Verdantix Green Quadrant Uncovers Software Vendors Shaping The Future Of Sustainability Reporting

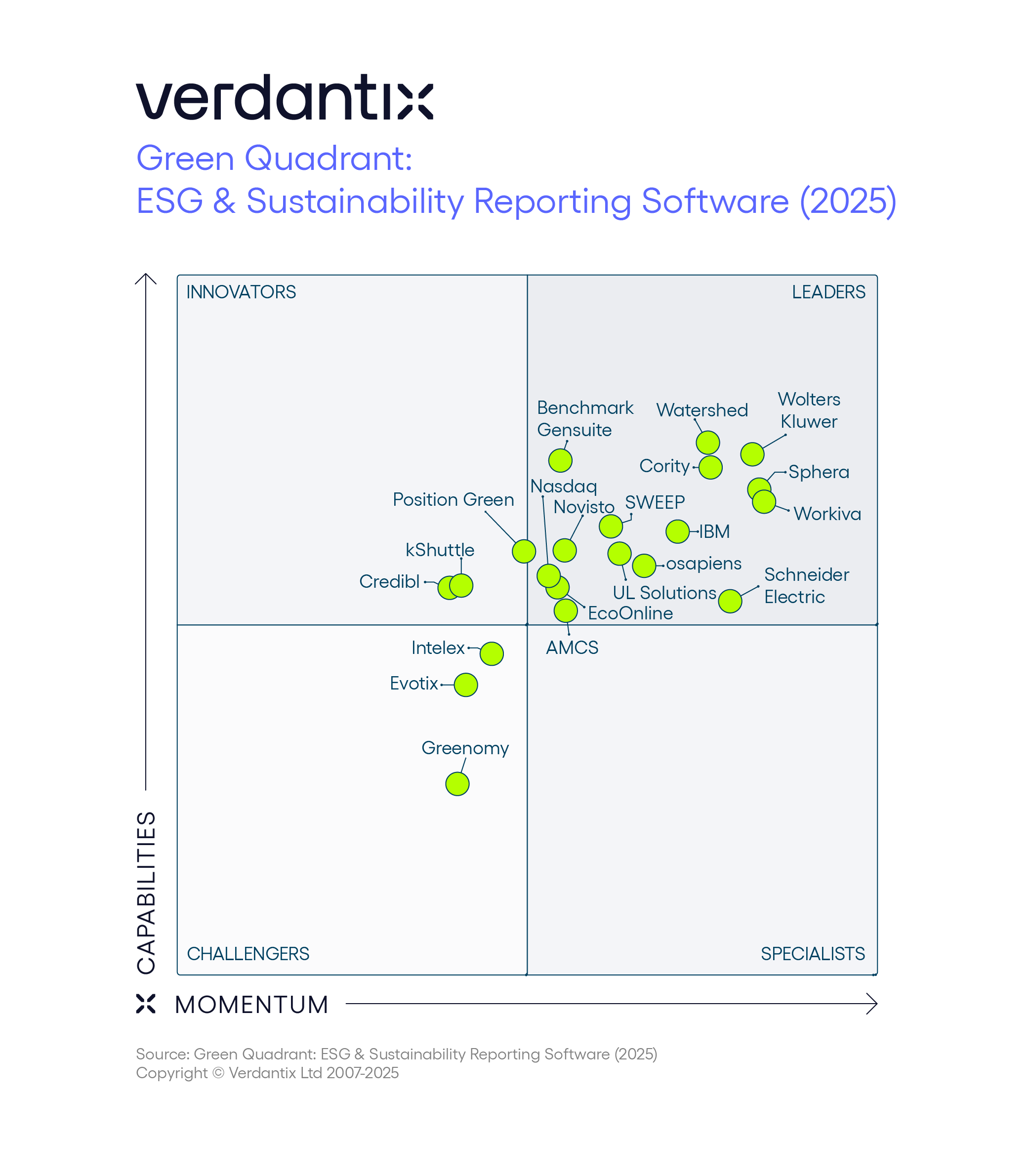

Verdantix recently released the Green Quadrant: ESG & Sustainability Reporting Software (2025) report. This year’s analysis, featuring 21 of the most prominent vendors in the market, confirms that sustainability reporting software is no longer an emerging category: it’s a core pillar for regulatory preparedness and corporate performance management. This shift reflects broader trends in sustainability, with political shifts and regulatory rollbacks not impeding sustainability’s momentum.

The report provides deep analysis of the functionality and market momentum of 21 leading vendors in this space – AMCS, Benchmark Gensuite, Cority, Credibl, EcoOnline, Evotix, Greenomy, IBM, Intelex, kShuttle, Nasdaq, Novisto, osapiens, Position Green, Schneider Electric, Sphera, Sweep, UL Solutions, Watershed, Wolters Kluwer and Workiva – based on extensive questionnaires, live briefings and buyer interviews. Our research reveals that:

- Investments are continuing, despite regulatory and political uncertainty.

Revisions to the CSRD via the EU Omnibus proposal and the collapse of the SEC climate rule following the 2025 US elections have introduced delays and scope reductions. However, Verdantix survey data show that corporate sustainability investments remain resilient, driven by pressure from investors, customers and regulators at the state and regional levels, as well as by reputational pressure to keep up with peers. Software buyers must now plan for a hybrid disclosure environment: regulated and voluntary, local and global, static and dynamic. The most advanced software vendors have responded by developing flexible data collection and reporting structures, allowing collected data to be automatically mapped to multiple disclosure frameworks – reducing manual effort by the user and quickly adapting to new frameworks.

- Cross-functional adoption is expanding, shaping software requirements.

Sustainability reporting is a team effort across functions. CEOs and boards rely on high-level dashboards for risk oversight and investor communications. Finance teams increasingly manage reporting processes, bringing expectations of rigour and assurance. ESG controllers ensure data traceability and compliance. Operational teams input facility-level data, while sustainability professionals use performance dashboards to track targets and forecast initiative impacts. This growing user base demands flexibility, multilingual support and integration with adjacent systems. Vendors are addressing this through configurable workflows, embedded analytics and pre-built integrations with EHS, ERP and carbon management tools. - AI has reached an inflection point.

The application of AI for sustainability reporting has reached an inflection point, with vendors taking divergent approaches. Some are using AI to support specific tasks such as data extraction or anomaly detection, while others are developing AI roadmaps that maximize AI – in other words, building towards a future of agentic AI that can manage the majority of, if not all, complex reporting workflows with minimal human input. As the market matures, education and transparency will be critical to bridging the gap between innovation and practical adoption.

To learn more about the 21 most prominent sustainability reporting software firms in the market, read the full report. For additional relevant research, visit the Verdantix research portal.

About The Author

Luke Gowland

Senior Analyst