Market Size And Forecast: QMS Software 2024-2030 (Global)

Executive Summary

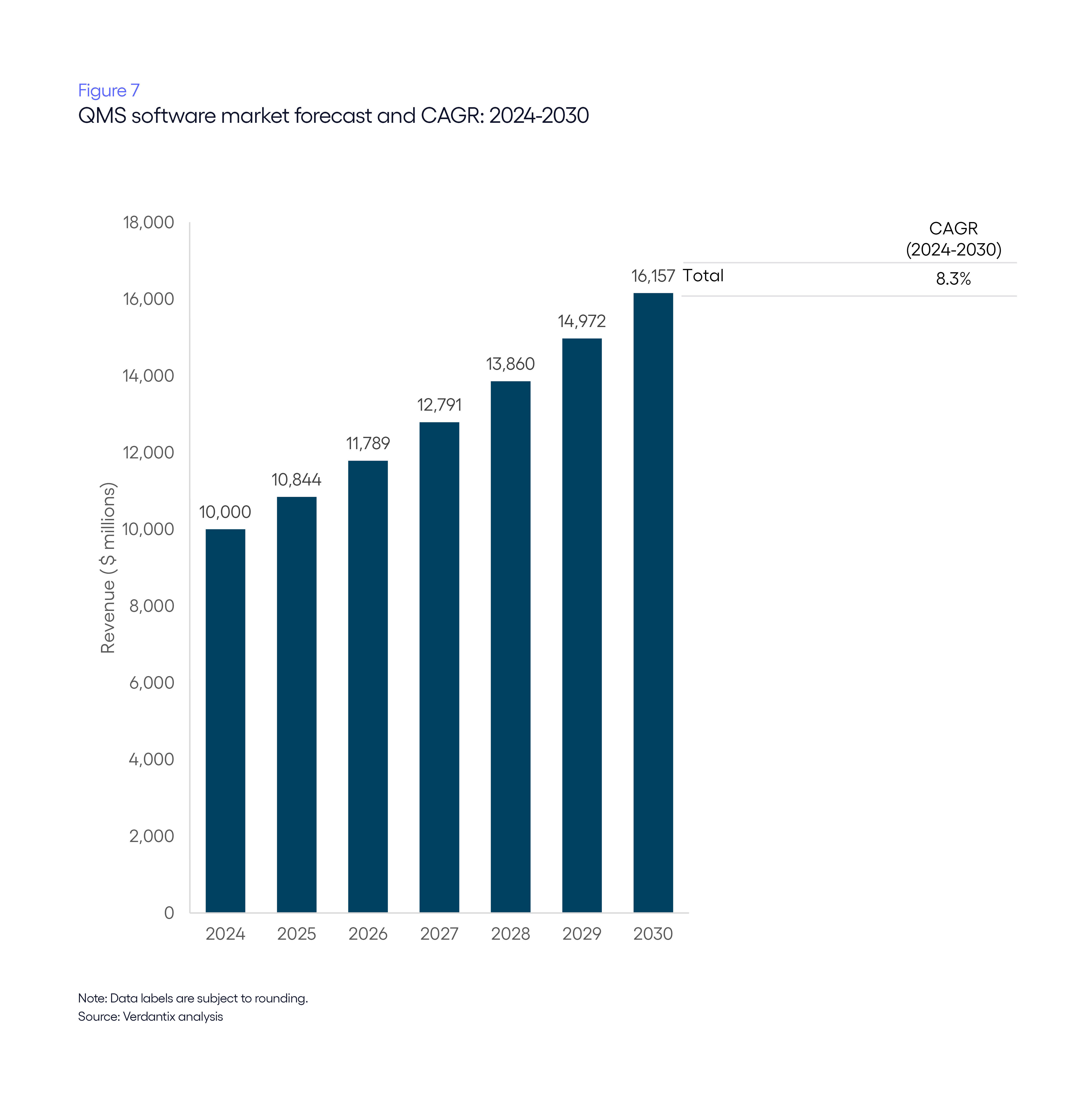

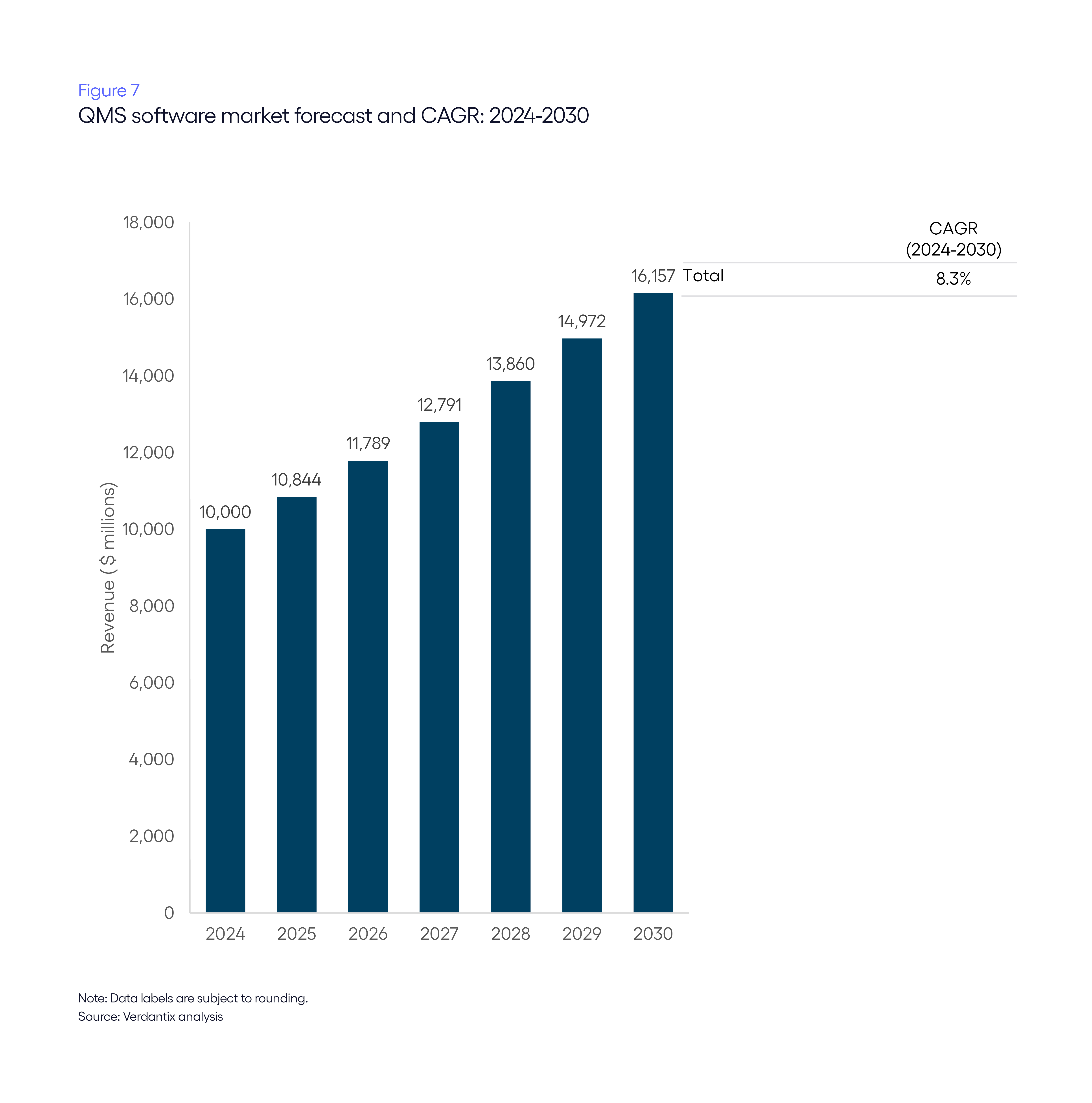

This report details the size and growth of the quality management system (QMS) software market by region and industry from 2024 to 2030. Our market size and forecast model determines how market-specific activity and macroeconomic trends have impacted penetration rates and average contract values for QMS software. The findings indicate that the QMS software market was valued at $10.0 billion by the end of 2024 and is expected to grow at a CAGR of 8.3% between 2024 and 2030, reaching $16.2 billion in 2030.

Summary for decision-makers

- This report providers quality management system (QMS) software vendors, buyers and investors with information on the size and potential growth of the QMS software market, split by industry vertical and region between 2024 and 2030.

- The Verdantix market size and forecast model leverages global corporate survey findings, discussions with QMS vendors and market research to provide an overarching view into the factors driving investment in QMS software. The model also considers industry-specific changes and underlying economic data that can influence software expenditure.

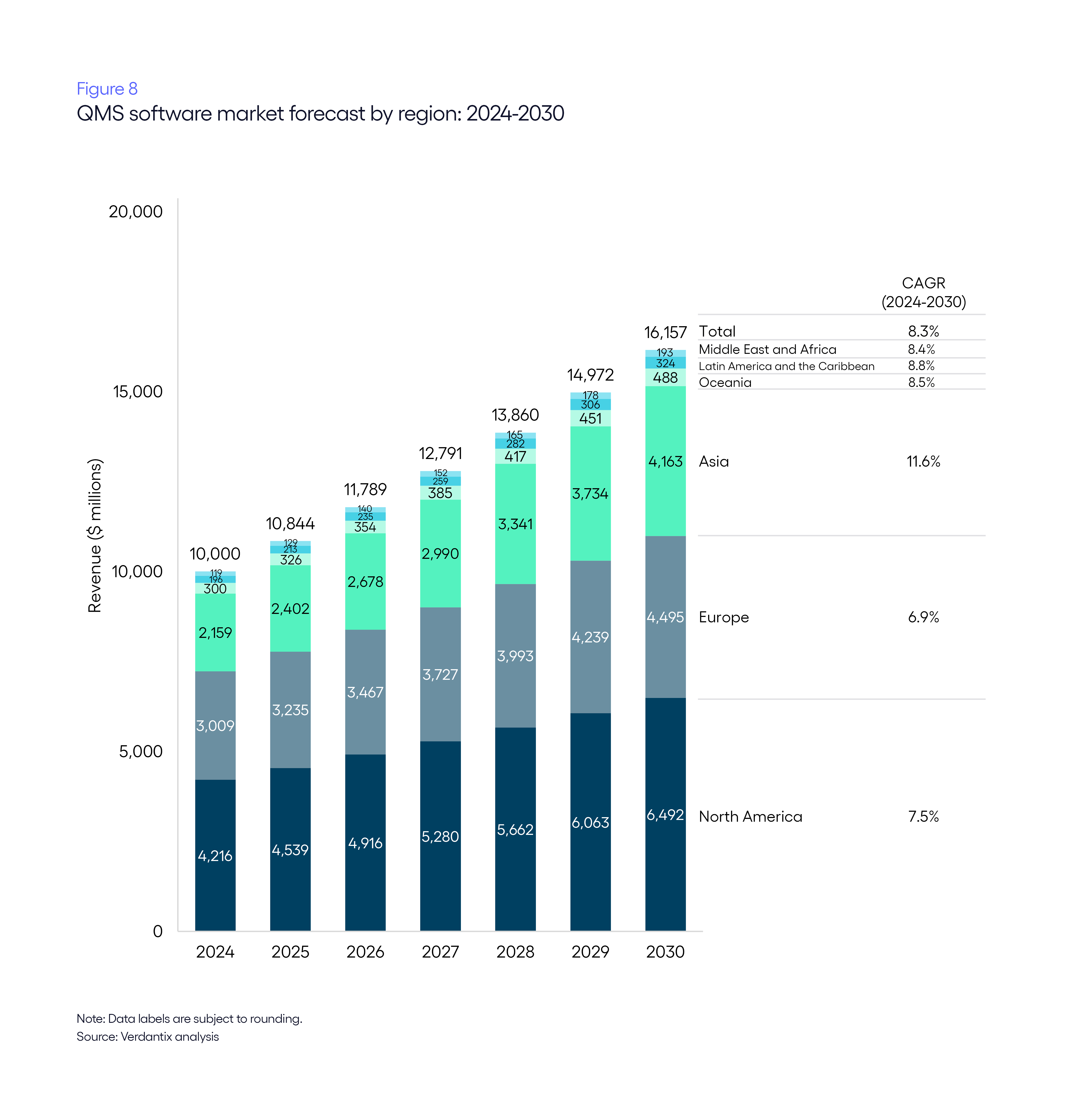

- The QMS software market totalled $10.0 billion in 2024, with North America and Europe constituting 72.3% of global spend. The main industries driving this expenditure are pharmaceutical products, vehicles, and food and beverage, which are subject to stringent regulations and bear harsh costs for non-compliance.

- The global QMS software market is projected to grow at a CAGR of 8.3% between 2024 and 2030, reaching $16.2 billion in 2030. This growth will be propelled by the need for granular data-driven insights and a desire to streamline operations.

QMS software adoption is driven by challenges such as compliance and customer satisfaction

This report provides quality management system (QMS) software vendors, corporate buyers and investors with granular data on the size and growth of the QMS software market, by region and customer industry vertical between 2024 and 2030. This report also considers the various trends and drivers that will shape the market over the next six years. Verdantix defines QMS software as:

“A digital tool that enables firms to centralize, standardize, streamline and improve quality management processes and systems with consistent workflows, data and reporting. It provides a systematic approach to ensure that products and services consistently meet customer requirements and comply with industry standards and regulations.”

In the previous iteration of this QMS software market size and forecast, ESG and sustainability was a main driver of market growth (see Verdantix Market Size And Forecast: QMS Software 2023-2029 (Global)). Specifically, firms were seeking to integrate ethical and sustainable practices into their quality management functions, as ESG and sustainability concerns contributed to increased scrutiny from various stakeholders. These pressures are reflected in the QMS market, where product failure and recall can significantly impact brand trust and market position. One year on, both ESG and reputational risk continue to influence spending on QMS software.

The macroeconomic environment was relatively unstable in the 2023-2029 iteration, with high levels of inflation, regions of conflict and political uncertainty. Although some of these factors – like political uncertainty – persist, inflation has reduced to a moderate level, while monetary policy has shifted from tightening to easing.

Similarly to other markets, Verdantix expects QMS software growth to retain its elasticity against larger economic factors. Improvements in software solutions and the introduction of AI have enhanced QMS software solutions, which have evolved from extensive databases that support compliance to strategic partners involved in each stage of the product life cycle.

Market size data reflect both macroeconomic trends and QMS software vendor activity across various regions and industries

Since the last iteration, Verdantix has refined its market size and forecast model, with more accurate data on firm count and average contract value, drawn from the upcoming Green Quadrant on QMS software. The updated market size and forecast presented here leverages elements of the previous iteration, alongside regional economic activity and growth rates. Specifically, the updated QMS software market model includes:

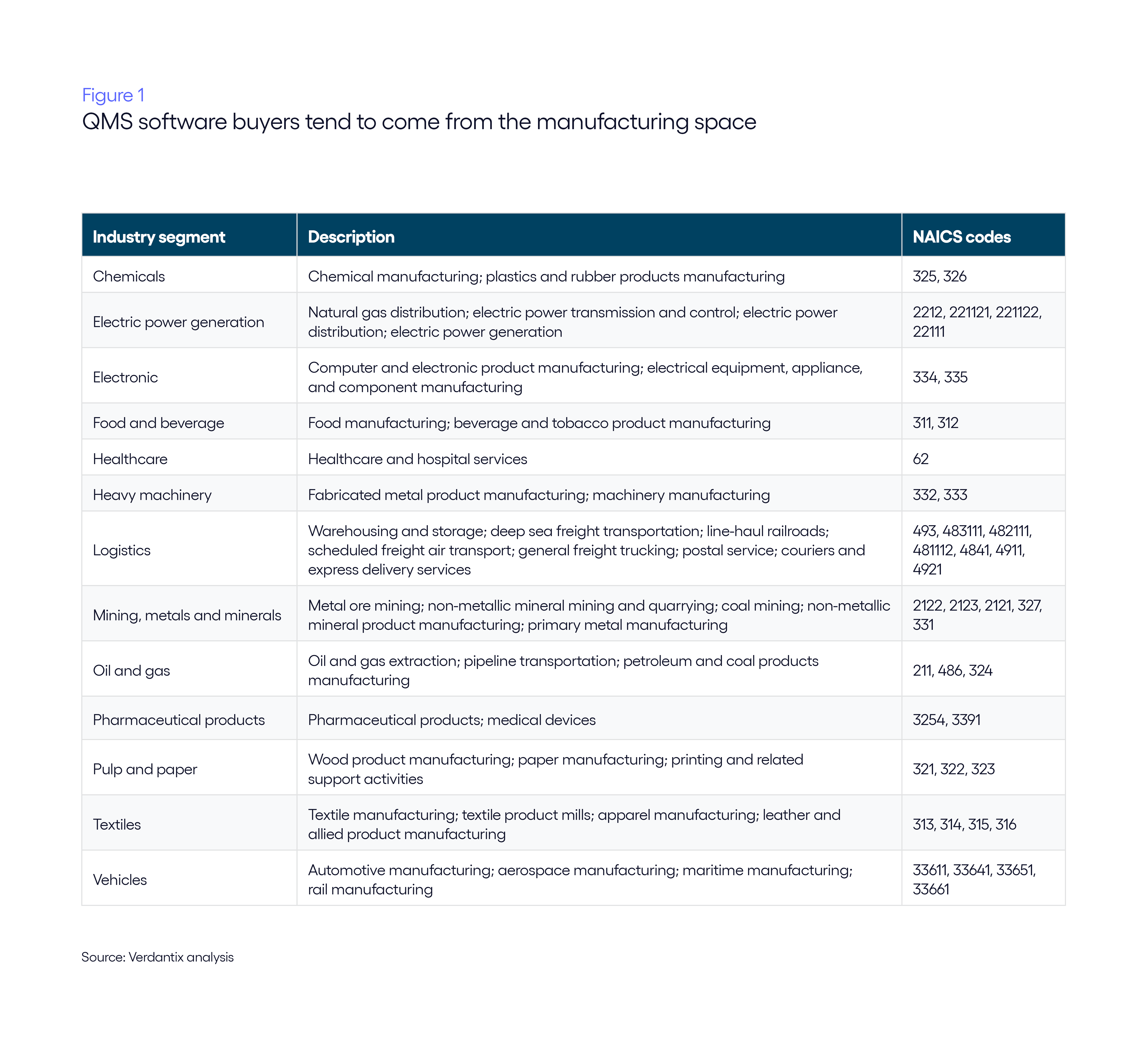

- 13 industry verticals with a focus on quality-centric sectors.

QMS software expenditure is mainly focused in high-risk industries, which are subject to stringent quality control and industry standards, and where failure to adhere to regulation can be detrimental (see Figure 1). Even minor product errors can have catastrophic consequences to people’s health and safety, meaning they must be rigorously tested to ensure they are safe and effective for their required purpose.

- Macroeconomic drivers shaping global spending and growth.

Verdantix considered how economic growth rates across both regional and industry verticals are influencing QMS software investment. The study gathered these data from reputable bodies, such as the International Monetary Fund (IMF) and the database of the library of the Organisation for Economic Co-operation and Development (OECD). This information is a key foundational input to the Verdantix market size and forecast methodology (see Figure 2).

- Accurate penetration rates based on Verdantix global corporate survey data.

The 2025 Verdantix quality management global survey gathered insights from 102 quality management decision-makers from 11 influential economies and 11 highly regulated industries (see Verdantix Global Corporate Survey 2025: Quality Management Budgets, Priorities And Tech Preferences).

- Average contract values leveraged from Verdantix Green Quadrant data.

This report utilizes vendor responses from our upcoming 2025 Green Quadrant to inform realistic estimates on vendor contracts. These figures are adjusted by geography and account for differences in industry penetration.

- Market research on how regulation impacts market activity.

As the quality industry is heavily impacted by regulation, Verdantix has considered how these legislative changes can influence QMS software spending. Industry-specific quality regulation, alongside economic and political factors, plays a significant role in influencing the market size and growth. The model leverages survey findings, market research and conversations with QMS software vendors to build a strong understanding of the various factors driving investment.

- Revenue and spend opportunities across key purchasing entities.

Verdantix leveraged multiple data sets from various sources, including major financial market data, country-specific census information and industry-relevant market data, to identify the number of firms with over 500 employees or revenues in excess of $50 million. Alongside disclosed software vendor revenues, this information provides the basis for our market size and forecast model.

Advanced economies with robust manufacturing industries dominate QMS software expenditure, which totalled $10.0 billion in 2024

Verdantix has analysed the market size of the quality management software space by leveraging regional economic data and internal research. Drawing from expert interviews, global corporate survey insights and Green Quadrant responses, Verdantix has forecast penetration rates and average contract values for firms in given regions and industries. Our model indicates that:

- Global spend is largely driven by North America and Europe.

Both North America and Europe have a host of heavily regulated industries such as pharmaceuticals, chemicals and vehicle manufacturing, all of which require a robust QMS. Moreover, many organizations in these sectors have already undergone significant digital transformation and are either currently using or are seeking commercial software to handle quality management processes. In 2024, Europe and North America reached a market size of $3 billion and $4.2 billion respectively. Their combined spending made up 72.3% of the entire QMS software market. Firms in these regions are subject to both global standards, such as the ISO 9001, and regional regulations including the EU Medical Device Regulation (MDR) and those set by the Food and Drug Administration (FDA) in the US. Moreover, both regions are home to a number of notable QMS software vendors, such as ComplianceQuest, Ideagen and Siemens.

- Pharmaceutical and vehicle manufacturing industries are key players.

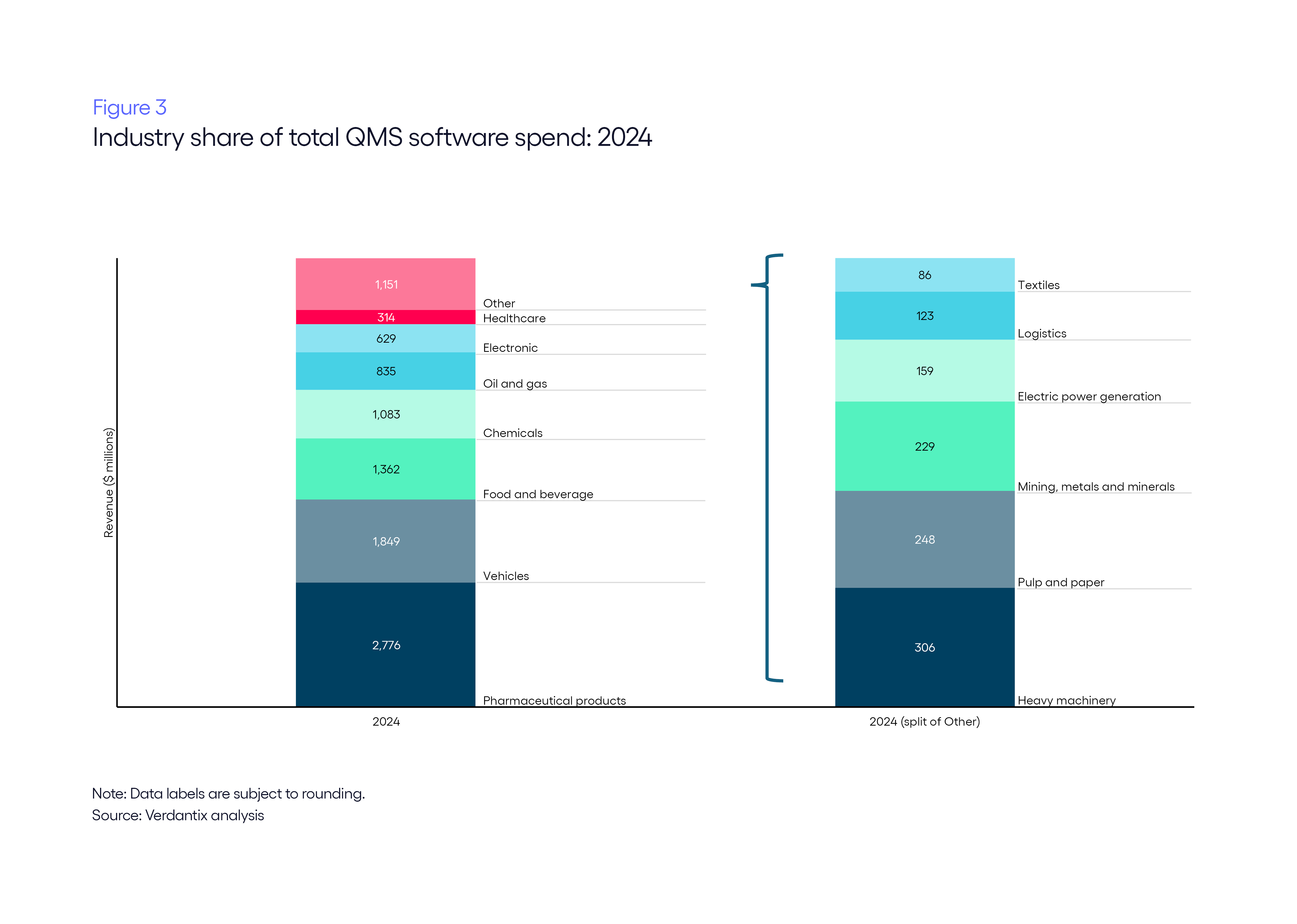

In line with the previous iteration of the market size and forecast, pharmaceuticals and vehicle manufacturing constitute the greatest spend. Specifically, pharmaceuticals represented 27.8% of total market share in 2024, with spending at $2.8 billion. Vehicles manufacturing makes up 18.5% of 2024’s total market share at $1.8 billion (see Figure 3). Quality management plays a significant role in both industries. In pharmaceuticals, manufacturing and selling defective products can place patients in extreme danger, while faulty components in vehicles can lead to road accidents. To address this, QMS software vendors have built solutions to ensure compliance with industry-specific regulation. For example, Ideagen offers pre-configured workflow templates to support ISO 9001 and IATF 16949 compliance for manufacturing, FDA 21 CFR Part 11 and EU Annex 11 for life sciences, and AS9100 for aviation.Figure 3.

- Chemicals and food and beverage manufacturing have an increased market share.

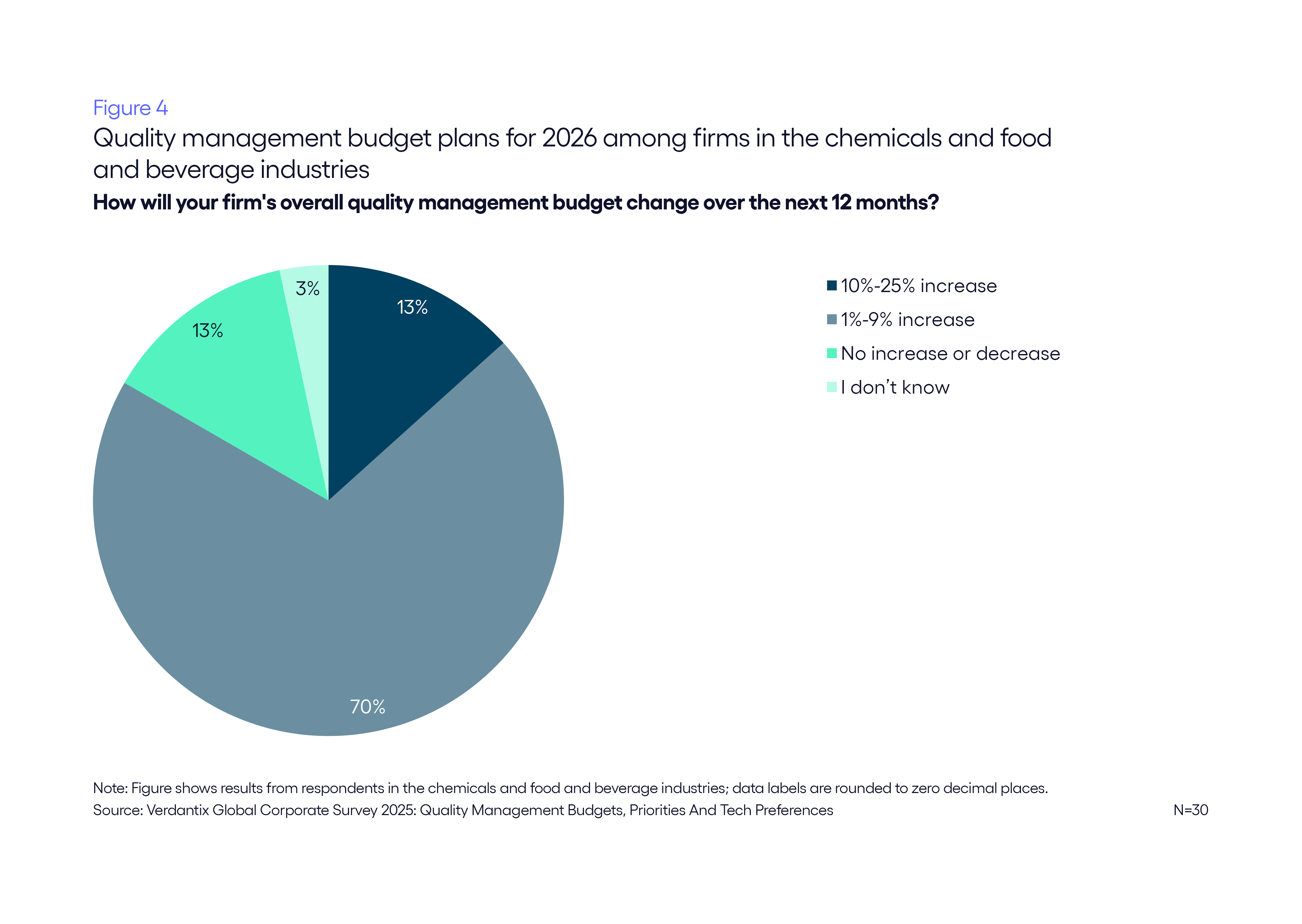

In comparison with the previous iteration of the market size and forecast, both the chemicals and food and beverage industries now occupy a greater market share. The chemicals industry now accounts for 10.8% of the market, while food and beverage accounts for 13.6%, rising by 2.2 and 0.3 percentage points respectively. Similarly to pharmaceuticals and vehicles, both industries are subject to stringent regulations as defective products can cause serious harm. Chemicals manufacturing involves the handling of toxic and potentially reactive substances, so firms must be aware of the specific ingredients included in products and their potential hazards. In food and beverage, faulty products can cause illness and damage brand reputation and consumer trust. This increased spending is reflected in global corporate survey results, with 83% of chemicals and food and beverage firms expecting larger quality management budgets over the next 12 months (see Figure 4) (see Verdantix Global Corporate Survey 2025: Quality Management Budgets, Priorities And Tech Preferences).

QMS software will help quality functions transition to the role of a strategic partner

Regulatory compliance has been a main driver of QMS software spend for a number of years. Now, as software systems improve and new technologies such as AI are introduced, QMSs have the ability to go beyond basic compliance needs, providing a preventative approach to quality management and assistance with other business objectives. Verdantix research indicates that market growth will be driven by the need to:

- Streamline supplier quality performance tracking.

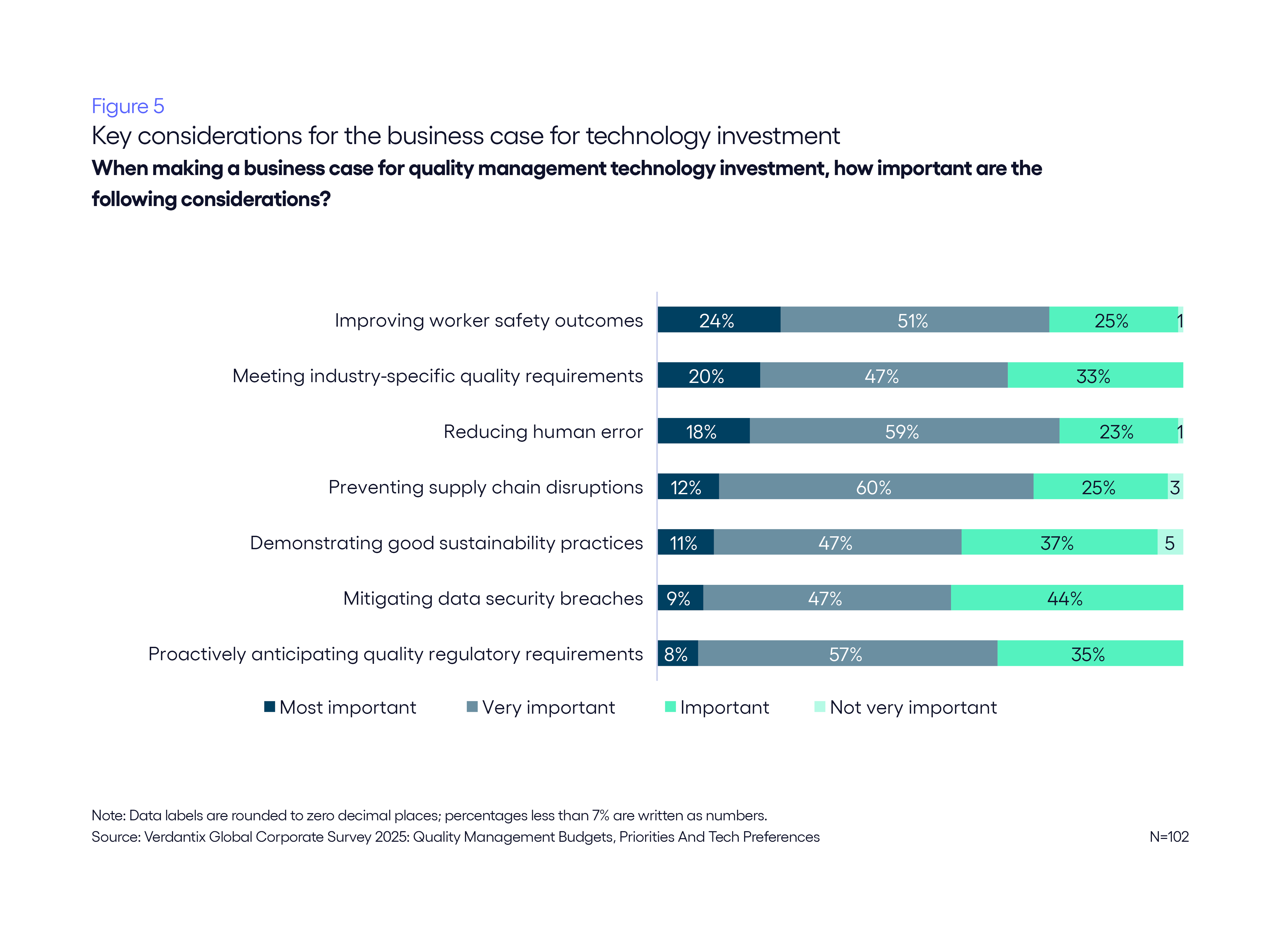

Several industries with high quality requirements rely on extensive, complex global supply chains to produce finished goods. Due to the complexity and size of these supply chains, there are a host of potential issues that can arise, spanning disruptions, inconsistent product standards and operational inefficiencies. The International Organization for Standardization (ISO) has acknowledged these challenges, and in the 2025 version of its ISO 9001 standard, introduced more structured methodologies to tackle risk identification, assessment and mitigation of supply chain disruptions. According to the quality management global corporate survey, 72% of decision-makers report that preventing supply chain disruptions is either the most important or a very important consideration when making a business case for quality management technology investment (see Figure 5). Recognizing this, QMS software vendors offer dedicated modules that enable firms to assess the suitability of potential suppliers. For example, Hexagon’s ETQ Reliance generates supplier performance scorecards based on various ESG metrics, ensuring that organizations select a vendor that balances cost, regulatory compliance and sustainability targets (see Verdantix Strategic Focus: The Role Of Quality Management Software In Sustainable Supply Chains).

- Reduce the risk of product recalls by identifying defects early.

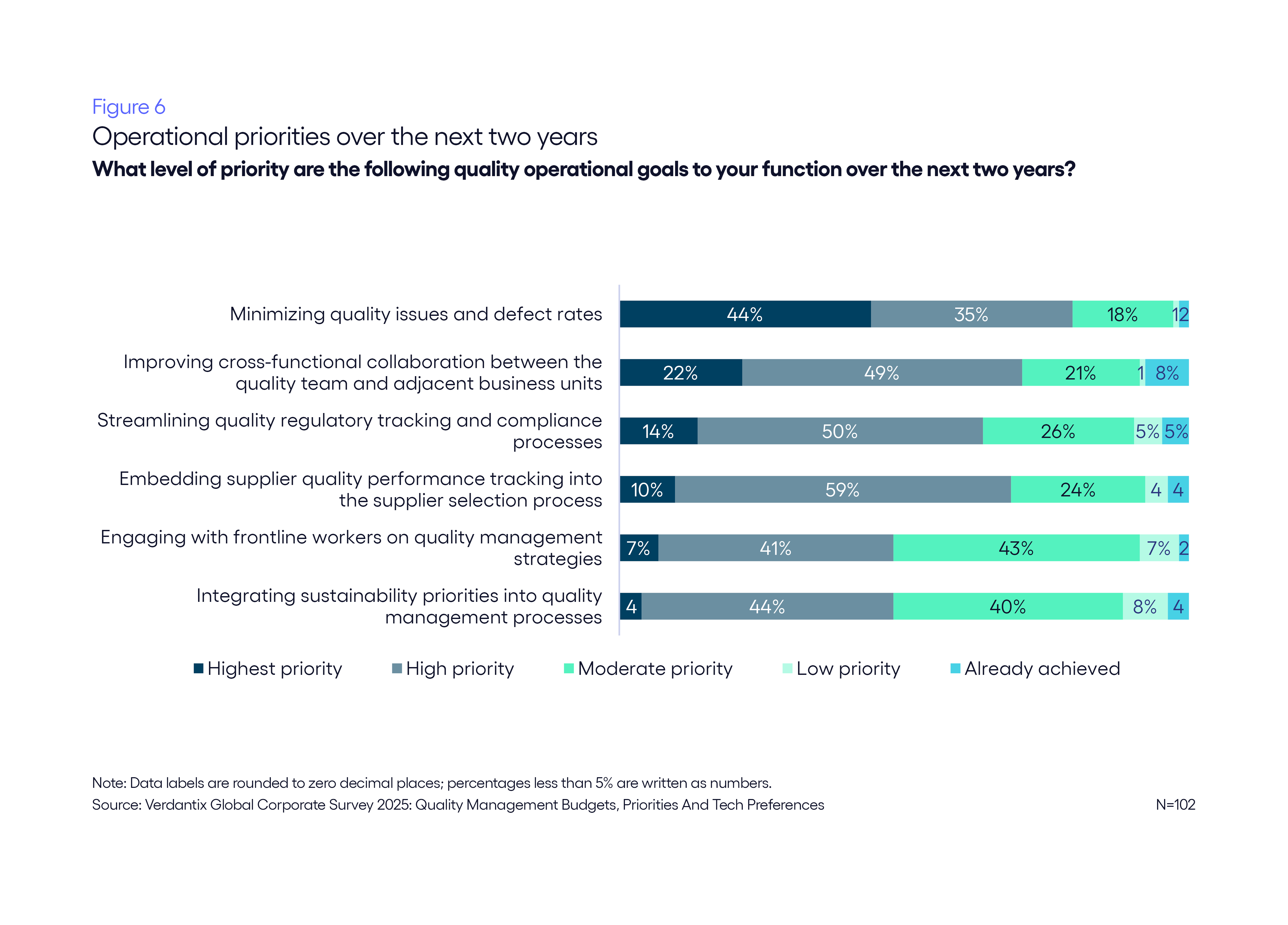

Product defects and malfunctions have stark consequences in highly regulated industries, and complex supply chains only increase their probability. Not only can defective products cause severe health and wellbeing effects, but there also financial implications through product recalls and potential fines – as well as reputational damage and a resulting loss of market share. Therefore, it is important that firms in these industries can clearly identify and manage quality-related issues to avoid such disasters from occurring. According to the 2025 global corporate survey, minimizing quality issues and defect rates is the most important operational goal for quality management functions over the next two years, with 44% considering it to be their highest priority (see Figure 6). QMS software can help by streamlining defect detection through real-time monitoring and automation, which ultimately reduces the risk of human error.

- Align quality systems with ESG and sustainability principles.

ESG and sustainability concerns remain an increasingly important priority for business functions, which seek to incorporate these principles into their operations. Changes to ISO 9001 in 2024-2025 suggest that quality functions must align their objectives with broader sustainability goals, specifically focusing on reducing waste and promoting resource efficiency throughout their operations. QMS software can help firms reduce waste by monitoring their production processes and identifying areas to reduce energy consumption. Moreover, integrating QMS software with product lifecycle management (PLM) systems ensures that sustainability measures are embedded throughout the product design and engineering process. Take PTC’s Windchill, which connects QMS change control processes with lifecycle assessment (LCA) data to ensure sustainability metrics – such as carbon footprint information – are assessed during the product approval stage.

- Exceed basic compliance to foster cross-function collaboration.

QMS software has enabled organizations to streamline quality management processes and centralize data. This has simplified regulatory compliance and relieved quality management professionals of mundane admin-based tasks. In addition, with the vast amount of data acquired through real-time monitoring systems, QMS software also has the potential to become far more than just a data repository. Instead, it can help quality functions support broader business objectives such as product design, supplier evaluation and customer satisfaction. A single source of truth ensures that all employees from across the organization have access to the latest and most accurate quality-related data. These teams can leverage their data and subject-matter knowledge to drive change, not only in quality-related processes but across the entire production operation.

- Transform raw data into actionable insights through AI tools.

Much like other business functions, quality management teams have started to leverage AI technologies to help streamline and enhance certain processes – and software vendors have developed their own use cases. According to the global corporate survey, the most popular of these are currently computer vision for quality defect detection and predictive maintenance analysis. Although only a small percentage of respondents (12% and 10% respectively) have widely rolled out these use cases so far, many are in the process of expanding implementation across their organization. AI tools can help firms apply a more preventative approach to quality, as teams can detect issues and defects early, reducing the risk of failure and disruption. Moreover, machine learning capabilities can identify patterns emerging in data, which may otherwise have remained overlooked. These capabilities ensure that QMS software will not only streamline and centralize tasks but also provide increased visibility to ensure quality standards are met (see Verdantix Strategic Focus: The Role Of AI In Quality Management).

The QMS software market will grow at a CAGR of 8.3% to reach $16.2 billion in 2030

Growth in manufacturing industries and increasing regulatory pressure will drive global adoption of QMS software. The threat and implications of quality failure are severe and QMS software provides a competitive advantage, allowing organizations to spot these potential issues early. Over the next six years, Verdantix finds that:

- QMS software spending will reach $16.2 billion.

The market size and forecast model predicts steady market growth at a CAGR of 8.3%, primarily driven by manufacturing industries including chemicals, food and beverage, and vehicles (see Figure 7). Akin to the 2023-2029 iteration, the Asian and North American pharmaceutical markets will spearhead market growth. The North American vehicle manufacturing segment will also be a major driver behind this market expansion. Meanwhile, changes to ISO 9001 made throughout 2025 have placed greater emphasis on integrating digital tools into quality management processes and embedding cyber security and data integrity. With these changes, firms must evaluate their current digital ecosystem to see whether it meets these requirements. The strategic value of QMS software is likely to improve as a result, driving sustained year-on-year growth.

- Asia will experience the greatest growth.

Verdantix expects that Asia will grow at the fastest rate, with a CAGR of 11.6%, reaching a total market share of 25.8% by 2030 (see Figure 8). While Europe is expected maintain a greater market share, the gap between the two markets will decrease significantly, to only 2 percentage points by 2030. Asia, and specifically China, boasts the largest manufacturing market, accounting for 40% of its total economic growth. As supply chains become increasingly global and firms in Asia are expected to meet international standards, the need for robust QMS software will only grow. North America currently occupies the largest segment, and is forecast to maintain this foothold through 2030. The vast majority of leading QMS software vendors are based in North America and it is also home to a large proportion of quality-intensive industries, such as pharmaceuticals and chemicals manufacturing. Moreover, reshoring policies will see growth in the US market for a number of industries, such as semiconductor and vehicle manufacturing, contributing to the number of organizations across North America investing in QMS software.

- Food and beverage, chemical manufacturing and electronics will be among the fastest growing industries.

By sector, the global electronics manufacturing industry is set to have the largest growth at a CAGR of 10%. This is closely followed by the food and beverage and chemicals manufacturing markets at 9.9% and 9.4%. Both of these industries have clear, stringent regulations around product safety with clear guidelines on what is expected. The electronics industry, meanwhile, faces intricate supply chains and complex design, which can make it challenging to manage and maintain quality throughout the product life cycle. With global standards such as ISO 9001 and regional requirements including the Restriction of Hazardous Substances (RoHS) Directive and GPSR (General Product Safety Regulation), the threat of a product recall is costly and ever-present. In 2023, there were 759 million units removed from US stores, with electronics and home appliances ranking second highest in terms of amount recalled. The expense of these incidents, coupled with negative brand perception and customer satisfaction, can ultimately lead to a loss of market share, demonstrating the need for a strong QMS solution that can identify potential non-conformances or defective products in their infancy.

About the Authors

Zain Idris

Industry Analyst

Zain is an Industry Analyst specializing in EHS digital strategy and corporate spending trends. His research examines how firms are positioning their EHS budgets, considering ...

View Profile

Nathan Goldstein

Senior Manager

Nathan is a Senior Manager at Verdantix, specializing in EHS software and the convergence of sustainability, EHS and operational risk. He leads research that helps corporate d...

View Profile