Buyer’s Guide: Third-Party Risk Management Software (2024)

Christine O'Donnell

Daniel Garcia

Access this research

Access all Third-Party Risk Management content with a strategic subscription or buy this single report

Need help or have a question about this report? Contact us for assistance

Executive Summary

This report provides decision-makers in risk management roles who are responsible for the selection, implementation and management of software for third-party risk management with an analysis of 18 prominent software platforms available on the market today. The analysis leverages data collected from the 18 vendors via questionnaires. In addition, Verdantix has built a holistic picture of the third-party risk management vendor landscape, key product enhancement trends and buyer requirements, using a range of publicly available data, as well as insights generated from our annual global corporate survey of 200 executives in director roles and above (see Verdantix Global Corporate Survey 2023: Risk Management Budgets, Priorities & Tech Preferences). The market for third-party risk management is undergoing a period of accelerated innovation, driven by a greater focus on business resilience, incoming mandatory regulations, pressure to meet ESG expectations and unprecedented levels of scrutiny over data quality and reporting. Prospective buyers should use this report to support them in their search for third-party risk management software applications that fit their requirements.Defining third-party risk management software solutions

Business resilience drives demand for third-party risk management software

Buyers should consider industry requirements when selecting third-party risk management software

Inclusion criteria for the 2024 Buyer’s Guide for third-party risk management software

Aravo overview

Archer overview

Diligent overview

Empowered Systems overview

Ethixbase360 overview

Fusion Risk Management overview

LogicGate overview

MetricStream overview

Mitratech overview

NAVEX overview

OneTrust overview

Origami Risk overview

Prevalent overview

ProcessUnity overview

Protecht overview

SAI360 overview

ServiceNow overview

Venminder overview

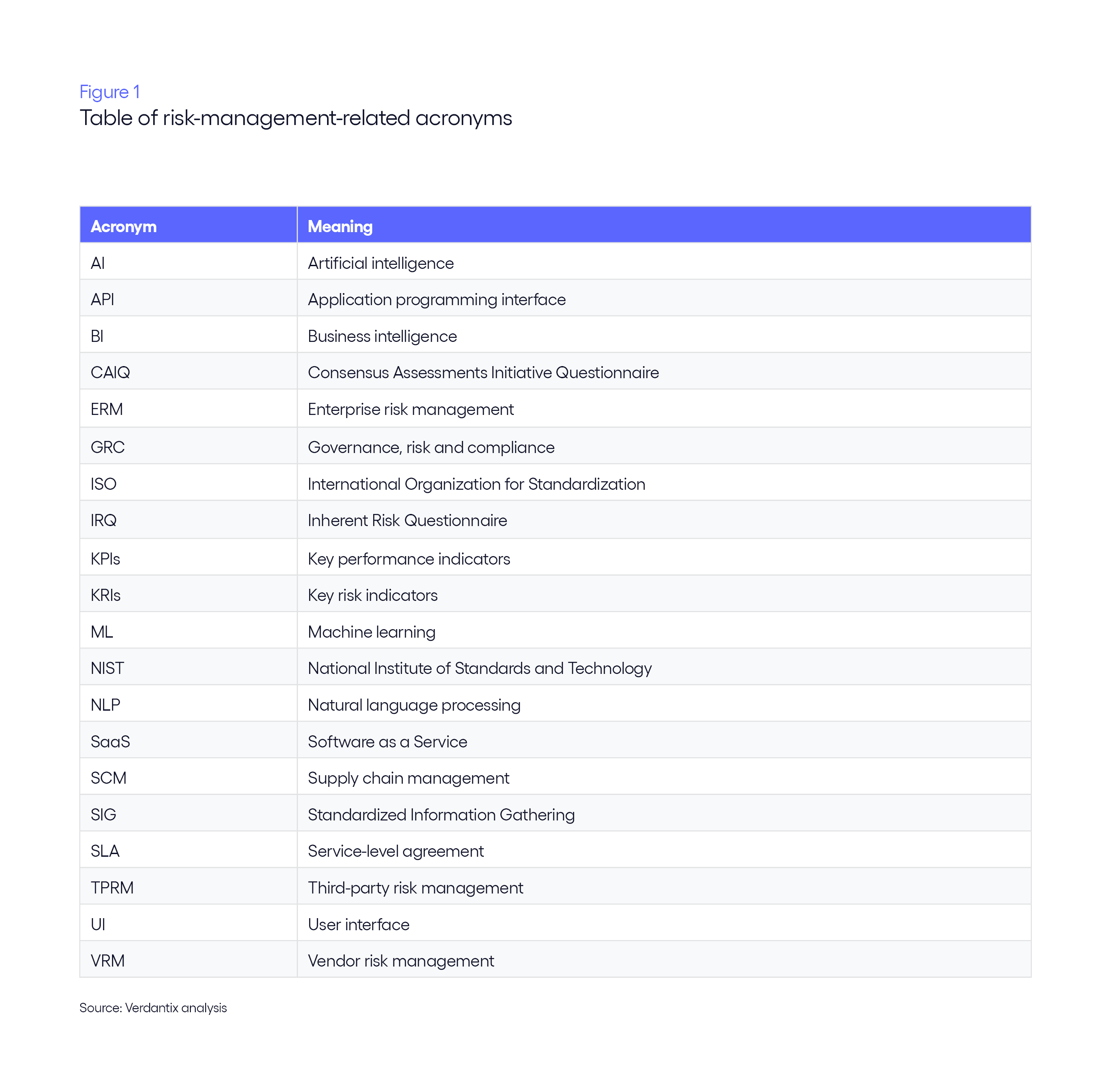

Figure 1. Table of risk-management-related acronyms

Figure 2. Third-party risk management functionality overview

Figure 3. Vendor types operating in the third-party risk management software market

Figure 4. Firms' priorities are reflected in a range of emerging risks

Figure 5. Pressures related to expansion into new geographies are key drivers of spend

Figure 6. Third-party risk management software providers

Figure 7. Aravo overview

Figure 8. Archer overview

Figure 9. Diligent overview

Figure 10. Empowered Systems overview

Figure 11. Ethixbase360 overview

Figure 12. Fusion Risk Management overview

Figure 13. LogicGate overview

Figure 14. MetricStream overview

Figure 15. Mitratech overview

Figure 16. NAVEX overview

Figure 17. OneTrust overview

Figure 18. Origami Risk overview

Figure 19. Prevalent overview

Figure 20. ProcessUnity overview

Figure 21. Protecht overview

Figure 22. SAI360 overview

Figure 23. ServiceNow overview

Figure 24. Venminder overview

About the Authors

Christine O'Donnell

Senior Analyst

Christine is a Senior Analyst at Verdantix, where she provides research-driven insights to help corporate leaders and technology vendors navigate the evolving third-party risk...

Daniel Garcia

Senior Manager

Daniel is a risk and compliance subject-matter expert (SME), with over 16 years of global experience, having worked for major financial institutions and consulting firms in La...