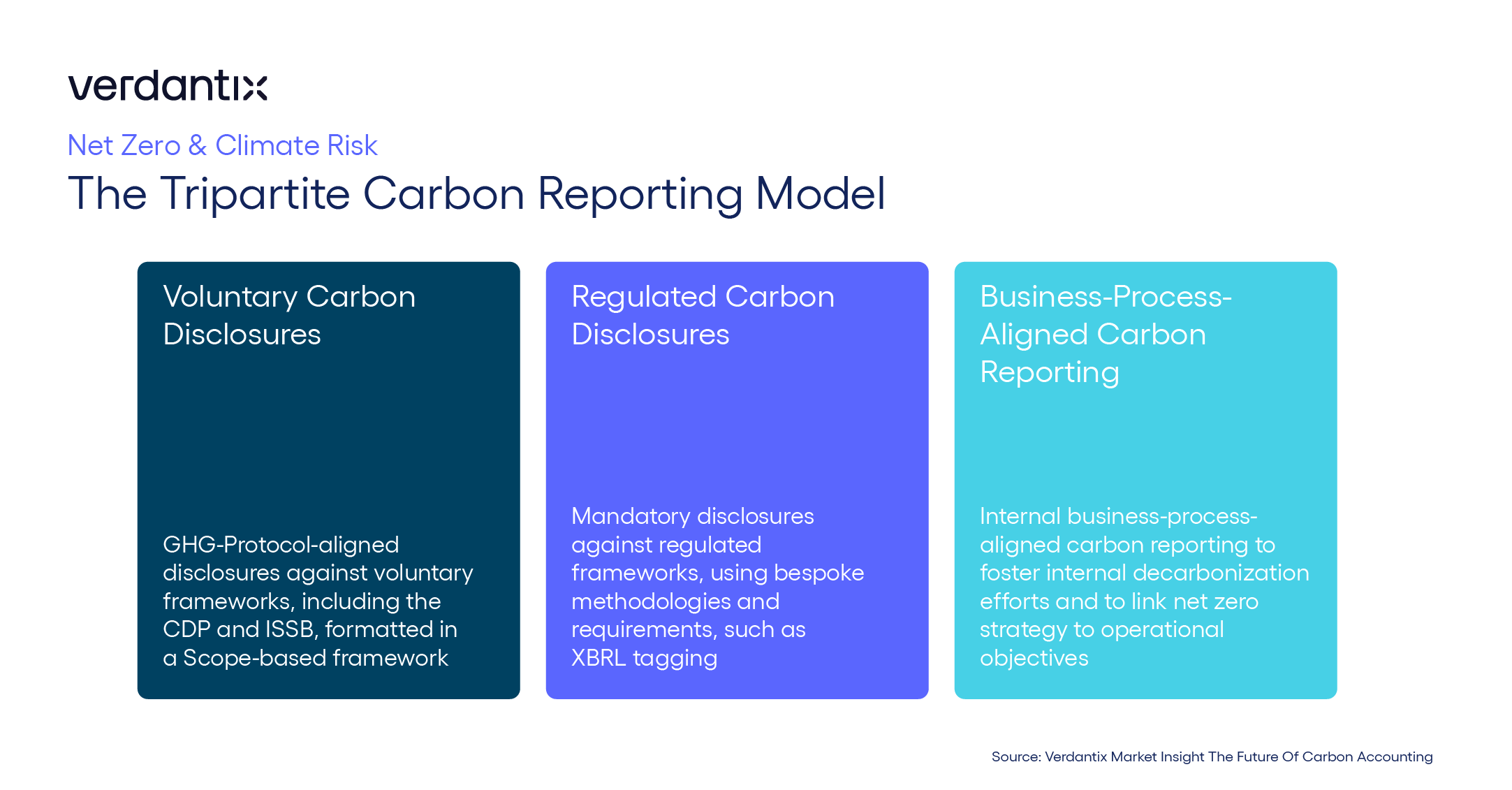

A tripartite carbon accounting model will evolve, which will tailor accounting efforts to particular business use cases. Voluntary carbon disclosures, based on the GHG Protocol, will continue, and will serve as an opportunity for firms to demonstrate extraordinary decarbonization progress in spheres such as downstream emissions management. Concurrently, bespoke accounting methodologies – backed by regulatory bodies such the US SEC – will focus on enabling comparability. This will disregard certain established elements of footprinting – such as avoided emissions or specific categories of Scope 3 – as impossible to regulate. Thirdly, business-process-aligned carbon accounting will develop, to allow firms to understand the impact of operational activity on decarbonization. This is already underway, championed by institutions like the PCAF.

For more information, see our latest report: Verdantix Market Insight: The Future Of Carbon Accounting.

About The Author

Connor Taylor

Principal Analyst