Cushman & Wakefield’s $150M Investment In WeWork Confirms Flex Space Is Making A Comeback

Ibrahim Yate

On August 9, 2021, WeWork and Cushman & Wakefield announced that they had entered into an exclusive, strategic partnership to market their services to both landlords and tenants. They will pitch their services around WeWork’s software platform for managing flex spaces and new, jointly developed solutions from both the firms. The partnership will combine WeWork’s workplace experience management software as well as its domain expertise in hospitality, with Cushman & Wakefield’s robust asset and facilities management services. Both firms are also in discussions about Cushman & Wakefield investing $150 million of non-dilutive backstop equity into WeWork. This follows Cushman & Wakefield launching its own, white-labelled service for landlords in early 2020, called INDEGO.

This deal follows a flurry of other activity in the flourishing flex space real estate and software market, spearheaded by the global real estate services firms. For instance, CBRE invested in Industrious, Newmark acquired co-working firm Knotel, and JLL partnered with WeWork in North America. The momentum is not just limited to the services side of the market, as flex space software vendor essensys raised £33 million ($46 million) in funding in 2021, and Yardi has recently touted a series of notable customer wins such as Office Space in Town and Liberty Space.

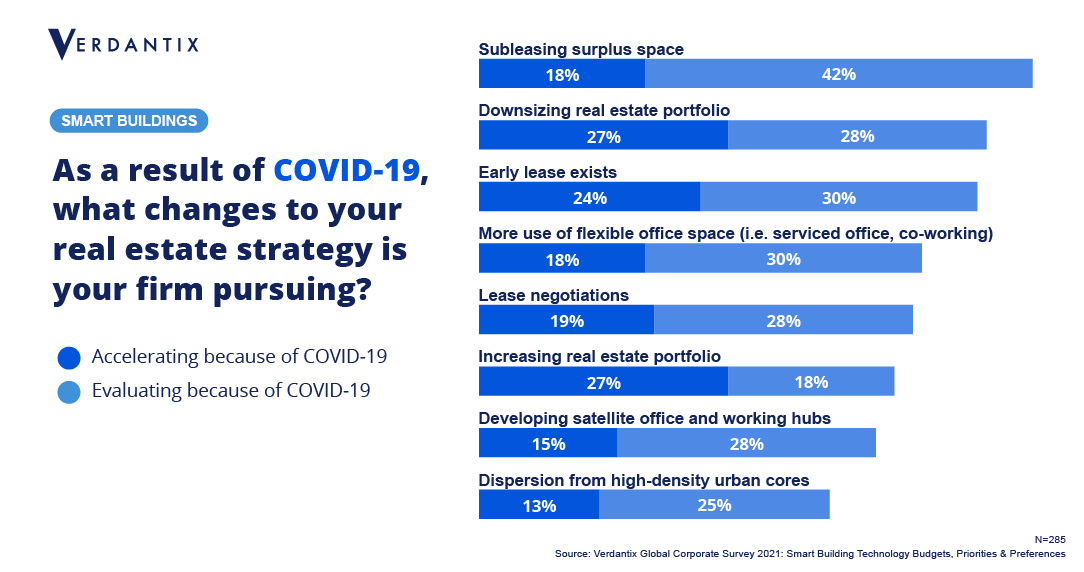

What is driving all of this activity? Two reasons stand out. The first is the improving workability of the flex space model as more recent entrants such as Industrious highlight new pathways to profitability. The other is tenant demand, which is rapidly re-emerging as corporates look for premium office space, already fitted out, with shorter lease commitments that make them feel more in control of their finances in the long term. Indeed, the latest Verdantix survey of corporate real estate decision makers indicates that 48% are either accelerating or evaluating more use of flex office space due to COVID-19 (and by extension, hybrid working). This is yet another sign of the vitality of the flex space real estate market, with more significant developments very likely in the coming two years.

To find out more about flex space and hybrid working, sign up to our upcoming webinar, taking place on the 2nd of September, Best Practices For The Hybrid Workplace.

About The Author

Ibrahim Yate

Senior Analyst